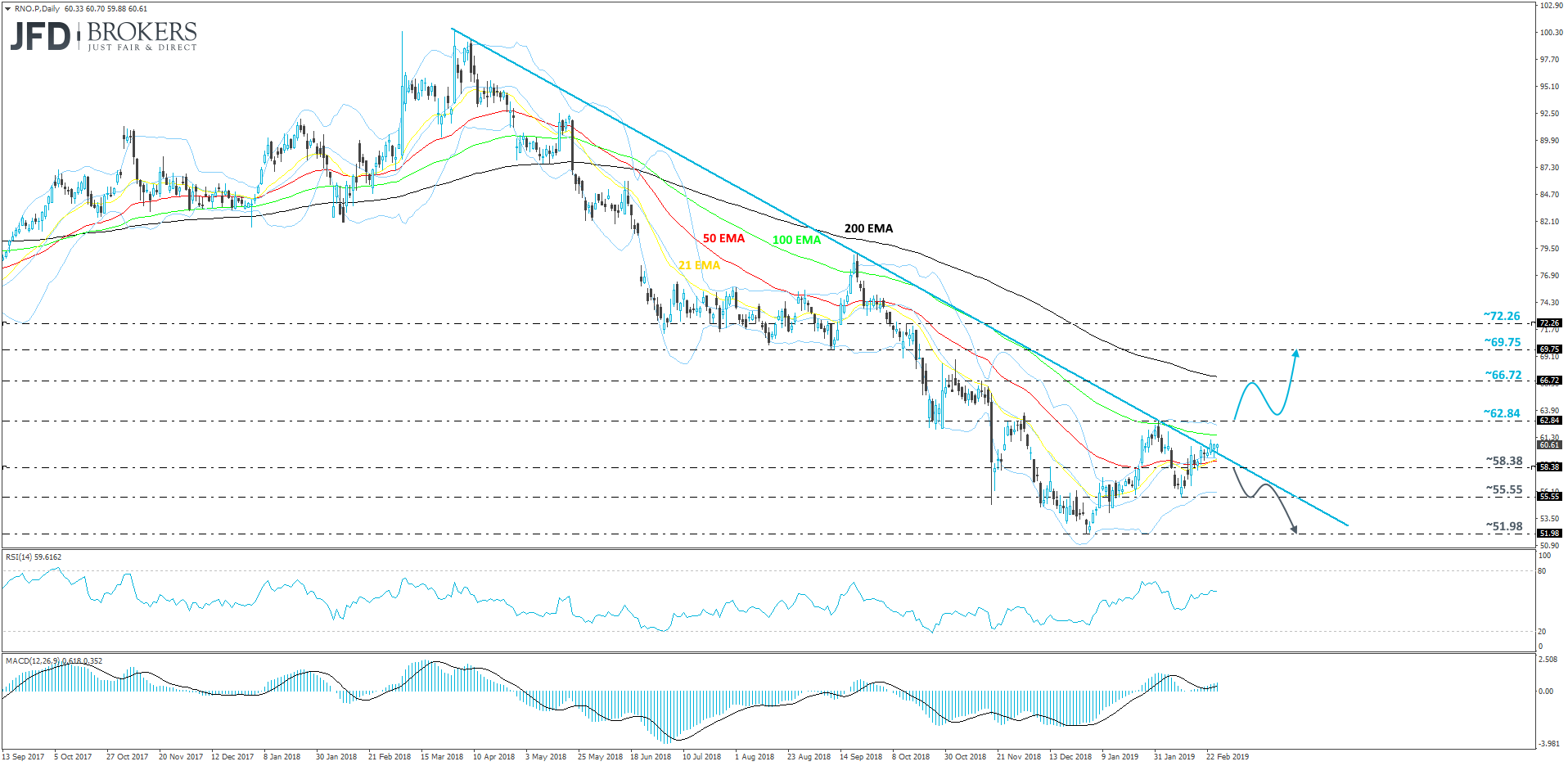

The stock of Renault SA (EPA: RNO) had taken quite a strong beating since it hit its first three-digit figure almost a year ago. The share price slid from the round 100 number to around a 52-euro price tag, wiping out half of its value. Of course, the arrest of Renault’s CEO in November last year, over the allegations of false accounting, did not help the stock to slow down the sell-off. So RNO continued to trade below its long-term downside resistance line (taken from the high of March 29th, 2018) until Monday, when the stock broke above it, which is a good sign for investors and traders. But given that RNO did not have a strong breakthrough, we will remain cautiously-bullish for now, as it still has a good chance of reversing back down again.

In order to get comfortable with the upside in the near term, we would like to see the stock pushing above the 62.84 barrier first, as it marks the high of February 1st. This is when the stock would confirm a forthcoming higher and we may start looking further north. The next potential area where the price could get a hold up could be around the 66.72 hurdle, which is the high of November 14th. If investors continue to see value in the stock even at that price, RNO could travel further up, where it may test the 69.75 barrier, marked by the low of November 11th.

Looking at our oscillators, the RSI and the MACD are somewhat in support of the above-mentioned scenario. The RSI is above 50 and points slightly to the upside. The MACD is above zero and its trigger line and also points a bit higher.

Alternatively, if the RNO drops below the aforementioned downside line and the 58.35 level, this may spook investors, as it could increase the chance for the stock to slider further. The share price could then travel to test the 55.55 obstacle, marked by the low of February 12th, which if broken could open the door to the 51.98 level. This was the lowest point of December 2018.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyzes and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyzes and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

FX and CFDs are leveraged products. They are not suitable for every investor, as they carry high risk of losing your capital. You should be aware of all the risks associated with trading on margin. Please read the full Risk Disclosure.

Copyright 2019 JFD Group Ltd.