Both the pound and the euro gained yesterday after UK PM Theresa May managed to secure Cabinet backing for her draft Brexit deal. However, the gains were limited as investors remained concerned over whether the deal could pass through Parliament. Aussie was the main gainer among the G10s due to Australia’s encouraging employment report, while SEK underperformed the most as Sweden’s inflation data missed estimates.

GBP and EUR Gain as May Secures Cabinet Backing, But Uncertainties Remain

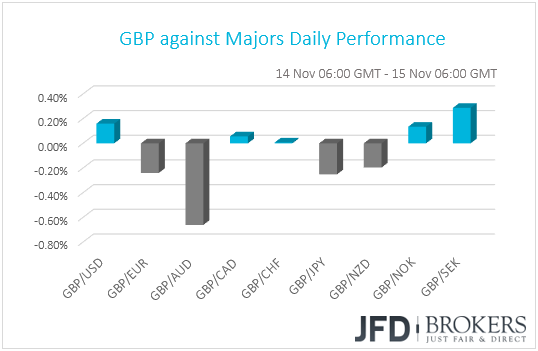

The pound traded mixed against the other G10 currencies yesterday. It gained against SEK, USD and NOK in that order, while it underperformed versus AUD, JPY, EUR and NZD. Sterling traded virtually unchanged against CAD and CHF.

The British currency traded in a roller-coaster manner yesterday, driven once again by developments surrounding the Brexit landscape. While the Cabinet meeting over the Brexit draft was underway, headlines suggested that UK PM Theresa May will not deliver a media statement after the gathering, and that Tory hardliners may call for a no-confidence vote on her leadership. The pound plunged around 150 pips against its US counterpart on the news, but surged a couple of hours later, after the meeting concluded with May securing the backing of her ministers. The currency recovered all the lost ground and gained even more, but it pulled back again overnight. The joy for GBP-bulls may have been limited given that the spotlight now falls to the Parliament, which must approve what is finalized at a possible EU summit later this month, most probably on the 25th.

As we noted several times recently, getting the deal approved in Parliament remains the hardest task in our view. May’s opponents appear ready to vote down the deal, even before reading it. Thus, with uncertainty over the final outcome still at elevated levels, we remain skeptical as to whether the pound can hold into any future rallies. Even if the currency continues to gain in the short run, we will hold a cautious stance with regards to the longer-term picture. The outcome scenarios still range from a calm and smooth divorce process to a disorderly and chaotic exit without any accord.

The euro also gained after May secured Cabinet approval for her Brexit plan. Strangely, at least to our eyes, the common currency gained more than the pound. However, we remain cautious over this currency’s future performance as well. Apart from concerns on whether the Brexit deal could pass through the UK Parliament, Italian politics are also likely to keep a lid on further euro gains, especially against its US counterpart. On Tuesday, Italy re-submitted its budget plans to the EU Commission, keeping the growth and deficit forecasts untouched, something that makes another rejection by the Commission the most likely outcome. The question now is whether the EU will indeed proceed with imposing sanctions to the nation.

On the other side of the equation, although the US dollar traded on the back foot yesterday, its fundamentals remain strong, we believe. The US economy is growing at healthy rates, while inflation, as measured by the core PCE index, stands at the Fed’s objective of 2%. Yesterday, the CPI data for October showed that the headline rate rose to +2.5% yoy from +2.3%, while the core rate just ticked down to +2.1 yoy from +2.2 yoy. What’s more, the labor market continues to tighten. In our view, all these keep the Fed on track to continue raising rates, with the next hike perhaps coming next month. According to the Fed funds futures, the market currently assigns a 73% chance for such a move.

Aussie was the big winner, surging after Australia’s employment report revealed that the unemployment rate held steady at 5.0% in October, instead of rising to 5.1% as the forecast suggested, while the net change in employment showed that the economy gained much more jobs than expected. Specifically, the economy added 32.8k jobs from an upwardly revised 7.8k in September. Expectations were for a 19.9k increase.

