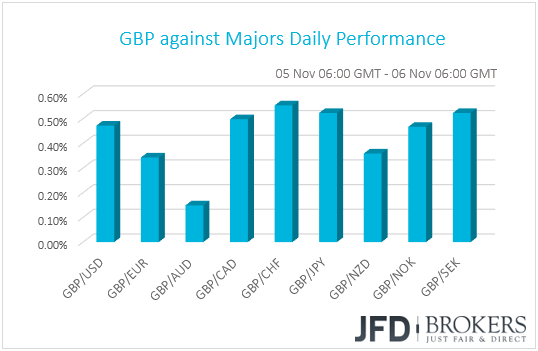

Today, the big event is likely to be the US midterm elections. Polls suggest that there is an increasing likelihood for Democrats to take control of the House, but the chances of gaining majority in the Senate are less. The pound was the main winner among the G10 currencies, as Brexit optimism continued to provide support for the currency. The Aussie took the second place, but at the time of the RBA decision, it didn’t react much.

US Midterm Elections Take Center Stage

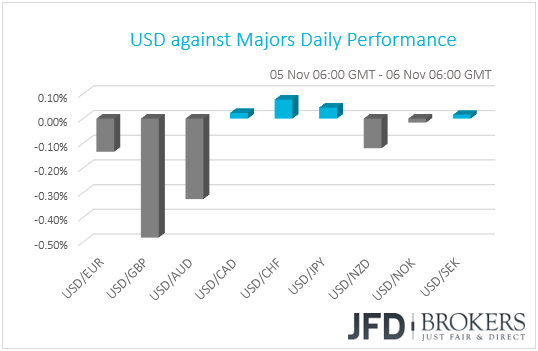

The dollar traded lower or unchanged against the other G10 currencies on Monday. It lost ground against GBP, AUD, EUR, and NZD in that order, while it stayed within a narrow range of ±0.10% versus the others.

Today, investors are likely to be sitting in the edge of their seats in anticipation of the outcome of the US midterm elections. All 435 seats in the House will be contested, as well as 35 of the 100 seats in the Senate. Currently, the Republicans hold the majority in both chambers of Congress and the big question is whether they will maintain full control. Polls suggest that there is an increasing likelihood for Democrats to take charge in the House, but the chances of gaining majority in the Senate are less.

So, what happens in case Democrats take the House and what does this means for the markets? With a split Congress, President Trump may find it hard to proceed with his political agenda, which may include further tax reforms. What’s more, a House led by Democrats may open the door for more investigations over Trump and perhaps lead to attempts to impeach him. However, we see the removal of the President as an unlikely outcome. A Democratic-led House could easily vote to impeach him by a simple majority, but for the President to be removed, it would require a two-third majority in the Senate.

With regards to market reactions, this outcome could spook the stock market and perhaps hurt the dollar as it could lessen the chances for more tax cuts and further deregulation. Remember that US equity markets surged following Trump’s election on speculation that his agenda will spur growth and help the economy. Political instability in the form of investigations and/or impeachment attempts could also weigh in the US markets. That said, given that this outcome appears to be the most likely and thereby, the one expected by market participants, we believe that any market response may be limited and short-lived.

The aforementioned reactions could be magnified in case Democrats gain majority in the Senate as well. This could come as a surprise to investors as the chances for something like that are low. Although Democrats would need to win only two extra seats, the 26 out of the 35 Senate seats subject to vote are already held by Democrats. So, they would have to protect all those seats and gain two more. In other words, Democrats have to take 28 out of 35 seats. Now, in the case Republicans maintain control in both chambers, we expect the opposite market response. US equities and the US dollar are likely to gain.

USD/CAD – Technical Outlook

USD/CAD has shown some good performance, drifting higher for the whole month of October. The pair is still trading above its upside support line drawn from the 1st of October low. The only issue here is that USD/CAD seems to be losing the upside momentum. But, as long as the upside line remains intact, we will stay cautiously bullish over the near-term outlook.

If USD/CAD makes a push above the 1.3120 level, marked by Friday’s high, it could try and push higher towards the 1.3170 resistance zone, which held the rate down on the 31st of October. That said, we would become more comfortable with the upside scenario only if we see a break above that resistance zone, as it could confirm a forthcoming higher high. The next target to watch could be the 1.3200 area, or even the 1.3225 barrier, marked near the peak of the 6th of September.

Alternatively, if the bulls start losing their positions and USD/CAD travels lower, drops below the aforementioned upside support line and closes below the 1.3050 hurdle, which was the lowest point of last week, this is where we could start examining lower levels again. A further decline could lead towards 1.3015 obstacle, a break of which may invite more bears to join in and drive the pair to the next key support zone at 1.2970, marked by the low of the 24th of October.

