The British pound skyrocketed yesterday as the UK Parliament voted in favor of stopping a no-deal Brexit under any circumstances. Today, we have the third vote in line this week, with lawmakers called to vote over extending Article 50. EU and US equity markets were a sea of green yesterday, perhaps on hopes that British lawmakers will vote down a disorderly Brexit. The slowdown in the US PPIs may have also contributed to the upbeat sentiment. As for tonight, during the Asian morning Friday, the Bank of Japan concludes its two-day monetary policy meeting, but we don’t expect any material changes.

GBP Rallies on No-deal Exit Rejection, Extension Vote Looms

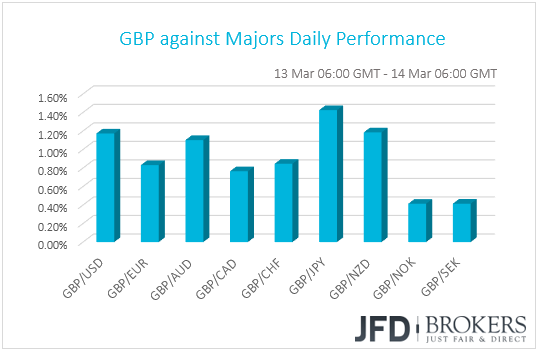

And back to the sky. The pound rebounded to outperform all its major peers yesterday. It gained the most against JPY, NZD, and USD in that order, while the currencies that lost the least were SEK and NOK.

For the umpteenth time, the catalyst was developments surrounding the Brexit landscape. Yesterday, the Parliament was scheduled to vote on whether they prefer to leave the EU with no deal on March 29th, but the motion was amended after lawmakers voted 312-308 in favor of a change that prevents a no-deal Brexit under any circumstances. When the motion was put on the table, MPs ruled out the case of a disorderly divorce via a 321-278 vote.

Although Parliament was expected to reject the no-deal case, the pound skyrocketed on these developments as the results highlight the willingness of lawmakers to never allow a chaotic withdrawal. Instead of preventing a no-deal exit on March 29th, they want to rule it out indefinitely. That said, we don’t know how is practically possible to assume a 0% probability of a no-deal Brexit when there is no clear plan how to move forward. After the vote, PM May herself said “The legal default in UK and EU law remains that the UK will leave the EU without a deal unless something else is agreed.”

As for today, we have the third stage of this series of votes, where MPs are called to vote over extending Article 50. The motion scheduled for today suggests that the government will request from the EU an extension until June 30th if a deal is reached by March 20th. Otherwise, the EU may require a clear purpose before approving any delay, and anything beyond June 30th would obligate the UK in participating to the EU Parliamentary elections of May. Having in mind that MPs showed how determined are to prevent a no-deal outcome, we expect them to vote in favor of extending the process today. But, as we have repeatedly pointed out, for any delay to take flesh, consent from all 27 EU member-states is needed.

This may prompt some hardliners to support May’s deal at a third “meaningful vote” next week, in order to avoid the softer alternatives, which include a second referendum or even revoking Article 50 altogether. In any case, anything suggesting that a no-deal Brexit can be eventually averted is likely to prove supportive for the pound. For the currency to tumble, MPs would need to vote down again May’s deal and EU member-states would have to reject the extension request. Even if they decide to accept a delay, a “kicking the can further down the road” policy from the UK will not be helpful for the currency either, as MPs will risk living what they want so much to avoid: a no-deal Brexit.

