Today, during the Asian morning, the Reserve Bank of Australia announced that they are keeping their cash rate at +1.50%, marking the 31st month in a row when the rate is at the same level. , China released its Caixin Services PMI figure for the month of February, which came out worse than expected.

Australia’s Cash Rate Remains Unchanged

Today, during the Asian morning, the Reserve Bank of Australia announced that they are keeping their cash rate at +1.50%, marking the 31st month in a row when the rate is at the same level. This was widely anticipated by analysts. According to the RBA statement released this morning, it says that even though the global economy had grown in the beginning of 2018, but the second half of it experienced a slide, which has dragged into 2019. That said, the outlook for of the Australian economy is still reasonable, but a few threats started to appear.

Of course, the US-China trade tensions are something that Australia is monitoring carefully, as this is damaging both China and the US. Given that China is an important trade partner of Australia, which buys a lot of its natural resources, any slowdown in the Chinese economy has a negative effect on the Australian economy. Also, another issue that RBA considered in its rate decision is a slight decrease in the headline inflation numbers across the globe, even though the core figure started picking up slowly.

The RBA also notes that the Australian labor market is doing good, at the moment. The last unemployment rate came out at 5%, which is considered to be a strong figure. Australia expects, that the number could drop a bit more in a few months’ time. This could be explained by the fact that certain areas of the continent are experiencing shortages in skilled workforce. Such conditions support the real wage, as it continues to grow slowly. Because the Australian inflation remains below the Bank’s target rate of 2%, this also helps the working class to enjoy their higher wages, for now.

