Equity markets were a sea of green yesterday, as risk appetite remained supported for another day. White House economic adviser Kudlow said that more tariffs on China are not ‘set in stone’, which may have boosted somewhat further market sentiment. Among currencies, the pound was the big gainer following reports that the UK and the EU agreed on financial services. As for today, GBP-traders are likely to turn their attention to BoE’s ‘Super Thursday’ meeting.

Market Sentiment Stays Supported, Kudlow Says More Tariffs not ‘Set in Stone’

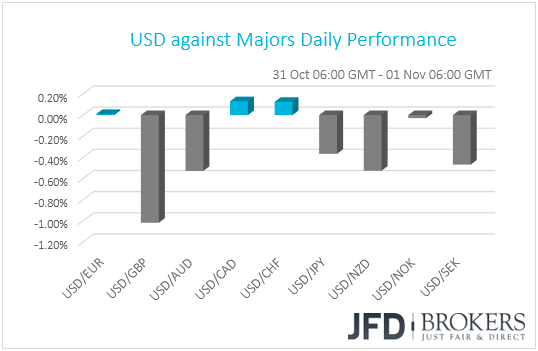

The dollar traded lower against most of the other G10 currencies on Wednesday. It lost the most against GBP, NZD and AUD, while it gained slightly against CAD and CHF. The greenback traded virtually unchanged versus EUR and NOK.

Although not so clear by the performance of the FX market, market sentiment remained supported for another day. Major EU and US indices were a sea of green, with risk appetite rolling into the Asian session Thursday. The only exception was Japan’s Nikkei 225, which closed 1.02% down.

Yesterday, White House economic adviser Larry Kudlow said that the US President has not ‘set in stone’ any decision for more tariffs on Chinese imported goods. He also said that the President could even pull back some of the previous duties if China and the US incline towards finding common ground over trade. President Trump and his Chinese counterpart Xi Jinping will meet at the G20 summit in Buenos Aires, scheduled for the end of November, but as Kudlow noted yesterday, the meeting agenda has not been worked out yet.

As for our view, although this appear to be positive news for market sentiment, we will take them with a grain of salt. Apart from words, there is no tangible evidence that a deal between the two nations is imminent. One word that does not describe President Trump is “predictable” and up until we see handshakes, we would consider the matter to be far from resolved. That said, for now, rhetoric by itself may be enough to keep market sentiment supported.

As we noted in the past, among currency pairs, one of our favorite gauges for playing the trade war theme is AUD/JPY. Due to its safe haven status, the yen tends to strengthen when the matter escalates, and weakens when tensions ease. On the other hand, due to its heavy trade exposure to China, the Aussie has the tendency to move in the opposite direction. In other words, AUD/JPY gains during “risk on” periods and weakens when sentiment deteriorates.