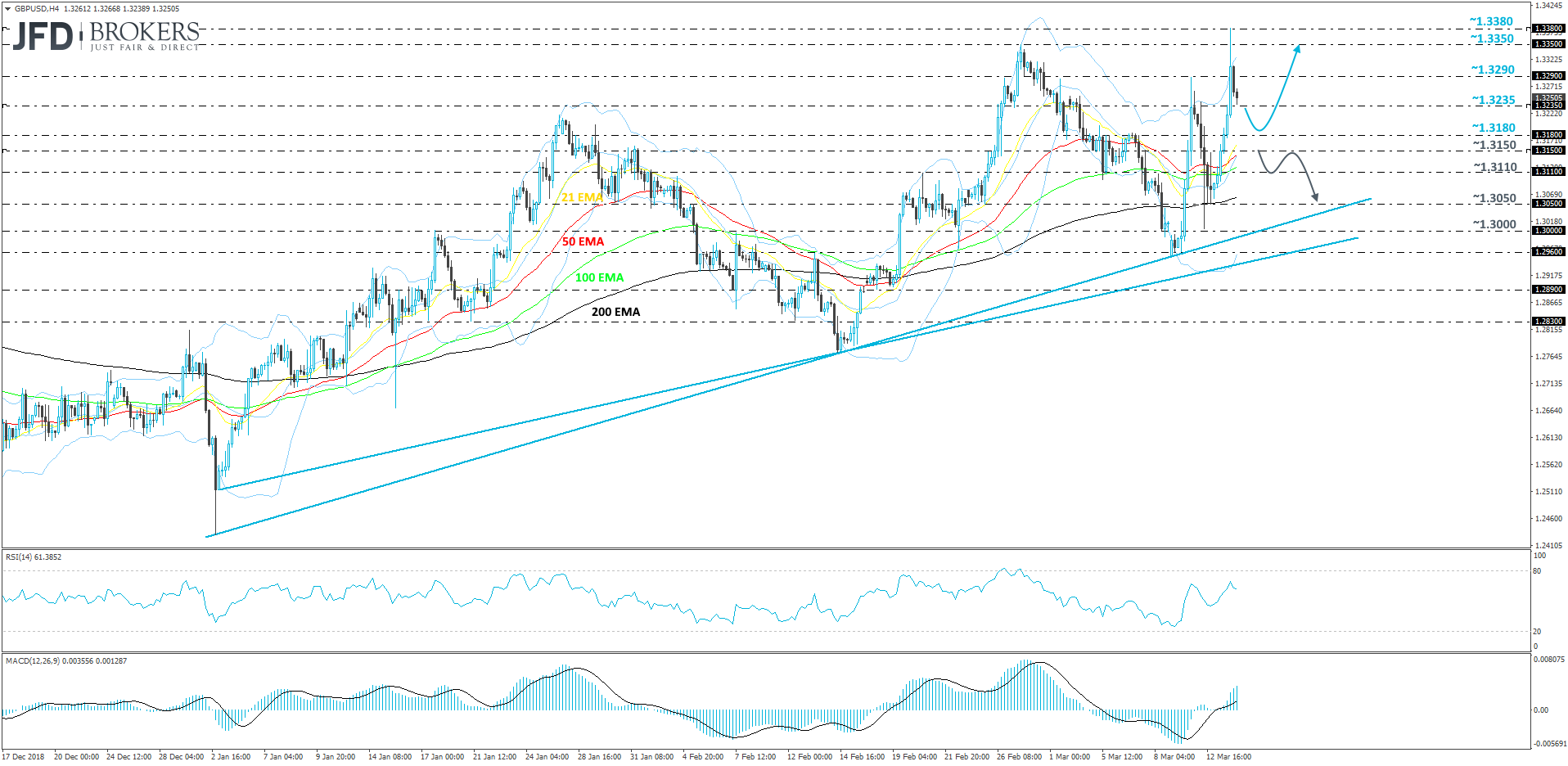

GBP/USD – Technical Outlook

After bouncing on Monday, from its short-term upside support line drawn from the low of 2nd of January, GBP/USD gained slightly more than 300 pips. But it quickly lost most of those gains the next day. But yesterday was another successful day for the bulls, as the pair pushed back up, gaining 300 pips again. Such a roller-coaster trading activity draws a very choppy picture for now. But one positive aspect is that GBP/USD is forming higher highs. For now, we may see a move back down, but we will class that as a correction, before another leg of buying.