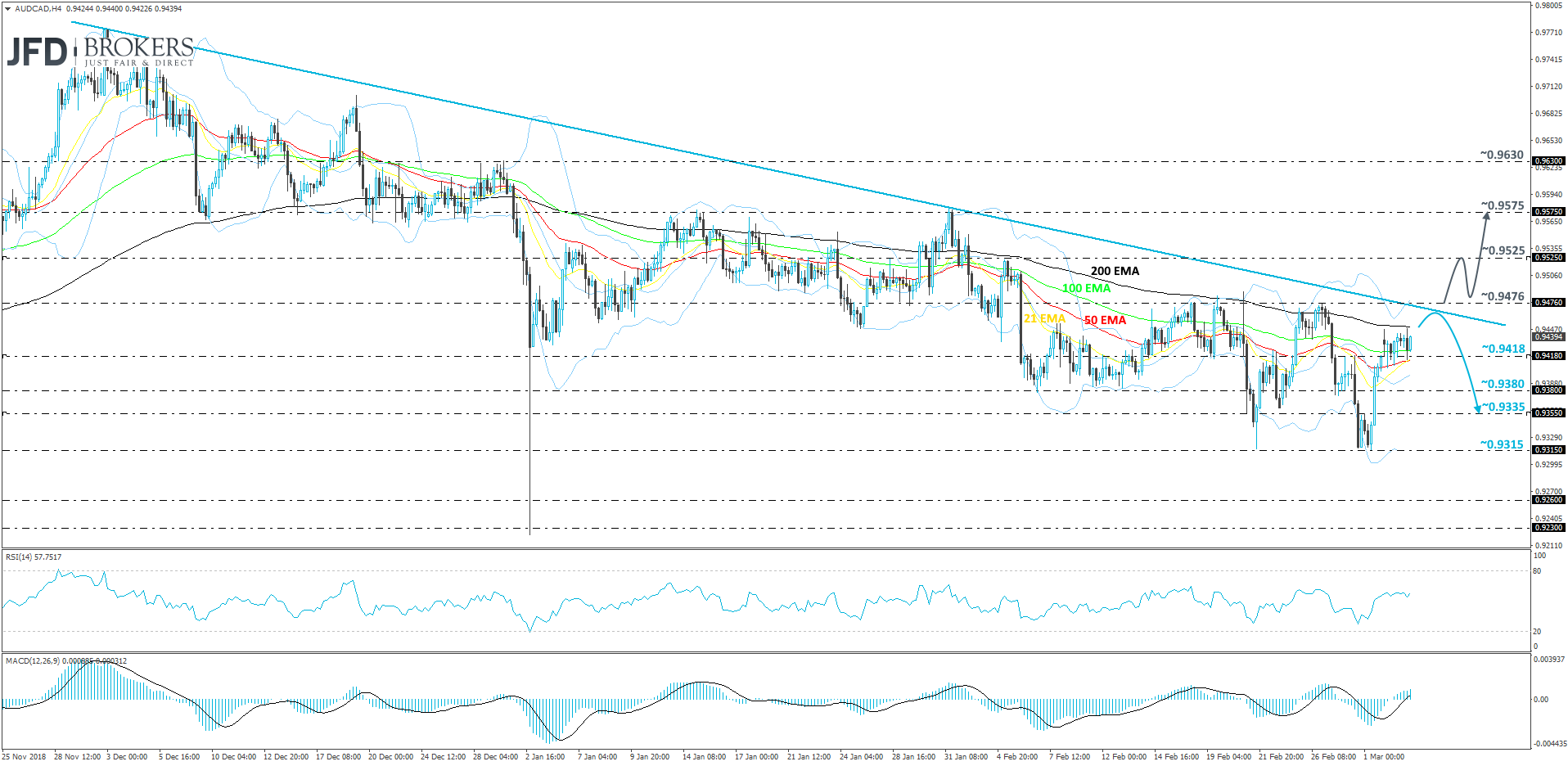

AUD/CAD – Technical Outlook

AUD/CAD continues to trade below its short-term downside resistance line taken from the high of December 3rd, even though the pair has shown some resilience in the past couple of trading days. The rate is close to testing the above-mentioned downside line, but as long as that line remains intact, we will aim for lower areas again. That said, given the strong reversal to the upside from the 0.9315 level, there might be a chance of seeing a break above that line as well. For now, we will remain somewhat neutral and wait for a confirmation break through one of our key levels.

If AUD/CAD travels a bit higher, but fails to overcome the aforementioned downside resistance line, we will aim again for the 0.9418 support area, which if broken, could attract attention from more bears. This is when we may see the rate falling to the 0.9380 obstacle again, or even the 0.9355 zone, marked by the inside swing high of March 1st.

Alternatively, if the previously-mentioned downside line gets broken and the rate accelerates above the 0.9475 barrier, marked by the high of February 26th, this may push AUD/CAD further north. That’s when we will target the 0.9525 obstacle, a break of which could lead the pair towards the 0.9575 resistance, which is near the high of January 31st.

China’s Service Sector is Seeing a Slowdown

Also, during the Asian morning, China released its Caixin Services PMI figure for the month of February, which came out worse than expected. The number showed up at 51.1, when it was believed that it might be around 53.5. This, of course, worries the markets, as it points out that the global economy is cooling off slowly. Last time when this number was at similar lows, was back in October. The figure then was at 50.8, which also started to hit alarm bells, as the figure for the month before was at 53.1. Just to remind that the Caixin Services PMI is built of a questionnaire that is completed by carefully chosen purchasing executives of 400 private sector companies in China.

Many analysts are not surprised already by the fact that the Chinese economy keeps showing these weaker numbers, as it is understandable that the US-China trade wars are not bringing any good to either of the sides.

Let’s not forget that China’s manufacturing PMI is still on a roll to the downside, which has been like that since the beginning of 2018. The business confidence index is not at its best levels as well, as it keeps sliding lower since mid-2018. The last three of the releases showed that the business sector has entered contraction. The Chinese government is trying to introduce measures, which could support the second-largest economy and stimulate growth, but the path might not be an easy one, given the political obstacles with some other major economies.

The Chinese government is now targeting its economic growth to be between 6.0 and 6.5 percent, which is a more modest one, comparing to the 2018 target that was at 6.5 percent. This, of course, allows analysts to manoeuvre in a slightly more comfortable way. The government recognizes the fact that the economy has slowed down and the risks, which are associated with the trade tensions with the world’s largest economy on the North American continent, are growing.

