The financial community switched back to ‘risk on’ yesterday, following reports that US Tr. Secretary Mnuchin is in favor of rolling back tariffs imposed to Chinese goods. Among currencies, the pound continued gaining on expectations that a no-deal Brexit is likely to be avoided. As for today, Canada’s inflation data for December are due to be released. Although we see some downside risks, we doubt that they could tempt BoC officials to change their mind with regards to more hikes over time.

Risk Assets Up, Safe havens Down on Tariff-relief Hopes

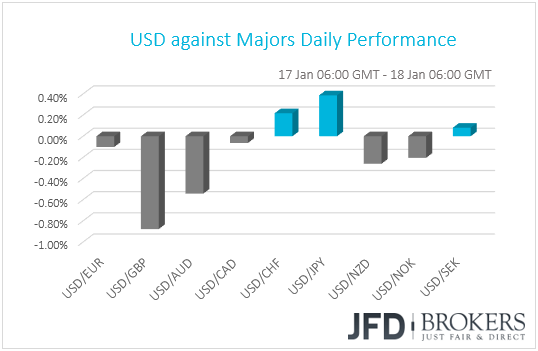

The dollar traded lower against most of the other G10 currencies on Thursday. It gained only against the safe havens JPY and CHF, while it traded virtually unchanged versus CAD and SEK. The main winners were GBP, and the commodity-linked currencies AUD and NZD.

The performance in the FX sphere suggests that, at some point during the day, market sentiment switched back to ‘risk on’. Indeed, even though most major EU bourses ended their trading in the red, perhaps feeling the heat of the Huawei investigation headlines, US equity indices closed in the green, with the positive appetite rolling into the Asian morning Friday. Japan’s Nikkei 225 and China’s Shanghai Composite ended their sessions 1.27% and 1.42% up respectively.

The driver behind the boost in investors’ morale may have been a Wall Street Journal report, saying that US Treasury Secretary Steven Mnuchin is in favor of rolling back tariffs imposed to Chinese goods in order to calm the nerves of financial market participants, although US Trade Representative Robert Lighthizer has reservations about the idea. That said, the Treasury Department was quick to deny the report, noting that neither Mnuchin nor Lighthizer has made any recommendations on the matter.

Stocks pulled back on the denial, but remained in positive territory, which means that investors remained hopeful over the prospect of a happy end in the US-China trade sequel. Despite the denial, they may be thinking that there is no smoke without fire, and that at some point tariffs will eventually be lifted. Now, focus turns to the 30th and the 31st of January, when China’s Vice Premier Liu He will travel to the US to hold talks with Mnuchin and Lighthizer. But ahead of this round of talks we may get trade headlines from the World Economic Forum in Davos next week, where Mnuchin and Lightizer could meet with China’s Vice President Wang Qishan.

Yesterday, we noted that we would switch flat with regards to the broader market sentiment and wait to see whether the Huawei investigations will affect negotiations between China and the US. Yesterday’s reports suggest that, at least at first glance, that’s not the case. Further progress in the upcoming rounds of talks may encourage investors to increase their bets with regards to a final accord before the 1st of March, when the 90-day deadline expires, and thereby equities and the risk-linked currencies are likely to gain more. At the same time, safe havens are likely to stay on the back foot. Chinese officials’ willingness to support their economy with further stimulative measures and the recent dovish shift by several Fed officials are also supportive factors. On the other hand, anything pointing that developments around the US-China trade standoff have changed course, as well as signs that the US shutdown has started leaving its marks on the US economy, may hurt risk appetite.

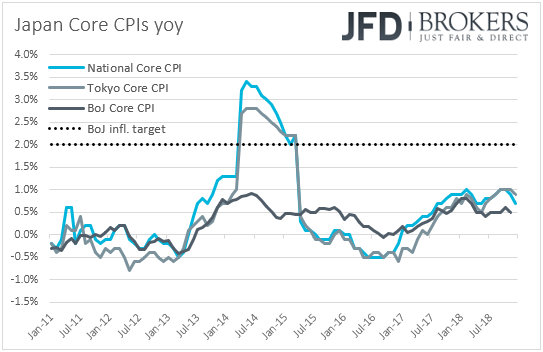

Although the yen did not react at the time the Japanese inflation data were out, the results allowed traders to keep selling the currency. The headline CPI rate slowed to +0.3% yoy from +0.8% as was expected, but the core rate slid by more than anticipated. Specifically, it fell to +0.7% yoy from +0.9%, missing expectations of a tick down to +0.8% yoy. Combined with the BoJ’s own core CPI, which stands at +0.5% yoy, these results add more credence to our longstanding view that Japanese policymakers have still a long way to go before considering a meaningful step towards normalization.

