After the boost received from upbeat headlines with regards to last week’s US-China trade talks, risk appetite eased somewhat, with negotiations set to continue in Washington this week. Concerns over a potential escalation between the US and the EU with regards to auto tariffs may have been one of the reasons behind the slightly softer investor morale. Overnight, the RBA minutes echoed Governor Lowe’s remarks with regards to a potential rate cut, noting that members saw scenarios where interest rates could increase or decrease, with the probabilities more evenly balanced than before.

US and China Trade Talks Resume, RBA Members See Rate-Cut Scenarios

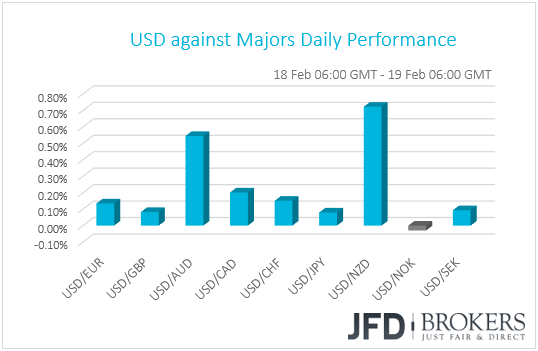

After sliding on Friday, the dollar stabilized on Monday, trading higher or unchanged against the other G10 currencies. The currencies that lost the most were NZD and AUD in that order, with CAD, CHF and EUR taking the third, fourth and fifth place respectively, although suffering much less than the former two. The greenback traded virtually unchanged, within a ±0.10% range, against GBP, JPY, NOK and SEK.

With no major economic data on yesterday’s agenda, the stabilization of the dollar and the yen, combined with the weakening of the commodity-linked currencies, suggests that, following the boost received by upbeat headlines with regards to last week’s US-China trade talks, risk appetited eased at somewhat. Indeed, major EU indices closed their Monday session slightly positive or unchanged, with the exception being UK’s FTSE 100, which slid 0.24%. US markets were closed in celebration of the President’s Day, while today in Asia, Japan’s Nikkei 225 was up only 0.10% (after rallying 1.82% on Monday), and China’s Shanghai Composite closed virtually unchanged.

It seems that after cheering last week’s round of negotiations in China, investors took a somewhat more cautious approach, with trade talks set to continue in Washington this week. Low-level talks start today, with higher-level sessions scheduled for Thursday and Friday, led by US Trade Representative Robert Lighthizer and China’s Vice Premier Liu He.

In our view, the fact that the talks continue, combined with US President Trump’s fresh comments on Friday that he could eventually extend the March 1st deadline if there is further progress, confirms the willingness of both sides to find common ground and is a positive for the broader market sentiment. Further progress this week may allow risk assets, like equities, to regain momentum and add to their latest gains, but once again, we believe that a final deal is unlikely to be reached.

Speaking at a news conference on Friday, President Trump said that the two nations are closer than ever to “having a real trade deal” and that he would be “honored” to remove tariffs if this is achieved. However, he also added that the talks are “very complicated”, which suggests that signing a deal this week remains a low-probability scenario. The fact that the talks will not include US President Trump and his Chinese counterpart Xi Jinping is another reason why we don’t expect a final consensus. As we noted in the past, we expect something like that to happen at a meeting between the two leaders.

Staying on the tariff front, the US Commerce Department sent a confidential report to the White House late on Sunday, including recommendations on how to proceed with regards to tariffs on imported cars and auto parts. Despite the fact that the results have not been published, the likelihood of a potential threat led the US auto industry to warn that such tariffs would increase substantially vehicle costs and could result in thousands of jobs being lost. Meanwhile, the European Commission vowed to retaliate in case the US follows through with such measures. In our view, although the US is getting closer to finding common ground with China, concerns over an escalation with the EU may have been a reason why risk appetite eased somewhat.

Back to the currencies, the Aussie did not react much overnight, when the RBA minutes were out. It spiked only 20 pips, just to give back those gains within the next few minutes and trade even lower in the following hours. As we noted yesterday, given that investors have already received sufficient information with regards to this Bank’s policy, there was little room for surprises from the minutes.

Although not pointed out in the statement accompanying the meeting, the minutes echoed Governor Lowe’s remarks with regards to a potential rate cut, noting that members saw scenarios where interest rates could increase or decrease, with the probabilities around these scenarios more evenly balanced than they had been over the preceding year, when an eventual hike had appeared more likely. What’s more, although policymakers acknowledged that the labor market data has been stronger than other data on economic activity, they saw “significant uncertainties” with regards to the overall economic outlook and noted that downside risks with regards to the global economy had increased.