Pound Gains on Brexit Optimism, Aussie Unfazed Again After RBA

The pound was the big winner among the G10s, opening the week with a positive gap after the Sunday Times reported that the UK government has secured concessions from Brussels to keep all of Britain in a custom union with the EU. The currency remained supported throughout most of the day and got another boost overnight following another report saying that the EU is ready to offer a border compromise in order to overcome the last key obstacle and secure a deal with the UK.

As for our view, it remains the same as last week. The pound could continue gaining on headlines suggesting that the EU and the UK are closer to securing a deal, but let’s not forget that even if the two sides agree on all matters, everything has to be approved by the UK Parliament. Today, PM Theresa May will discuss the latest developments with her cabinet, where we could get a taste whether the positive news for the pound is positive news for her ministers as well.

The second strongest currency was the Aussie, despite reacting only little to the RBA decision. On Friday, several headlines suggested that Trump’s request for a draft trade deal with China was not true, something confirmed by Larry Kudlow, the White House’s economic advisor. However, the President himself said that he thinks US will make a deal with China and that it would be a very good deal. Thus, the driver behind the Aussie’s appreciation may be optimism surrounding the US-China trade dispute.

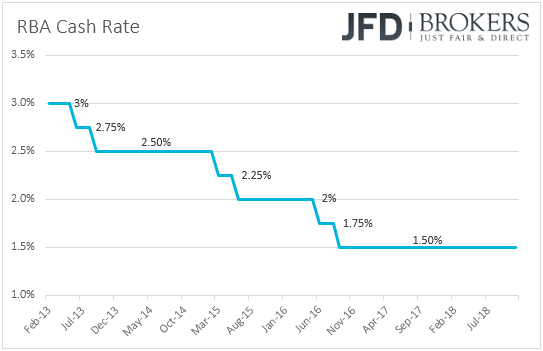

With regards to the RBA, the Bank kept interest rates unchanged once again and proceeded with some positive changes in the accompanying statement. That said, the Aussie strengthened only 10 pips at the time of the release, a move suggesting that the changes were not significant enough for market participants to alter their expectations with regards to the RBA’s future plans.

The Bank noted that it now expects GDP growth to average around 3.5% in 2018 and 2019, compared to the “a bit above 3%” included in the October statement, while it now sees the unemployment rate declining to around 4.75% in 2020. In October, officials expected the rate to slide to 5% over the next couple of years. With regards to inflation, they said that the latest prints were in line with their expectations and that they expect inflation to pick up over the next years and to be around 2.5 in 2019 and a bit higher in 2020. In our view, the statement suggests that the new quarterly report, due out on Friday, is likely to include upside revisions in the GDP and inflation forecasts, as well as downside revisions in the unemployment rate.