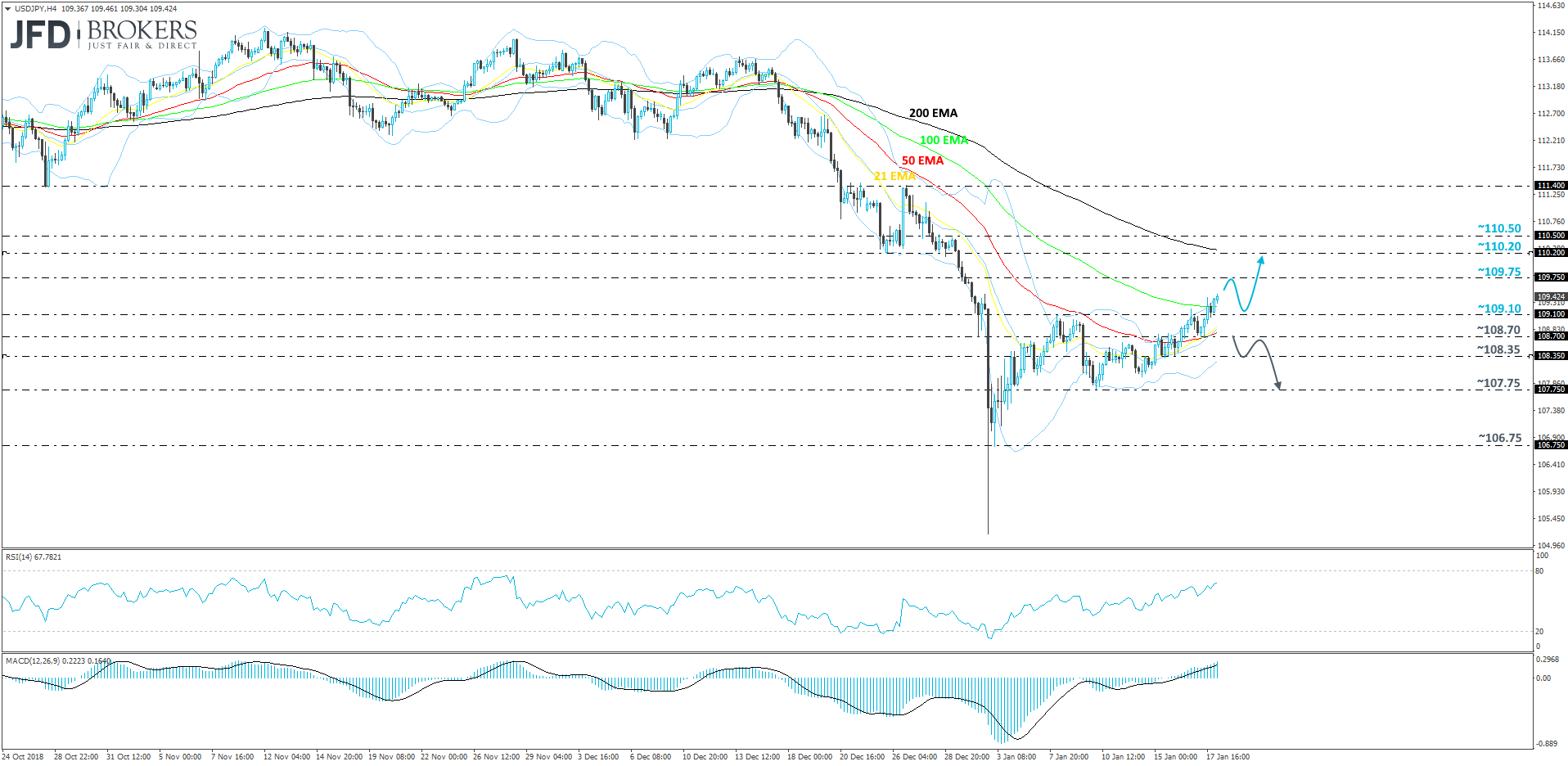

USD/JPY – Technical Outlook

The interest in the Japanese currency seems to be fading away, for now, as the market risk sentiment is back on. USD/JPY keeps on slowly grinding higher towards levels last seen in the beginning of January and the end of December. Because the buying momentum is not so rapid, we will remain cautiously-bullish in the short run.

Yesterday, USD/JPY managed get above one of its key resistance areas, at 109.10. Such a move may lead the pair further up, as more buyers could become more confident in USD/JPY’s upside potential. We will now target the 109.75 obstacle, a break of which could push the rate a bit higher, to test the 110.20 barrier, marked by the lows of the 25th and the 28th of December. Just slightly above we have another potential resistance zone that could get reached, at 110.50, which is the high of the 31st of December.

