UK Lawmakers voted 432-202 against the deal agreed between PM May and the EU, with the leader of the Labour party calling for a no-confidence vote in the government. The pound had been on a steep decline ahead of the vote and rebounded strongly in the aftermath, in a “sell the rumor, buy the fact” market reaction. Elsewhere, the euro was hit hard after data showed that Germany’s economy grew at the lowest annual pace in 5 years.

May’s Deal Gets Rejected by a 230-vote Margin

Yesterday, it was all about Brexit and UK Parliament’s vote over the deal agreed between PM Theresa May and the EU. Lawmakers voted down the accord as was widely expected, but the margin by which May lost was the largest in modern British history. Specifically, MPs voted 432-202 against the deal. Just after the vote, Jeremy Corbyn, the leader of the Labour party called for a no-confidence vote in May’s government, which is scheduled to take place today.

However, we don’t see May losing this vote. Northern Ireland’s DUP and hardliners within her own party, although they strongly opposed her plan, said that they would support her. So, if this is the case, it would be interesting to see what kind of a plan B she will bring back to Parliament, something she said she will do by Monday. In our view, making amendments that will convince more than 115 MPs to change their mind appears to be a hard task at the moment, especially with the EU reiterating that the rejected deal is the best and only way to ensure an orderly exit.

So, what are the other possible outcomes? Still all scenarios are on the table we believe, ranging from a hard Brexit to a no Brexit at all. In the aftermath of the vote, EU Commission President Jean-Claude Juncker said that the risk of a disorderly exit has increased, but although chaos is one word that could well characterize the situation in the UK political scene, the only thing everyone agrees is that a no-deal exit should be avoided. The Labour party said that if the no-confidence vote fails to trigger an election, then it may support a second referendum, while May noted that, conditional upon winning the vote, she will hold talks with other parties in order to secure a viable plan. There is also a lot of discussion around extending the Article 50, while President of the EU Council Donald Tusk suggested that the UK should now consider reversing Brexit altogether.

As for the pound, although it ended the session slightly lower against the greenback, the ride was not an easy one. Cable had been on a steep decline ahead of the vote, losing around 250 pips, but hit a low of 1.2668 at the time the vote was over and surged to recover most of the ground lost ahead of the decision. In our view, this looks like a classic “sell the rumor, buy the fact” market reaction, with those who heavily sold the currency during the day, covering their short positions at the time the outcome was known.

Looking ahead, the pound’s faith is likely to continue being dictated by developments surrounding the Brexit front. Further headlines suggesting that other options are much more likely than the case of a disorderly withdrawal could keep the currency supported. On the other hand, with the clock ticking towards the 29th of March, anything suggesting that there is no consensus of how to move forward could revive fears of a no-deal outcome and thereby, sterling could come under renewed selling interest.

