Risk appetite got boosted yesterday, a reaction reflecting investors’ relief after the US midterm elections. Overnight, the RBNZ stood pat, with Governor Orr keeping the prospect of a rate cut on the table. The central bank torch is now passed to the FOMC, which decides on policy later today. Expectations are for officials to remain on hold, but we expect them to keep the door wide open for a December hike.

Risk Appetite Gets Boosted After US Elections, Fed Decides on Policy

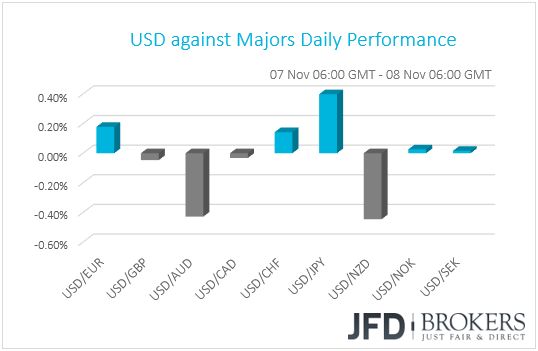

The dollar traded mixed against the other G10 currencies on Wednesday. It gained against JPY, EUR and CHF in that order, while it underperformed against AUD and NZD. The dollar traded virtually unchanged against GBP, CAD, NOK and SEK.

The weakening of the safe havens JPY and CHF and the strengthening of the commodity-linked AUD and NZD suggest a boost in investors’ risk appetite. Indeed, EU and US stock indices were a sea of green yesterday, with the upbeat sentiment rolling into the Asian morning Thursday. Although China’s Shanghai Composite index closed slightly lower, Japan’s Nikkei ended its session 1.83% up.

In our view, this reflects investors’ relief after a risk event, namely the US midterm elections, resulted in the expected outcome. Despite trading lower for the first half of the day, the greenback rebounded as well, staying on the back foot only against Aussie and Kiwi. Remember that yesterday we said that we don’t expect its weakness to last for long. The Democrats could make President Trump’s life difficult in terms of proceeding further with his agenda, but his already-implemented policies are unlikely to be rolled back. Therefore, we expect the US economy to continue expanding, and the Fed to stay on course for more rate increases.

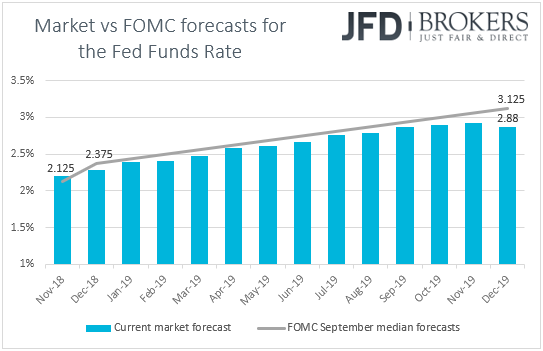

Speaking about the Fed, the Committee concludes its monetary policy meeting today. This would be one of the “smaller” meetings that are not accompanied by new economic projections, neither a press conference by Fed Chair Jerome Powell. Expectations are for the Committee to keep interest rates untouched within the 2.00-2.25% range, with the market assigning a 93% probability for such an outcome. Thus, if this is the case, market participants are likely to quickly turn their attention to the accompanying statement.

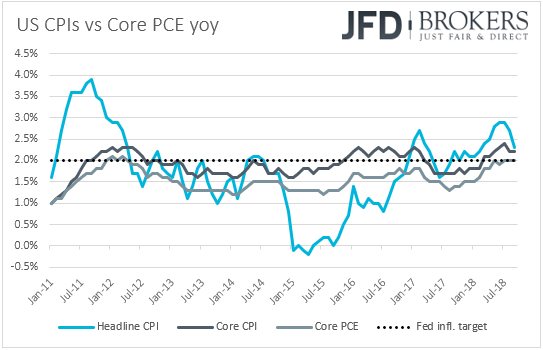

The key takeaway we got from the latest FOMC meeting, as well as by the minutes of that gathering, is that Fed officials are willing to continue raising rates mainly guided by economic data, instead of how close to their neutral level interest rates are. What’s more, a number of policymakers believe that it would be necessary to raise rates above neutral for some time. After that gathering, data showed that the headline CPI slowed in September, but the core CPI rate remained unchanged at +2.2% yoy. The yearly core PCE rate for the month, the Fed’s favorite inflation measure, also held steady, at +2.0%. What’s more, although the economy slowed in Q3, according to preliminary data, it still grew at a strong pace (+3.5% qoq SAAR). Last but not least, Friday’s employment figures showed stellar job gains and with wage growth hitting its highest rate since 2009.

In our view, the data keep the Fed on track for more rate hikes and thus, we don’t expect to get any surprises from this meeting’s statement. We expect officials to repeat that the labor market has continued to strengthen, that economic activity has been rising at a strong rate, that inflation remains near 2%, and that they expect further gradual increases in interest rates. According to the Fed funds futures, there is a 75% probability for the next hike to come in December, while investors are fully pricing in two more for 2019 at a time when the Fed expects three. Therefore, if US data continue to come in on the strong side, we believe that there is room for market participants to bring their expectations closer to the Fed’s, and thereby for the dollar to stay supported. As for today’s reaction, given that officials are widely expected to stay on hold and keep the door open for a December hike, we do expect the dollar to gain, but not much.

USD/JPY – Technical Outlook

USD/JPY continues its road north by slowly breaking key resistance levels. It seems that the pair is trying hard to make its way back to the highs that were last tested in the first days of October. Given that USD/JPY keeps on forming higher lows and higher highs, we will remain bullish, at least for the short run.