Alternatively, if the rate reverses sharply and drops below the 109.10 level, the bulls might start worrying over the pair’s upside potential in the short run. That said, in order to shift our views towards lower areas again, we will wait until we see a break below the 108.70 hurdle, marked by yesterday’s low. The break could indicate that USD/JPY is ready for a bit more retracement back down. The rate could then go ahead and drop to the 108.35 obstacle, a break of which opens the door to another good potential area of support, at 107.75, marked by the low of the 10th of January.

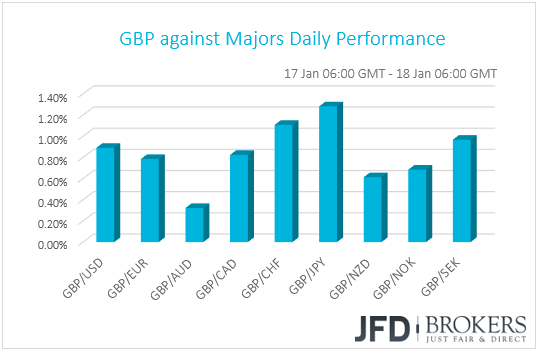

GBP the Main Gainer, Canada’s CPIs in Focus

The pound continued gaining yesterday, outperforming all the other G10 currencies. It seems that GBP-bulls continued adding to their positions on expectations that the UK will seek any other option rather than crashing out of the EU with no accord, from extending Article 50 to a second referendum, or even revoke the process altogether.

Yesterday it was announced that the Parliament will vote on May’s plan B on the 29th of January. The new plan must be presented on Monday, and we still find it hard for any amendments to be broadly accepted. The EU does not want to deviate much from what was already agreed with May, but Parliament’s vote shows that a lot needs to be changed for a new plan to pass. So even if May agrees with MPs on the changes, she may not find EU on the same page.

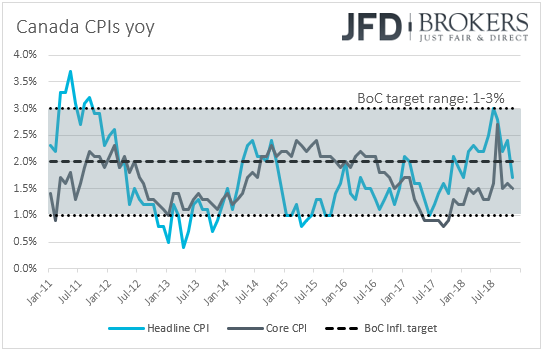

As for today, the main event on the agenda is Canada’s inflation data for December. Expectations have now changed and suggest that the headline rate held steady at +1.7% yoy, while still there is no forecast for the core CPI, which was at +1.5% yoy in November. Bearing in mind that oil prices remained in a sliding mode during the month, we view the risks surrounding the headline rate as tilted somewhat to the downside.

That said, even if inflation edges somewhat lower, it would be in line with the BoC’s view and thus, we don’t expect it to alter officials’ plans, who still see the case for more rate hikes over time. We believe that a notable tumble, especially in the core rate, is needed for market participants to start worrying again that the Bank will stop its hiking process.