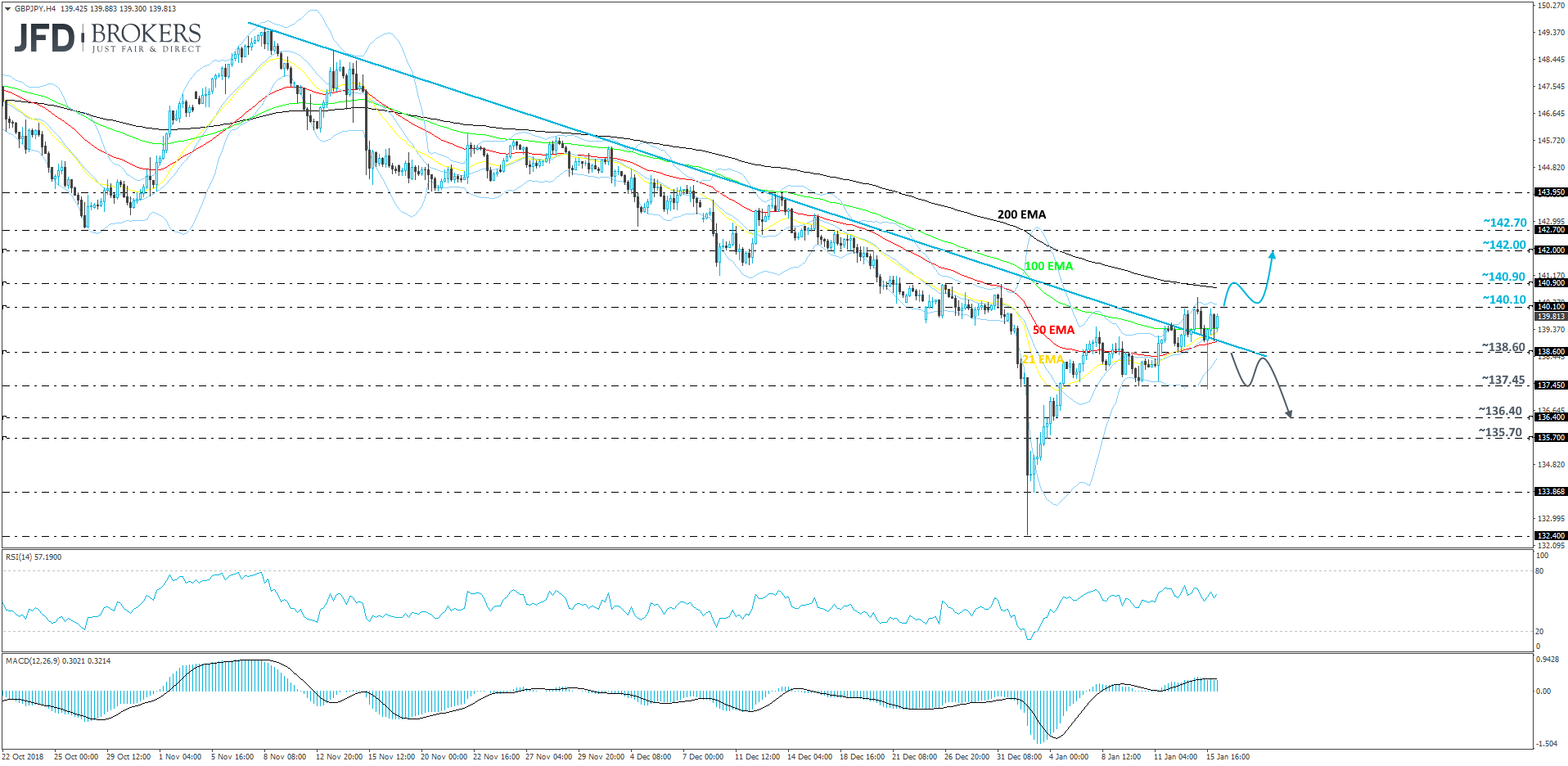

GBP/JPY – Technical Outlook

GBP/JPY had a volatile day yesterday, where the pair initially travelled around 300 pips down before the UK Parliament vote, and then straight after, it recovered about 90% of its losses. Of course, there is still a lot of uncertainty surrounding the UK political scene. From the technical side, the pair is trading back above its short-term tentative downside resistance line, drawn from the high of the 8th of November 2018. That said, in order to aim higher, at least in the short run, we would like to see a break through one of our key resistance areas first. That is why, for now, we will remain somewhat bullish and wait for the next move of GBP/JPY.

If the rate moves higher and gets above the 140.10 resistance area, this might be seen as a signal for more bulls to join in and drive the pair upwards to its next potential resistance zone at 140.90, marked near the highs of the 26th and the 31st December. If that area is not able to withstand the bull-pressure, a further rise could easily lead the pair to the 142.00 barrier, or even the 142.70 hurdle, which is the high of the 18th of December.

Because GBP/JPY is still not far from the aforementioned short-term downside resistance line, it still has got a chance to drop below it, if there is a sudden rise in yen-buying activity, or depreciation of the British pound again. A drop back below the downside line and a break of the 138.60 support level, marked by the low of the 14th of January, could invite more sellers to the table. This may bring the rate down to test the 137.45 obstacle, a break of which could clear the path towards the 136.40 hurdle, which is the in the intraday swing low of the 4th of January.

Germany’s Annual Growth Rate Slides to the Lowest in Five Years

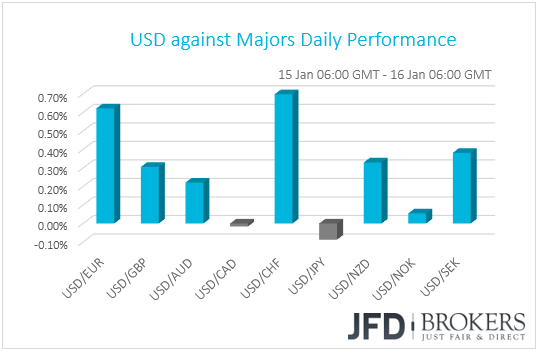

Moving to the other currencies, most of them underperformed against the dollar, with the exceptions being JPY, CAD and NOK. The former gained somewhat and the other two traded nearly unchanged. The main losers were CHF, EUR and SEK in that order.

The euro was hit hard yesterday, after the German government reported that growth in Eurozone’s economic powerhouse slowed to +1.5% in 2018 from +2.2% in 2017. That’s the lowest rate in five years and, although in-line with expectations, it enters the basket of data prompting market participants to raise bets that the ECB could change its language around the economic outlook soon and note that the risks have shifted to the downside.