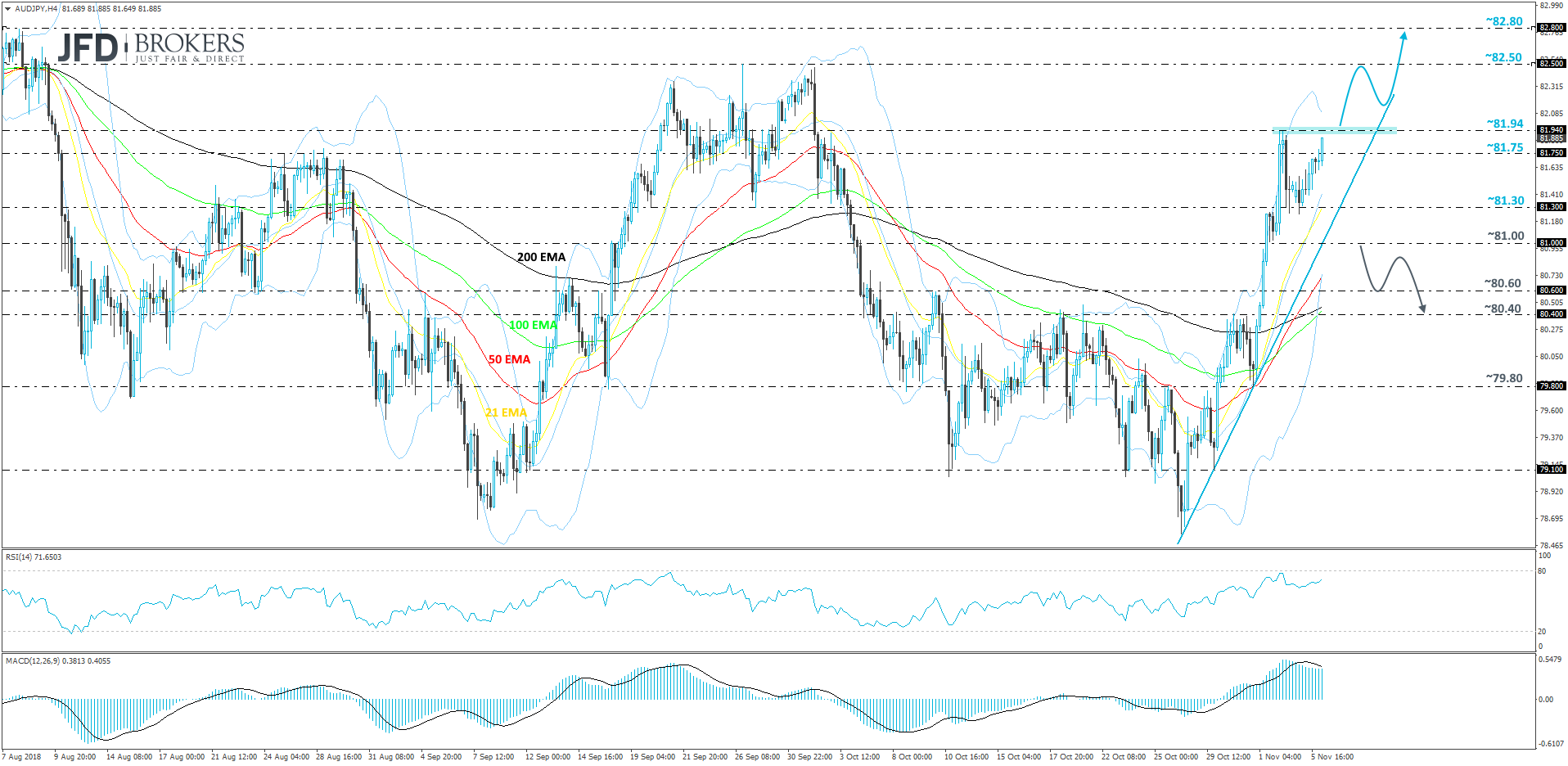

Back to the Aussie, we expect it to stay sensitive to changes in the broader market sentiment, and especially any news surrounding the US-China trade dispute, rather than small monetary policy tweaks. More encouraging headlines may keep market sentiment supported and thus, the Aussie could continue gaining, due to Australia’s heavy trade exposure to China. On the other side of the equation, we prefer to have the yen, which has the tendency to weaken during “risk on” periods. Thus, barring any headlines reviving fresh fears over the USD-China trade dispute, we would expect AUD/JPY to continue drifting north.

AUD/JPY – Technical Outlook

Last week we talked about this pair and pointed out that it has got good potential to continue climbing higher. When we looked at AUD/JPY last Thursday, it was preparing to break the 80.40 level, which it happily did. Since then, the pair has moved higher for quite a decent amount of pips and it seems now that it is preparing to charge the 81.94 barrier, marked by the high of last week. AUD/JPY is still trading above its steep upside support line taken from the low of the 26th of October. Therefore, for now, we remain bullish and will aim for higher levels.

A nice good pop above the 81.94 barrier could initiate another leg of buying at least for short-run and AUD/JPY could easily get pushed towards the next key resistance area at 82.50, marked by the peak of the 26th of September. If that area is not capable of stopping the pair from moving higher, its break could open the way towards the 82.80 hurdle, which held the rate down on the 8th of August. If AUD/JPY struggles to overcome the 81.94 barrier and then retraces back down, still, not all is lost for the bulls, as the pair could remain above the aforementioned short-term steep upside line, which could provide some additional support.

The RSI, even though it already peaked near the 80 mark on the 2nd of November, is still trying to push higher, by pointing to the upside. The MACD also topped on the 2nd of November and moved below the trigger line, but it seems that it is curving back up. Both are still supporting the upside.

On the downside, for us to start examining lower level, we would need to see, not only a drop below the steep upside line, but also a break below the 81.00 level, marked by the intraday low of the 1st of November. This is where more bears could join in the party and lead the way towards the next potential area of support at 80.60, a break of which could push AUD/JPY a little bit lower, to test the 80.40 obstacle, marked by the high of the 30th of October.

As for the Rest of Today’s Events

During the European day, we get the final services and composite PMIs from the nations of which we had the manufacturing data on Friday. As usual, the bloc’s final prints are expected to confirm their preliminary estimates. Eurozone’s PPI data and Germany’s factory orders, both for September are also coming out. Eurozone’s PPI rate is forecast to have remained unchanged at +4.2% yoy, while German factory orders are anticipated to have declined 0.6%mom, after rising 2.0% in August.

Later in the day, the US JOLTs job openings for September are due out, as well as Canada’s building permits for the same month.

As for tonight, during early Asian morning Wednesday, New Zealand’s employment data for Q3 are scheduled to be released. The unemployment rate is expected to have remained unchanged at 4.5%, just a tick above 4.4%, which was seen in Q1 and is the lowest since Q3 2008. The net change in employment is expected to have risen at the same pace as in Q2. As for the labor costs index, it is expected to have slowed to +1.9% yoy from +2.1%. The nation’s 2-year inflation expectations for the quarter are also due to be released, but no forecast is currently available.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Brokers, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Brokers analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyzes and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyzes and must therefore be viewed by the reader as marketing information. JFD Brokers prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.