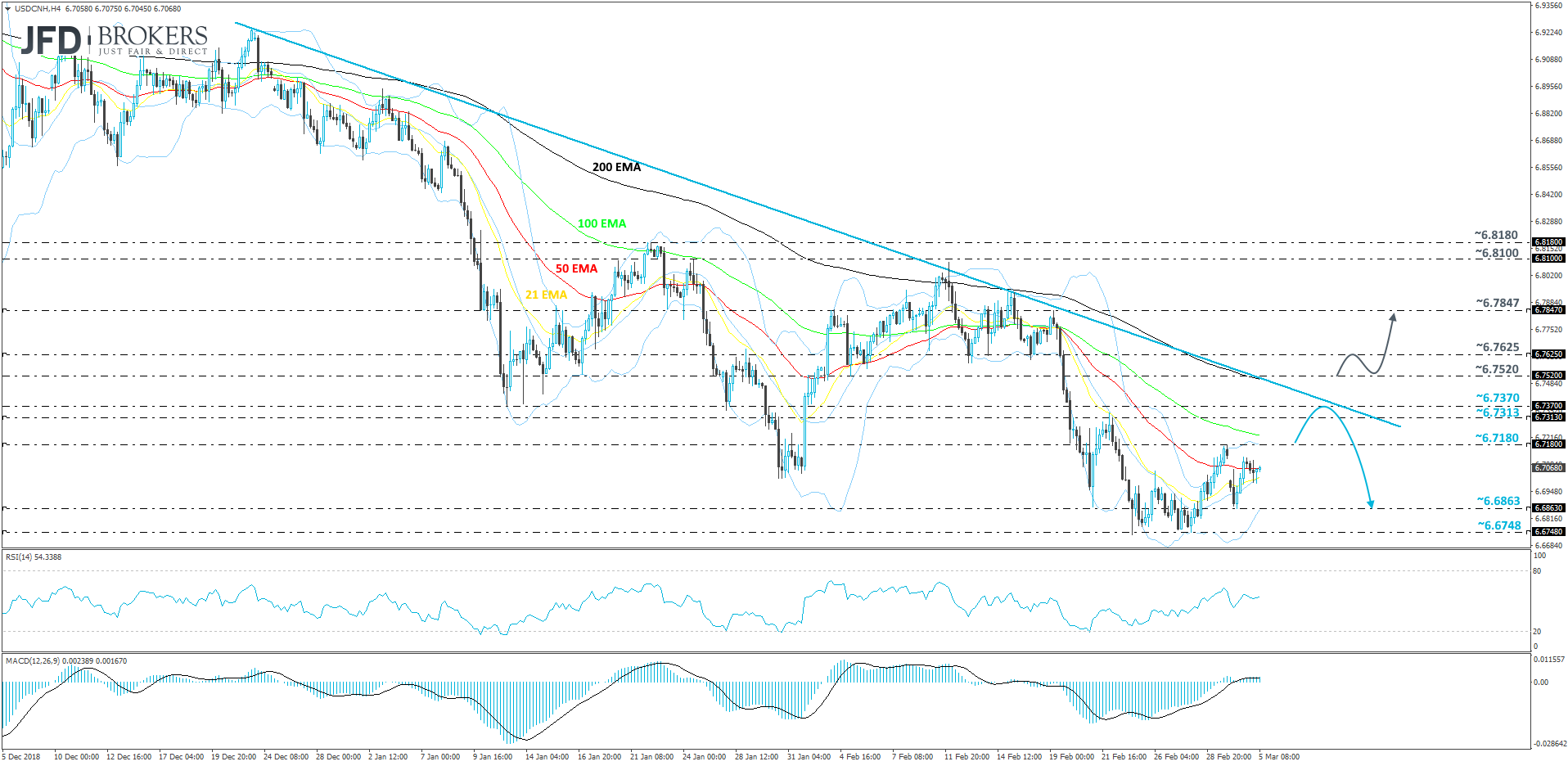

USD/CNH – Technical Outlook

After finding good support near the 6.6748 level between the 25th and the 28th of February, USD/CNH moved slightly to the upside, sparking hope in the bull-bloc. But given that the pair is still trading below the tentative short-term downside resistance line drawn from the high of December 23rd, we will aim lower in the near term.

A push above the 6.7180 barrier, which is the Friday’s high, could lead the rate towards its next possible resistance area between the 6.7313 and 6.7370 levels. Not far from there runs the aforementioned downside resistance line, which if remains intact, could invite the bears back into the game. Such a move might give sellers the opportunity to drag the rate back down to the above-mentioned 6.7180 barrier, which if fails to withstand the bear-pressure, may allow a further slide south. The next possible support zone could be at 6.6863, marked by yesterday’s low.

On the other hand, if the previously-mentioned downside line gets broken and the rate rises above the 6.7520 hurdle, marked by the low of February 5th, this could push USC/CNH further north. We will then look at the possibility of seeing a test of the 6.7625 obstacle, a break of which could lead the pair towards the 6.7847 level, which is the high of February 19th.

As For the Rest of Today's Events

From the Eurozone, we have retail sales for January and expectations are for a +1.3% mom rebound after a 1.6% slide in December. This may drive the yoy rate up to +2.0% from +0.8%. We also get the final services and composite PMIs for February from several European nations and the bloc as a whole, but as it is usually the case, the final prints are expected to confirm their preliminary estimates.

The UK services PMI for February is coming out as well. The forecast suggests that the index slipped into contractionary territory. Specifically, it is expected to have declined to 49.9 from 50.1, something that may amplify concerns on how Brexit uncertainty is weighing on the UK economy. Nevertheless, with a disorderly exit most likely to be averted, at least on March 29th, we don’t expect the PMIs to prove game changers with regards to the pound's forthcoming direction. Remember that the pound fell when the January services print disappointed but surged in the second half of February on hopes that a no-deal exit can be eventually avoided.

Therefore, we expect GBP-traders to keep their focus locked on developments surrounding the UK political landscape and the vote-series PM Theresa May promised to Parliament. Remember that last week, PM May told lawmakers that they will have a new deal on the table by March 12th, and if it is not approved, another vote will take place the on March 13th. The second vote will be on whether Britain should leave the EU with or without a deal. If Parliament rejects the option of a disorderly withdrawal, a third vote over extending the process will be held the following day.

In the US, we get the final Markit services and composite PMIs for February, as well as the ISM non-manufacturing index for the month. As it is the case most of the times, the final Markit prints are expected to confirm their preliminary numbers, while the ISM index is anticipated to have risen to 57.4 from 56.7. New Home sales for December are due out as well and the forecast suggests a slowdown to +2.9% mom from +16.9%.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

76% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2019 JFD Group Ltd.