If the bulls continue pushing USD/JPY higher and break the 113.95 barrier, marked by the high of the 8th of October, this could open the way towards the 114.20 obstacle, which was the intraday swing low of the 4th of October. If that doesn’t slow down the buying momentum, this could be a good sign that the pair is very close to reaching the October’s highest point near the 114.55 barrier.

On the downside, because the pair is still trading above its medium-term upside support line, drawn from the low of the 29th of May, any move lower could be seen as a correction. A drop below the 113.00 zone could clear the path towards the next potential area of support at 112.56, marked by the low of the 1st of November. A further decline could mean that the bulls are stepping away and letting the bears play the game, for now, where they could drag USD/JPY all the way to the 112.20 level, a break of which could push the pair towards a test of the 111.80 hurdle, which is near the above-mentioned upside line.

RBNZ Stays on Hold, Governor Orr Keeps Rate Cut on the Table

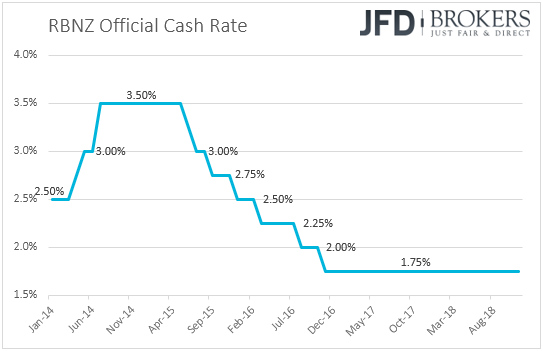

The Kiwi was one of the two gainers against the US dollar. As we already noted, its performance is mainly owed to the improvement in risk sentiment, rather than the outcome of the RBNZ policy decision. The Bank kept its official cash rate unchanged at +1.75% as was widely anticipated, while in the statement accompanying the decision, Governor Orr repeated that rates are expected to stay at this level through 2019 and into 2020.

What appeared interesting at first glance is that the Governor removed the part saying that the next move could be up or down. However, he noted that the timing and direction of any future move remains data dependent, which suggests a change in wording and not a shift in stance. Indeed, at his press conference, Governor Orr confirmed exactly that. He said that a rate cut is not off the table and that he would consider a cut if GDP falls short of the Bank’s projections. With regards to the quarterly Monetary Policy Statement, the Bank kept its GDP projections largely unchanged, but upgraded its inflation ones. As far as the timing of when officials expect rates to start rising, it remained unchanged at Q3 2020.

The Kiwi spiked higher at the time of the release, perhaps on the removal of the part saying that rates could go either up or down. However, the currency was quick to give back the gains and trade near its pre-decision levels. After reading the statement more carefully, investors may have understood that the new phrase still keeps a rate cut on the table. Saying that the direction of any future move remains data dependent suggests that if economic numbers deteriorate, the rate direction could be down.

EUR/NZD – Technical Outlook

EUR/NZD has been under a very steep downtrend line lately, taken from the high of the 26th of October. It looks like that there was no room for the bulls to jump in and ride the pair back up, but looking at the pair and where it is right now, EUR/NZD is very close to testing its long-term upside line, which could provide a bit of support for the bulls. Even though the short-term downtrend is still strong, the pair could stall near that upside line, or even rebound slightly back up for a bit of a correction. For us to get comfortable with either the upside or the downside, we would need to see a break of certain levels, which will be discussed below. Hence, for now, we will remain neutral.

Given the significance of the aforementioned long-term upside support line, there could be a good chance to see a bit of a rebound back to the upside. EUR/NZD could move higher to test the 1.6910 obstacle, a break of which could push the pair a little bit higher towards the 1.6995 resistance zone, marked by yesterday’s high. This is where the pair could meet good resistance from the previously-mentioned steep downtrend. If EUR/NZD is not able to push above that line, the bears could take advantage of that and drag the pair back down to test the long-term support line again. If the downside momentum remains high and EUR/NZD goes on and breaks below the above-mentioned long-term upside line, this could add even more negativity into the whole near-term outlook of the pair.

Alternatively, a break of the steep downtrend line and a push above the 1.7060 level, could be a good opportunity for the bulls to recapture some of the lost grounds. EUR/NZD could then make its way back up to the 1.7175 hurdle, marked by the high of the 2nd of November, a break of which could invite more bulls to join in and lead the pair a bit higher. A further acceleration of the rate could move EUR/NZD towards the 1.7265 barrier, which acted as a good support area on the 31st of October, where now it could become a good resistance. But this is where the upside could be limited, due to the short-term downside resistance line drawn from the high of the 10th of October.

As for the Rest of Today’s Events

In the US, besides the FOMC decision, we also have initial jobless claims for the week ended on the 2nd of November. Expectations are for initial claims to come in at 214k, the same print as the week before. Canada’s housing starts for October are also coming out and expectations are for a slight increase.

As for tonight, during the Asian morning Friday, we have China’s CPI and PPI data for October. Expectations are for the CPI rate to have held steady at +2.5% yoy, while the PPI rate is anticipated to have declined to +3.3% yoy from 3.6%. The RBA’s quarterly Statement on Monetary Policy is also due to be released. As we noted on Tuesday after the RBA decision, we see the case for the report to include upside revisions in the GDP and inflation forecasts, as well as downside revisions in the unemployment rate.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Brokers, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Brokers analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyzes and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyzes and must therefore be viewed by the reader as marketing information. JFD Brokers prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.