The biggest loser was SEK, which came under selling interest following Sweden’s inflation data for October. The CPI remained unchanged at +2.3% yoy, missing expectations of +2.4%, while the CPIF rate ticked down to +2.4% yoy from +2.5%. The core forecast was for an increase to +2.6% yoy. As far as the core CPIF metric is concerned, it declined as well, to +1.5% yoy from 1.6% the previous month. This data set may have come as a disappointment to those betting for a Riksbank hike in December instead of February. That said, the Bank’s upcoming gathering is scheduled for the 20th of December, and up until then we have another set of inflation data. Therefore, we prefer to wait for the next figures before we start examining when the Bank will most likely hit the hiking button.

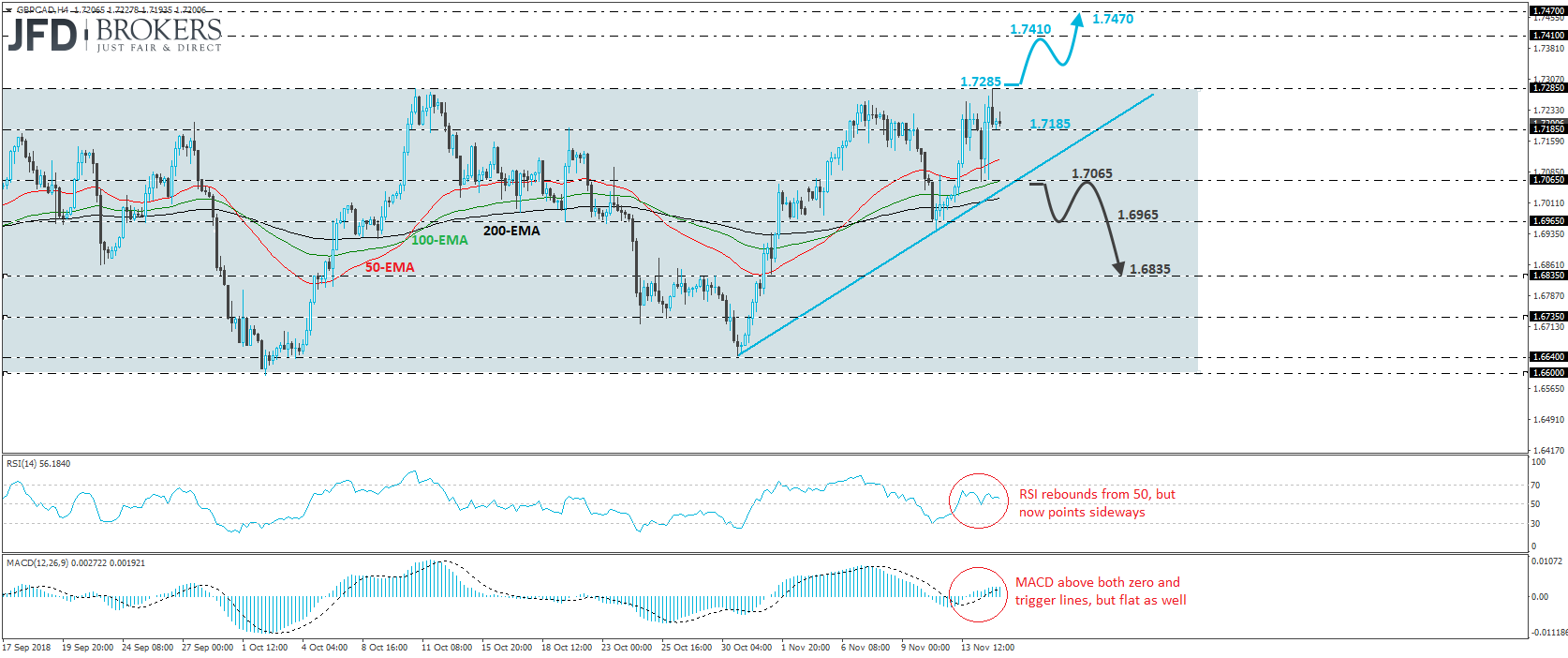

GBP/CAD – Technical Outlook

GBP/CAD traded in a volatile manner yesterday. It tumbled on headlines that PM May was likely to face leadership challenge but hit support near 1.7065 and surged after the UK Cabinet approved her draft Brexit plan. That said, the rebound was stopped by the key resistance zone of 1.7285, which stopped the rate from drifting north on the 11th of October. Although the pair is trading above the upside support line taken from the low of the 30th of October, it still remains within the broader sideways range that’s been containing the price action since the 25th of July.