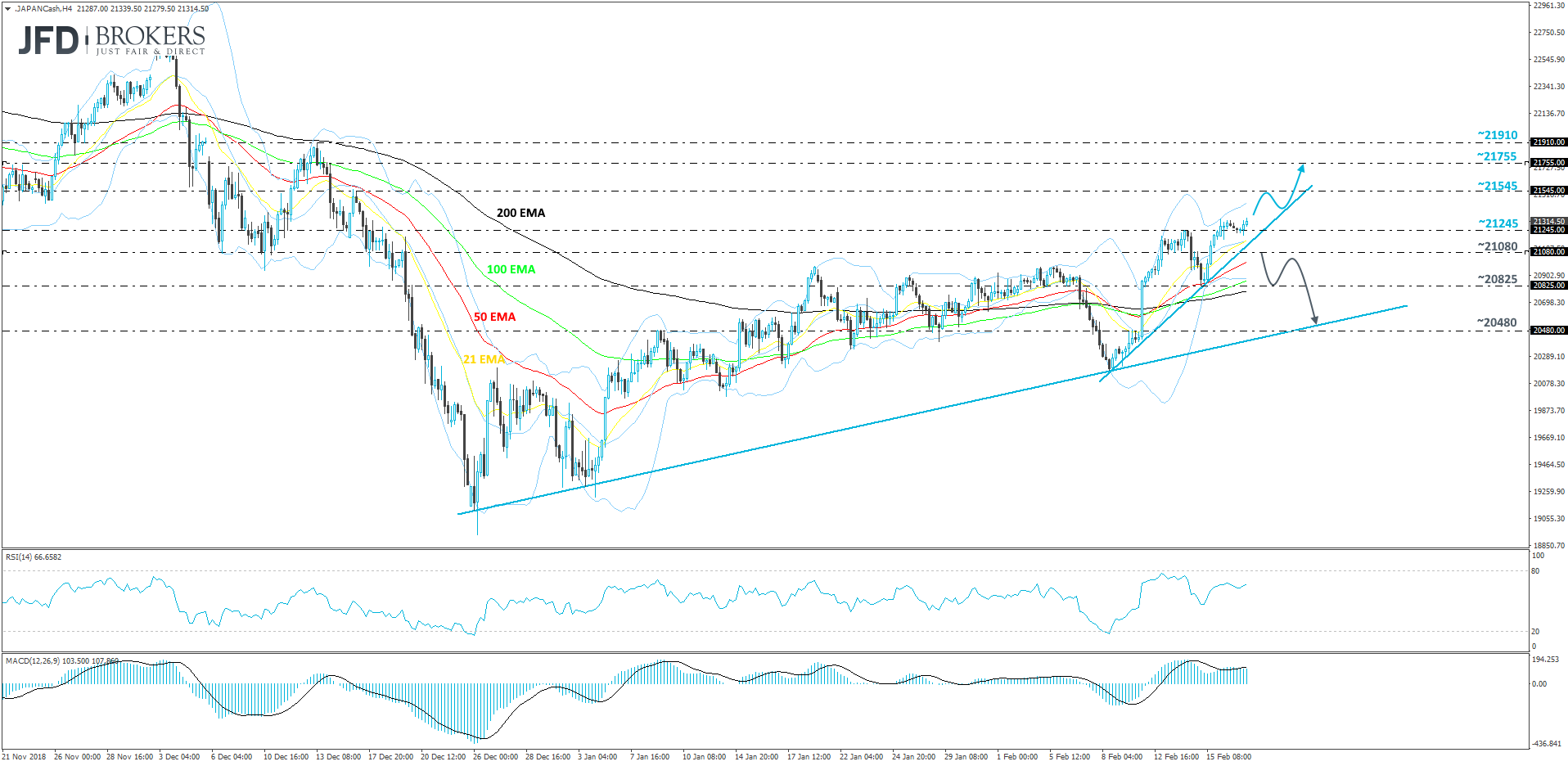

Nikkei 225 – Technical Outlook

Since the beginning of last week, the Japanese index keeps on climbing higher, trading not only above its tentative upside line taken from the lows of December, but also above its steeper upside support line drawn from the low of January 8th. Looking at our Nikkei 225 cash index on the 4-hour chart, the price is currently sitting above last week’s high, at 21245. For now, this may be interpreted as a possibility of seeing more upside, especially if the steeper upside line remains intact.

A further price-acceleration might drag Nikkei towards its next potential area of resistance at 21545, which is near the high of December 17th. The index could get held around there, or even retrace back down. But if the price fails to drop below the aforementioned steep upside line, this move lower could be seen just as a small correction before another leg of buying. The bulls may take charge again and push Nikkei above the 21545 barrier, this way clearing the path for themselves towards the 21755 hurdle, marked by the high of December 14th.