With the minutes of the previous gathering showing that some policymakers argued for such a change to take place then, it would be interesting to see whether this will happen as early as next week, when the Bank holds its first policy meeting for 2019. Yesterday, ECB President Draghi said that data have been weaker than expected for longer than expected, adding that “There is no room for complacency”, which, in our view, increases the likelihood for a dovish shift next week.

Such expectations may keep the euro under pressure heading into the gathering but given the latest improvement in the broader market sentiment, we prefer to exploit any potential euro weakness versus the Aussie and Kiwi, which tend to strengthen when risk appetite is supported, especially due to news concerning China, one of Australia’s and New Zealand’s biggest trading allies.

Putting the euro against the safe-havens, we prefer to stand pat on EUR/JPY for now, while we actually see the case for EUR/CHF to strengthen a bit. Apart from a broader risk-on environment, headlines suggesting a potential dovish shift in ECB’s language and speculation that policymakers could delay raising rates may also weigh on the franc, as something like that could also delay any tightening plans by the SNB, which closely follows the ECB’s footsteps.

EUR/CHF – Technical Outlook

Since the first days of January, EUR/CHF keeps on forming higher lows, which shows that the bulls are trying hard not to give up and push the pair back up again. But let’s not forget that, last week, EUR/CHF tried to fly higher, but got held near the 1.1340 barrier, which failed to break and then the pair quickly got back down again. That said, it wasn’t able to create a lower low, which, in our view, means that we might see another attempt by the bulls to drive the rate higher.

In order to consider the upside again, we would need to see a strong push above the 1.1290 hurdle, marked by the highs of the 11th, 13th and the 15th of January. This way we may start examining again the possibility for EUR/CHF to challenge the 1.1317 obstacle, which if broken, could open the door for a re-test of the 1.1340 resistance area, last time reached on the 11th of January. Slightly above lies another potential area of resistance, at 1.1345, which held the pair down on the 24th of December.

Alternatively, a drop below the previously-mentioned upside support line and a break through the 1.1245 hurdle, marked by the low of the 14th of January, could force the bulls to abandon the field, at least for a while. This is when EUR/CHF could make its way to the 1.1220 obstacle, a break of which may drag the rate lower, to test the 1.1185 support level, which is near the lowest point of January.

As for the Rest of Today’s Events

The final German CPI for December is set to be released, and is expected to confirm its preliminary estimate, namely that inflation in Eurozone’s growth engine has slowed to +1.7% yoy from +2.3% in November.

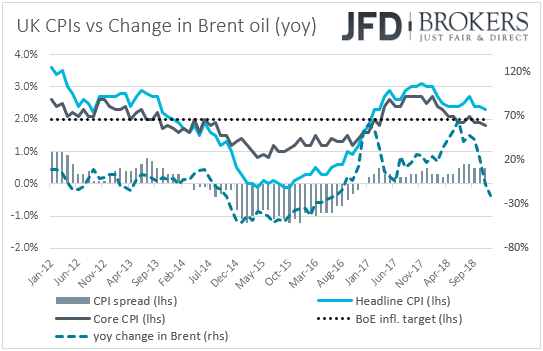

We get inflation data for December from the UK as well. The headline CPI is forecast to have slowed further, to +2.2% yoy from +2.3%, while the core rate is expected to have remained unchanged at +1.8% yoy. The case for a declining headline rate, conditional upon an unchanged core print, is supported by the fact that the yoy change of Brent oil slid further into the negative territory during the month.

With headline inflation returning to the BoE’s target faster than previously thought and the core rate staying below that objective, investors may price further out their hike expectations. However, we stick to our guns that pre-Brexit inflation numbers are likely to continue attracting less attention than usual, especially this data set, which is set to be released in the midst of all this uncertainty surrounding the UK political scene.

From the US, we get retail sales for December. Expectations are for headline sales to have risen +0.2% mom, the same pace as in November, while core sales are forecast to have slowed to +0.1% mom from +0.2%. The CB consumer confidence index declined for the second consecutive month in December, but the UoM consumer sentiment gauge rose. Thus, having that in mind, it’s hard to say to which direction the risks of the retail sales forecasts are tilted.

With regards to the energy market, the EIA (Energy Information Administration) weekly report on crude oil inventories is coming out. Expectations are for inventories to have declined 1.3mn barrels after falling 1.7mn barrels the week before. That said, bearing in mind that the API report showed a much smaller decline, we view the risks of the EIA forecast as tilted to the upside, something that could weigh somewhat on oil prices.

As for the speakers, we have only one on the agenda: BoE Governor Mark Carney.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

68% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.