A drop below the 1.3235 hurdle could drive the pair towards its next support area at 1.3180, marked near the high of March 7th. If GBP/USD struggles to overcome it, this could be the green light for the bulls to step in again and take advantage of the lower rate. We will then target the 1.3235 hurdle again, a break of which may open the door back to Monday’s high at 1.3290, or even the 1.3350 barrier, marked by the highest point of February.

Alternatively, if GBP/USD continues with the slide below the 1.3150 obstacle, this might lead to a deeper correction, which could resemble Tuesday’s trading activity. If so, then the next potential support zone to keep an eye on could be around the 1.3110 level, a break of which could allow the bears to steer the pair towards the 1.3050 support area, marked by the intraday swing low of Tuesday, or even to the above-mentioned short-term upside support line.

“Risk On” Trading Wednesday, BoJ Decision on Friday

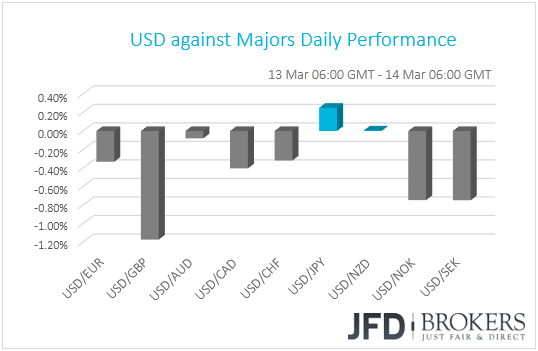

The dollar slid against most of the other G10 currencies yesterday. It gained only against JPY, while it traded virtually unchanged versus NZD. The main gainers were GBP, NOK and SEK.

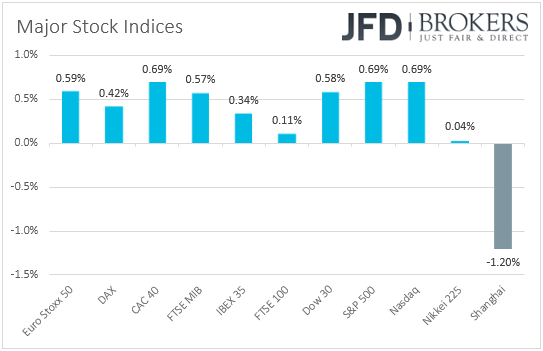

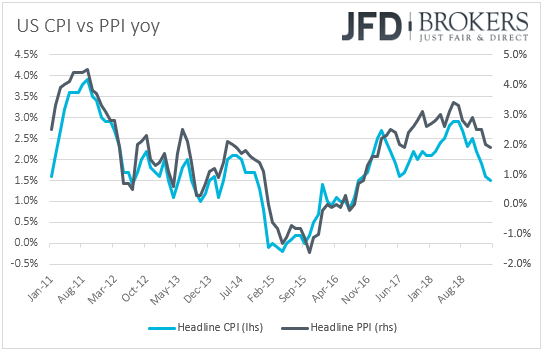

Although the commodity-linked currencies Aussie and Kiwi failed to capitalize yesterday, the weakening of both the dollar and the yen suggests a risk-on trading mood, at least during most of the day. Indeed, all major EU and US bourses ended their trading in the green, perhaps due to hopes that the UK Parliament will reject a disorderly Brexit, something it did. Coming on top of the slide in the US CPI rates for February, the slowdown in the PPIs may have also contributed to investors upbeat morale and the weakening of the dollar.

Continued muted inflation supports the case for a “patient” Fed, and with interest rates expected to stay at current levels for longer, equities rose. Remember that in the past we pointed out that higher interest rates mean higher borrowing costs for companies, something that could erode their profitability. Thus, with no expectations with regards to a Fed hike this year, investors are probably willing to increase their risk exposure.