Alternatively, a break of the above-mentioned upside line and a price-drop below the 21080 obstacle, which is the intraday swing high of February 14th and the low of February 13th, could open the door to the next potential support zone, at 20825. That zone last time held the index from moving lower on February 15th. If this time it fails to withhold the price from dropping lower, a further slide might take Nikkei to test the 20480 hurdle, marked by the high of February 11th.

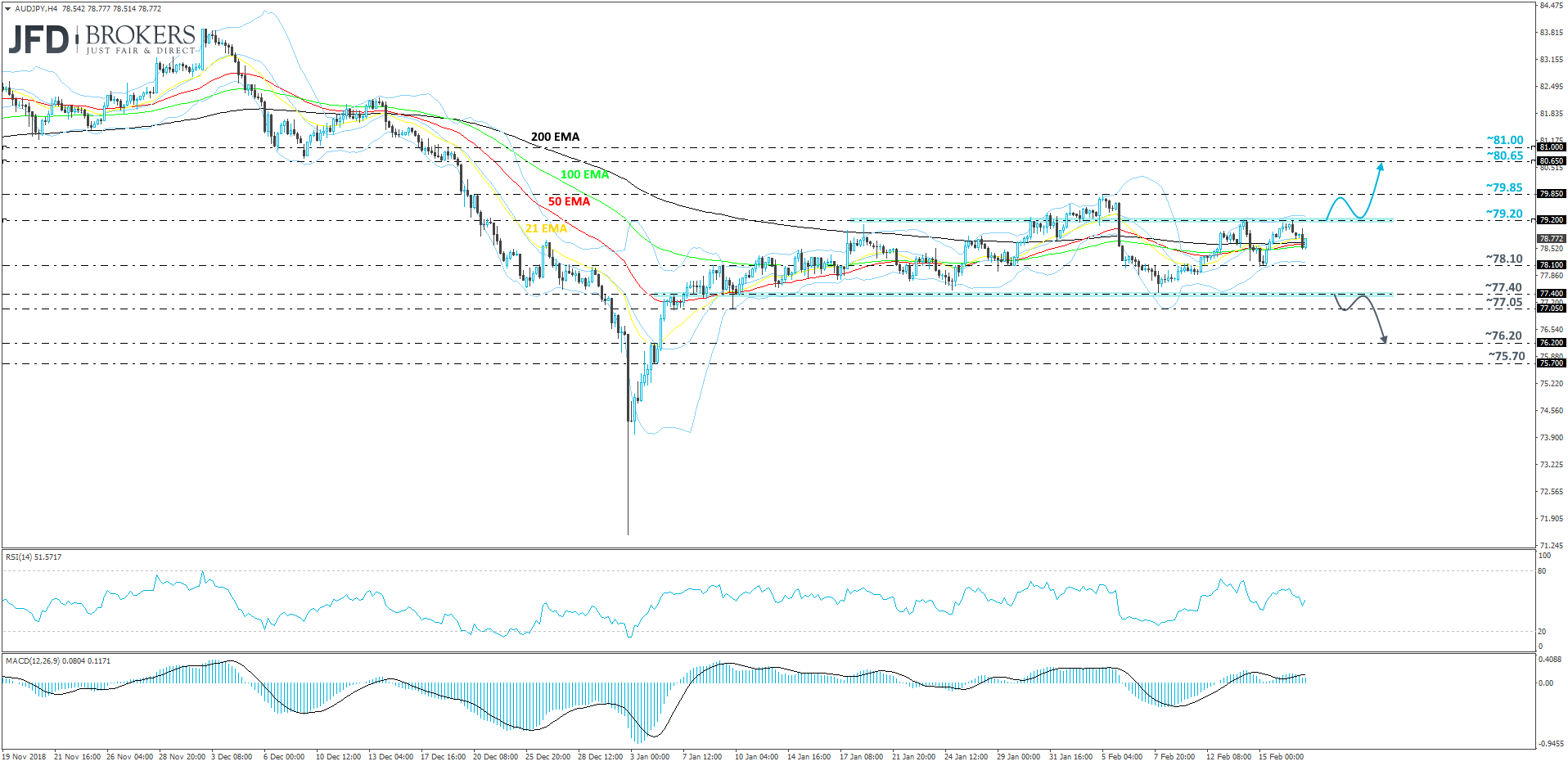

AUD/JPY – Technical Outlook

Even though we are seeing a few overshoots and undershoots along the way, still, AUD/JPY continues to move sideways, roughly between the 77.40 and the 79.20 levels. For now, we will remain cautious and wait for a break through either of the sides of the range.