A decisive break above 1.7285 would confirm a forthcoming higher high on both the 4-hour and daily charts and could signal the upside exit out of the aforementioned range. Such a break could set the stage for extensions towards the 1.7410 zone, defined by the peak of the 17th of July. Another break above 1.7410 could open the path for the 1.7470 hurdle, marked by the highs of the 9th and 16th of that month.

Taking a look at our short-term oscillators, we see that the RSI rebounded from its 50 line but is now pointing sideways. The MACD lies above both its zero and trigger lines but runs flat as well. These indicators detect slowing upside speed and corroborate our view to wait for a break above 1.7285 before we trust further advances.

On the downside, a clear dip below 1.7065 could suggest that the bulls have abandoned the battlefield for now, and that the bears are willing to keep the pair within the aforementioned range for a while more. They may initially target the 1.6965 zone, the break of which could trigger extensions towards our next support territory of 1.6835.

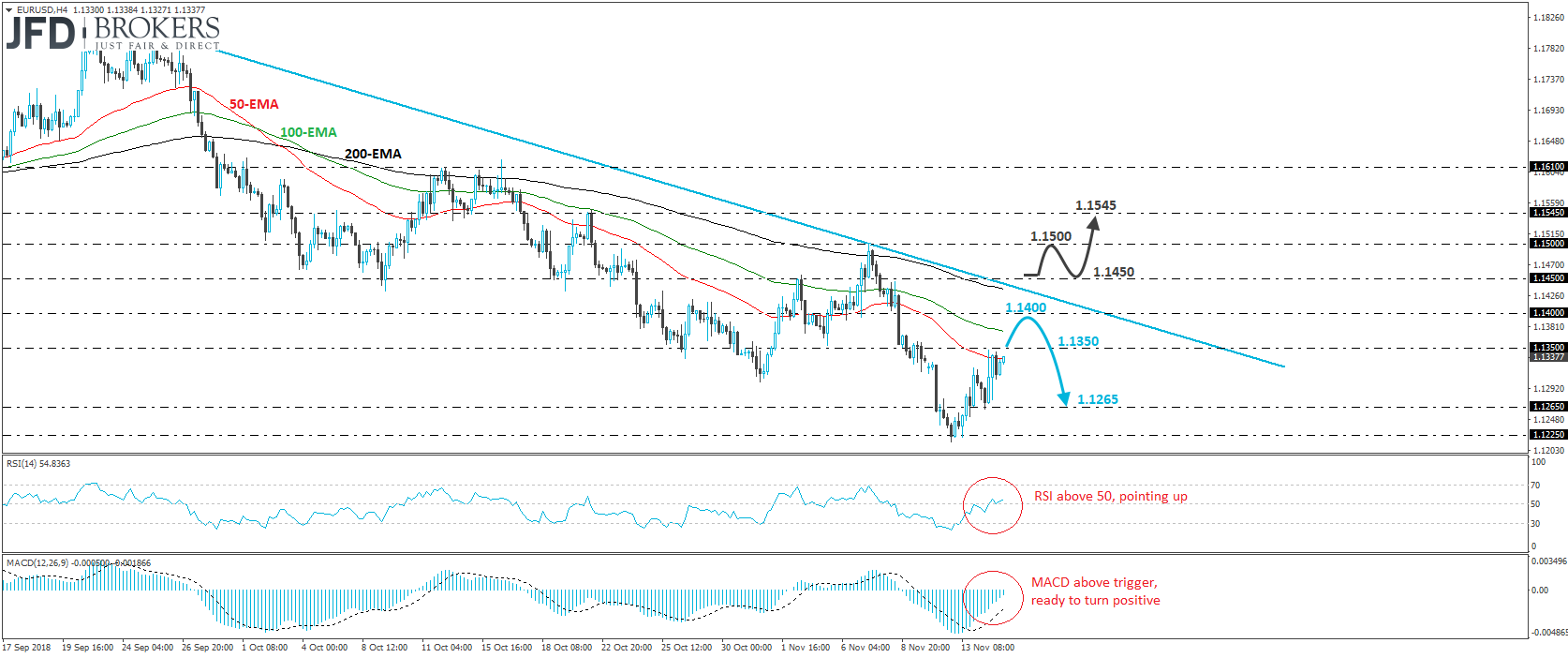

EUR/USD – Technical Outlook

EUR/USD also traded higher yesterday after the UK Cabinet approved May’s draft text on Brexit. The pair rebounded from near 1.1265 to hit resistance at around 1.1350. That said, it continues to trade below the downside resistance line taken from the peak of the 24th of September and thus, we would consider the near-term outlook to be somewhat negative for now. Even if the latest recovery continues for a while more, we would expect it to remain capped.

We would expect the bears to take charge again soon and push the rate down for another test near the 1.1265 line, the break of which could open the path for another test near 1.1225. That said, before the next bearish leg, we see the case for some more recovery. A break above 1.1350 could confirm our view and may allow the rate to challenge the 1.1400 zone, or the aforementioned downside line, from where the bears may be tempted to jump back into the action.

The notion for some more recovery is supported by our short-term oscillators as well. The RSI moved above 50 and now points up, while the MACD, already above its trigger line, looks ready to obtain a positive sign soon.

Having said all these, in order to start examining whether the bulls have gained the upper hand, we would like to see a clear break above 1.1450, a resistance marked by the high of the 8th of November. Such a break could open the way for the previous day’s peak, near the psychological zone of 1.1500. If that hurdle fails to prevent the pair from rising further, then we may experience extensions towards 1.1545.

As for Today’s Events