Having said all that though, investors’ mood changed overnight, and this is evident by the performance of the Asian stock indices. Japan’s Nikkei 225 closed virtually unchanged, while China’s Shanghai Composite slid 1.20%. This may be due to Chinese data, which showed that industrial production in February grew at the slowest pace in 17 years, adding to concerns with regards to the performance of the world’s second largest economy, even though fixed asset investment and retail sales beat estimates.

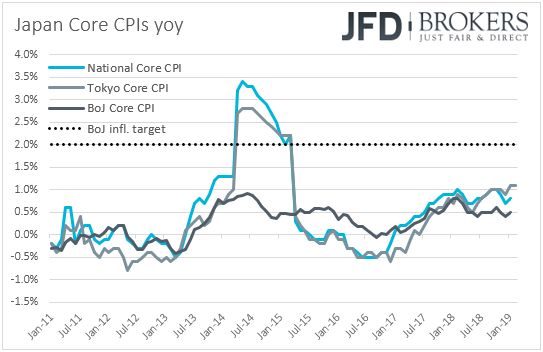

Staying in Asia, tonight during the Asian morning Friday, the Bank of Japan concludes its two-day monetary policy meeting. At their first meeting for 2019, Japanese policymakers kept their ultra-loose policy unchanged, reiterating that they intend to maintain the current extreme low levels in interest rates for an extended period of time. What’s more, in their quarterly report, they trimmed further their inflation projections for the whole forecast horizon. The Bank now expects its core CPI to hit +1.4% yoy in the fiscal year 2020/21, down from +1.5% previously, and well below its inflation objective of 2%.

Latest inflation data showed that headline consumer prices slowed to +0.2% yoy in January from +0.3% in December, while the core National CPI rate ticked up to +0.8% yoy from +0.7%. The Bank’s own core inflation rate stood at +0.5% yoy. Thus, with all inflation metrics running well below the BoJ’s 2% objective, we stick to our guns that policymakers are unlikely to alter their ultra-loose policy anytime soon.