A good push through the 79.20 barrier could invite more bulls into the arena, who could lead AUD/JPY towards the next possible area of resistance at 79.85, marked by the high of February 5th. This is where the initial hold up might occur. Of course, if the buying activity remains strong, that area could easily be broken and the rate could rise to test the 80.65 hurdle, which is the low of December 18th.

On the other hand, if AUD/JPY travels lower and drops below the 78.10 obstacle, this could make the bulls worry, as it may increase the chances of seeing the rate sliding further. But for a better confirmation of the downside, we would like to see a break below the lower side of the aforementioned range. This is when we will target the 77.05 obstacle, a break of which may attract even more attention from the bears, who could put even more pressure on the pair. AUD/JPY could then make its way towards the 76.20 level, marked by the intraday swing high of January 4th.

As for Today’s Events

During the European morning, Sweden’s CPIs for January are due to be released. Both the CPI and CPIF rates are expected to have risen to +2.2% yoy and +2.3% yoy, from +2.0% and +2.2% respectively. However, we will once again pay more attention to the core CPIF metric, which excludes energy. At last week’s policy meeting, the Riksbank decided keep interest rates unchanged at -0.25%, while in the accompanying statement, officials repeated that the next increase is likely to come during the second half of 2019, also keeping their rate-path projections unchanged. In December, the core CPIF rate ticked back up to +1.5% yoy from +1.4% and thus, another increase may encourage some participants to raise bets that the next hike could come during the summer months. However, the Bank’s upcoming gathering is scheduled for the 25th of April, and up until then, we have the February and March inflation data. Thus, we prefer to wait for upcoming inflation numbers before we start examining whether (or not) the world’s oldest central bank will signal that rates could rise early in the second half of the year.

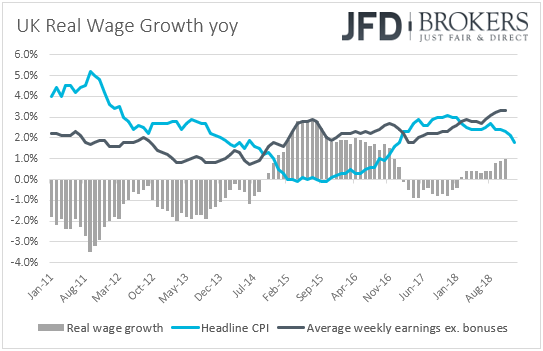

From the UK, we get the employment report for December. Expectations are for the unemployment rate to have held steady at 4.0%, while average weekly earnings, both including and excluding bonuses, are expected to have accelerated. The including bonuses rate is anticipated to have ticked up to +3.5% yoy from +3.4%, while the excluding bonuses one is forecast to have risen to +3.4% yoy from +3.3%. According to the IHS Markit/KPMG & REC Report on Jobs for the month, given that demand for workers outstripped supply, starting salaries continued to increase, with wage inflation among the quickest seen for over three years. In our view, this supports the case for accelerating weekly earnings.

All that said though, we expect market participants to continue paying more attention to UK politics than UK economic data. Last week, UK PM Theresa May suffered another defeat in Parliament, with MPs voting against her request for support in seeking changes to the Brexit bill. Although the vote does not prevent May from returning to Brussels and try to renegotiate, the defeat suggests that with no parliamentary backing, the EU may be less willing to listen to May’s proposals.

In Germany, the ZEW survey for February is due to be released. Expectations are for the current conditions index to have declined for the 5th consecutive month, to 20.0 from 27.6, while the economic sentiment index is forecast to have risen somewhat, but to stay within the negative territory (-14.0 from -15.0). Although this survey is usually not a major market mover, it comes in the midst of disappointing data out of the Eurozone as a whole. Thus, another deterioration in analysts’ morale with regards to Eurozone’s growth engine could slightly increase speculation that the ECB may not raise interest rates this year.

As for tonight, during the Asian morning Wednesday, we get Japan’s trade balance for January, which is expected to show that the nation’s deficit has widened. Exports are expected to have fallen at a faster pace than in December, while the imports rate is expected to have dipped into the negative zone for the first time since March 2018. Australia’s wage price index for Q4 is also coming out and the forecast suggests that the yoy rate remained unchanged at +2.3%, its highest since Q3 2015. Although this is positive, we doubt that it can alter market expectations with regards to the RBA’s future plans. After all, the Bank has put the likelihood of a rate cut on the table, already acknowledging the pick-up in wage growth.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

76% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2019 JFD Group Ltd.