During the European day, we have the UK retail sales for October. Both headline and core sales are expected to have rebounded 0.1% mom and 0.2% mom respectively, after both fell 0.8% in the previous month. Even though this is likely to bring the headline yoy rate down to +2.8% from +3.0%, the core yearly rate is anticipated to have ticked up to +3.3% from +3.2%, something supported by the rebound in the yearly rate of the BRC retail sales monitor for the month. Eurozone’s trade balance for September is also due out, but no forecast is currently available.

Later, we get retail sales data for October from the US as well. Both headline and core sales are anticipated to have accelerated to +0.6% mom and +0.4% mom respectively, from 0.1% in September. The Conference Board consumer confidence index for the month increased, but the UoM consumer sentiment index declined fractionally. So, it’s hard to say to which direction the risks of the retail sales forecasts are tilted. Initial jobless claims for the week ended on the 9th of November, as well as the New York Empire State and Philly Fed Manufacturing indices for November are also due to be released.

With regards to the energy market, the Energy Information Administration’s (EIA) weekly crude oil inventories are coming out. The forecast suggest that inventories rose 3.2mn barrels after rising 5.8mn the week before. Something like that would mark the 8th straight week of crude stock increases. Yesterday, the API report for the same week showed a 8.8mn barrels increase, from 7.83mn, which suggests that the risks surrounding the EIA forecast may be tilted to the upside.

Yesterday, oil prices rebounded somewhat after a report suggested that OPEC and its allies were discussing the case for a 1.4mn bpd output cut, which is more than the previously mentioned 1mn bpd. That said, prices pared gains after the API report was out. They could fall even lower if the EIA report today surprises to the upside.

As for the speakers, we have six on the agenda. During the European morning, ECB Chief Economist Peter Praet and ECB Executive Board member Benoît Cœuré step up to the rostrum, while later in the day, we will get to hear again from Fed Chair Jerome Powell and Fed Board Governor Randal Quarles. Atlanta Fed President Raphael Bostic and Minneapolis Fed President Neel Kashkari wil also speak.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Brokers, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Brokers analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyzes and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyzes and must therefore be viewed by the reader as marketing information. JFD Brokers prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.