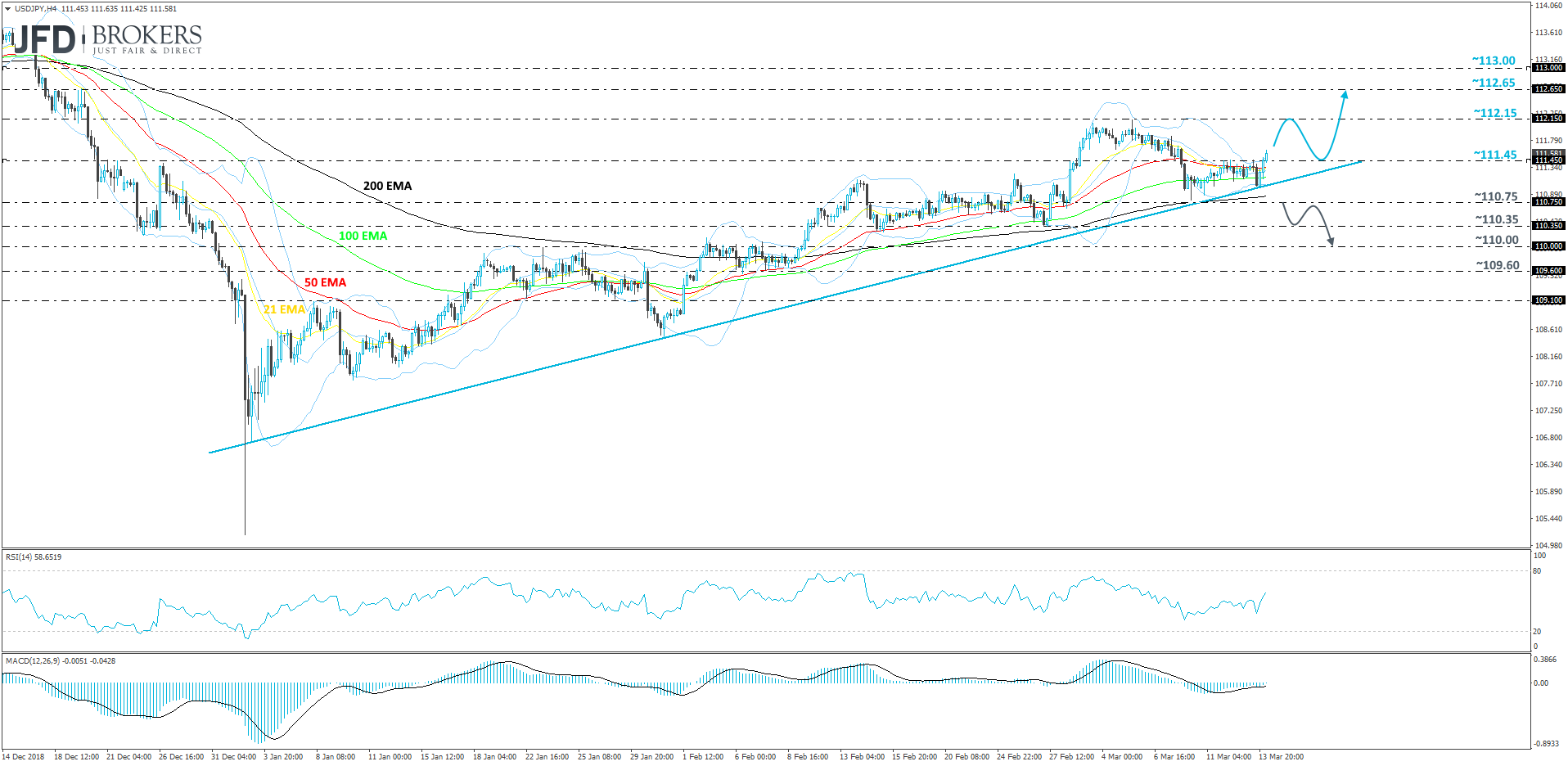

USD/JPY – Technical Outlook

USD/JPY continues to be supported by its short-term upside line taken from the low of January 3rd. During the Asian morning today, the pair had already made a move higher, breaking above its resistance barrier at 111.45, a move that could lead to slightly higher areas. That said, the US dollar is not the strongest of currencies lately, but bearing in mind that the yen could stay weak if risk appetite prevails again, we would take a more cautiously-bullish approach, at least for now.

A further push higher, away from the 111.45 barrier, could increase the USD/JPY’s chances of hitting its next potential resistance zone, at 112.15, marked by the high of March 5th. Of course, if that zone holds again, we may see a small correction back down. But as long as the aforementioned upside line remains intact, we will continue targeting higher areas. Another push higher and eventually a break of the 112.15 hurdle could open the door to levels which were last time tested in December. This is when the 112.65 resistance area might come into play. It marks the highs of December 18th and 19th.

On the other hand, a break of the previously-discussed upside line and a drop below the 110.75 hurdle could change the short-term outlook to a negative one. Such a move might spook the bulls from the field and allow the bears to sit behind the steering wheel. USD/JPY could then slide to the next potential support area, at 110.35, which marks the low of February 27th. If that areas is not able to withstand the bear-pressure, a break below could lead the rate towards the psychological 110.00 level, which played the role of good resistance between February 4th and 7th.

As for the Rest of Today's Events

Besides the UK vote on extending Article 50, the economic calendar includes the US new home sales for January and the initial jobless claims for the week ended on March 8th. New home sales are expected to have slid 0.6% after rising 3.7% in December, while initial jobless claims are anticipated to have increased to 225k from 223k the week before. This is likely to drive the 4-week moving average slightly down, to 226.00k from 226.25k.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

76% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2019 JFD Group Ltd.