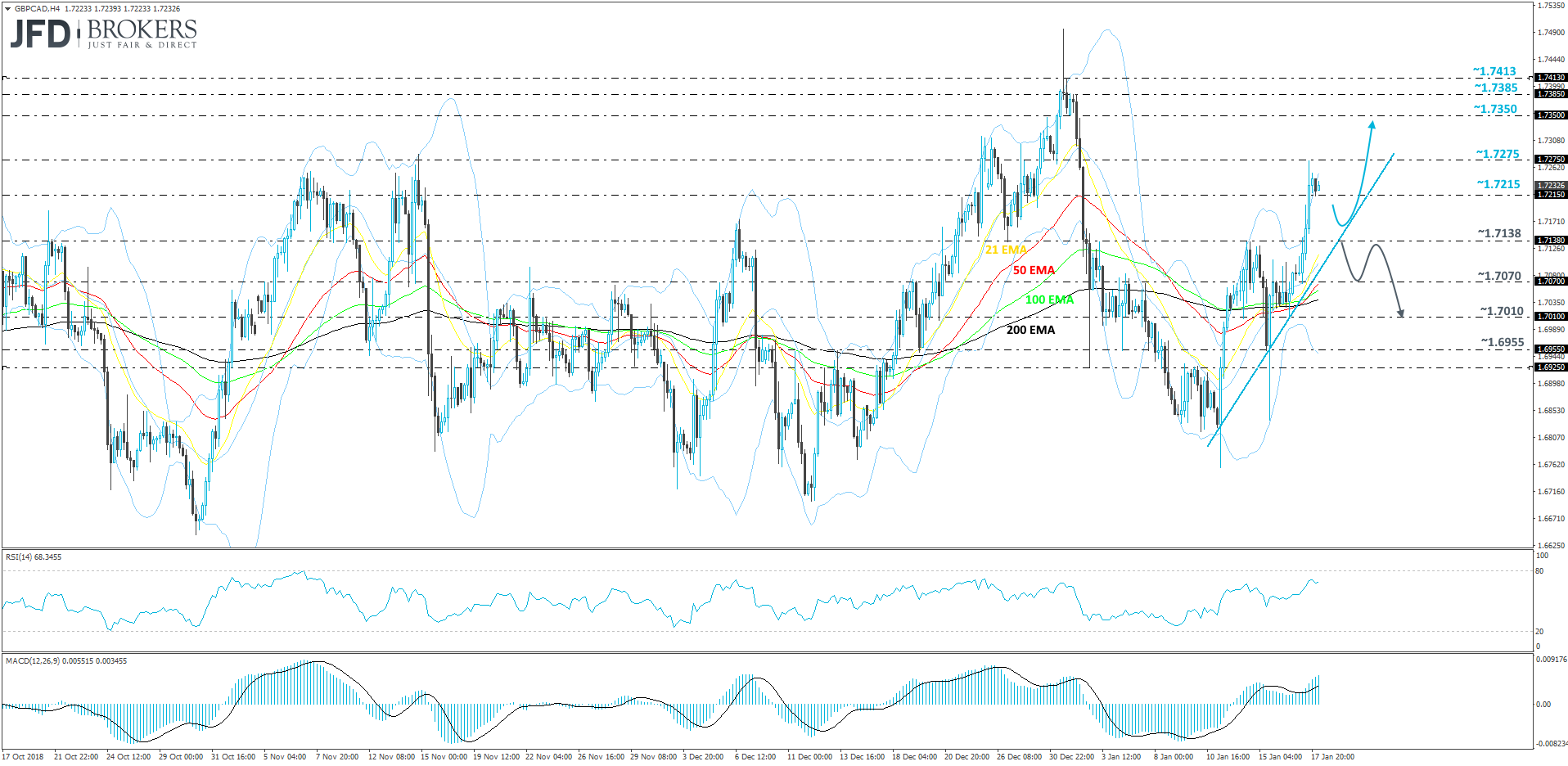

GBP/CAD – Technical Outlook

GBP/CAD is having a great run this week, where the pair keeps making new highs. It is also trading above a short-term tentative upside support line, connecting the lowest points of the 4-hour candle-bodies that formed the troughs on the 11th and 15th of January. In our view, this adds a positive spin on the pair’s short-term outlook. But because GBP/CAD is already quite extended to the upside, there might be a chance for the rate to correct a bit back down, and if that upside line remains intact, we may see another leg of buying.

A drop below the 1.7215 hurdle could place GBP/CAD under a bit of pressure and the pair might move slightly lower, to test the aforementioned upside support line. If that line withholds the rate from dropping lower, this could be the time for the bulls to step in again and drive GBP/CAD back up. A move above the 1.7215 obstacle, could clear the path towards yesterday’s high, near 1.7275, a break of which might push the rate further up, where the next potential area of resistance could be at 1.7350, marked by the inside swing low of the 1st of January.

If GBP/CAD continues sliding beyond the aforementioned short-term upside support line, this would also place the rate below the key support hurdle, at 1.7138, which is the high of the 14th of January. This could invite more sellers into the game, which may lead to the rate dropping towards the 1.7070 obstacle, where another break may push GBP/CAD further down. The next potential area of support could be near the 1.7010 level, marked by the low of the 16th of January.

As for the Rest of Today’s Events

During the European day, we get the UK retail sales for December. Both headline and core sales are expected to have slid 0.8% mom and 0.5% mom, from +1.4% mom and +1.2% mom respectively. This may drive the headline yoy rate slightly lower, but it could leave the core yearly rate unchanged. The case for a slide in the headline yoy rate is supported by the BRC retail sales monitor for the month, which slid further into the negative territory, to -0.7% yoy from -0.5%.

In the US, industrial and manufacturing production for December are due to be released, as well as the preliminary UoM consumer sentiment index for January. Industrial production is expected to have slowed to +0.2% mom from +0.6%, while manufacturing production is forecast to have risen 0.3% mom after stagnating in November. That said, bearing in mind the tumble in the ISM manufacturing PMI for the month, we remain skeptical over the manufacturing production forecast. With regards to the preliminary UoM consumer sentiment index, it is expected to have declined to 96.9 from 98.3 in December.

As for the speakers, we have two on today’s schedule: New York Fed President John Williams and Philadelphia Fed President Patrick Harker.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

68% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.