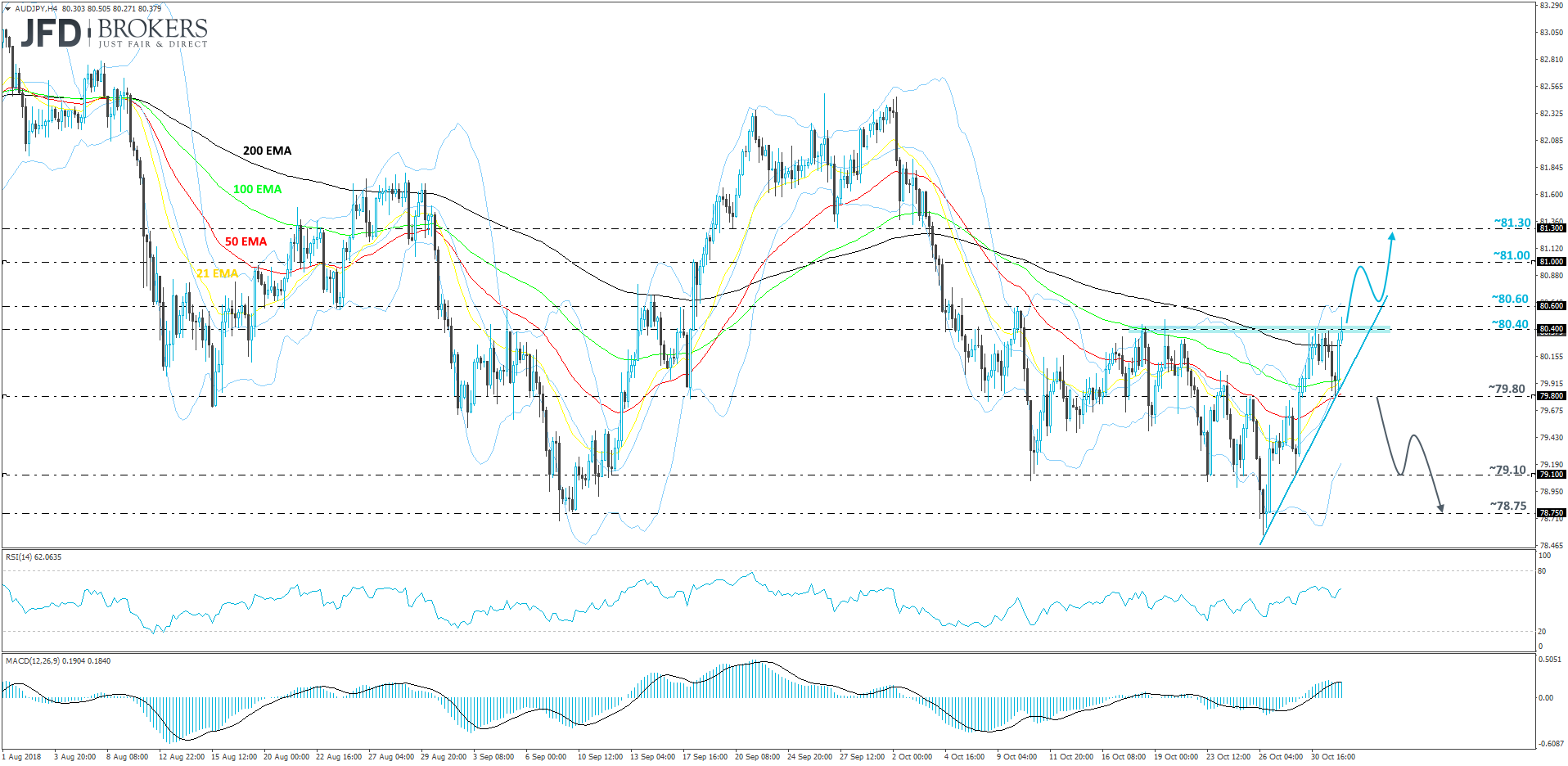

AUD/JPY – Technical Outlook

After a strong reversal on the 26th of October, AUD/JPY continues its route higher, currently testing the important 80.40 resistance zone. At the same time, the pair is trading above its upside support line drawn from the low of the 26th of October. For now, given the fact that AUD/JPY is making higher lows, we will aim for slightly higher levels.

A good push north from the 80.40 zone could lead AUD/JPY to test the 80.60 resistance barrier, marked by the peak of the 10th of October. If that area doesn’t hold the rate down, then the pair could easily make its way towards the 81.00 obstacle, a break of which could lift it towards the next key resistance level at 81.30, marked by the low of the 27th of September.

The RSI looks like it is in full swing of moving higher, as it is sitting comfortably above 50, which adds a bit more bullishness into the near-term outlook. The MACD has turned somewhat flat but remains in the positive territory.

On the downside, if AUD/JPY moves below the aforementioned short-term upside support line and breaks the 79.80 barrier, this could be a be a bad sign for the bulls, who could start abandoning the pair in favour of the bears. AUD/JPY traders could then shift their focus towards testing lower levels like the 79.10 hurdle, marked by the low of the 29th of October. If that doesn’t hold the rate from falling further, the pair could make its way to the 78.75 support zone, which was seen as a good support on the 26th of October.

Pound Rallies on Services Deal, Focus Turns to BoE’s ‘Super Thursday’

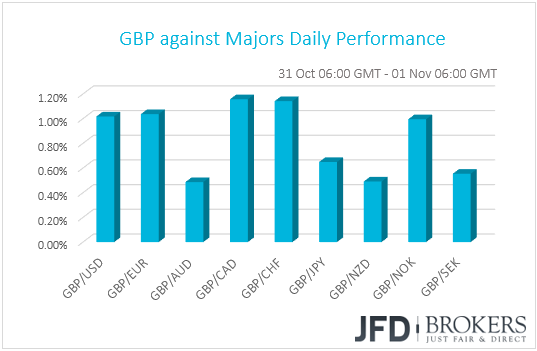

After suffering the most on Tuesday, the pound was yesterday’s main gainer. The British currency has been on a recovery mode early in Europe and was boosted further after UK Brexit Secretary Dominic Raab said that a Brexit deal between the EU and the UK could be agreed by the end of November. That said, the big news had yet to come. Overnight, the Times reported that UK PM Theresa May has struck a tentative deal with the EU on financial services. According to the report, as long as the UK and the EU financial regulations remain aligned, UK companies would be allowed access to EU markets.

The pound skyrocketed on the news as this appears to be a material step towards securing a Brexit deal and avoiding a disorderly departure on the 29th of March. However, even if the pound continues to gain on the positive development, we cannot hide that we are still concerned over Brexit. The thorny issue of the Irish border remains unresolved, and even if the government gets close to agreeing on all matters with the EU, everything has to be approved by the UK Parliament, something that appears to be a hard task, in our view.

As for today, pound traders may take a break from Brexit and turn their attention to the BoE decision. Actually, it will be a “Super Thursday” for the Bank, as besides the rate decision and the meeting minutes, it also releases its quarterly Inflation Report, which will be presented by Governor Mark Carney at a press conference after the decision.

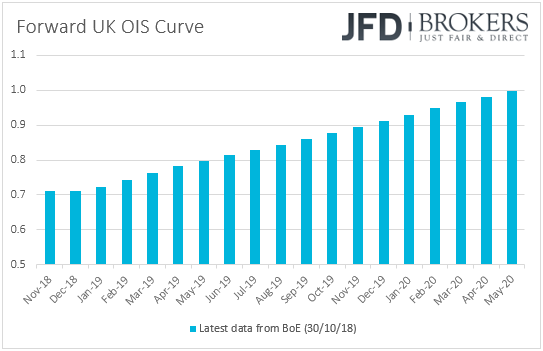

The Bank is widely anticipated to keep policy steady via a 9-0 vote, so if this is the case, market participants will quickly turn their attention to the minutes, the economic projections and Carney’s conference. When they last met, officials proceed with no surprises, keeping rates unchanged at +0.75%. The key takeaway since August has been that the Bank is probably done hiking for this year, and according to the UK OIS forward curve, the next rate increase is now fully priced in for May 2020. Back in August, Governor Carney said that a hike per year for the next few years is a good rule of thumb, but with the caveat that it will depend on what happens with Brexit. Therefore, investors’ pessimistic pricing for the next hike may reflect their concerns over the matter.

Latest data showed that wages accelerated in September, but inflation slowed in both headline and core terms, suggesting little urgency for any rate increase in the months to come, especially with five months to go before the official date of the UK’s departure from the EU. Thus, we expect officials to reiterate that further rate increases are likely to be gradual and to a limited extend, and we see no reason for a hawkish spin by Governor Carney at the press conference.

GBP/USD – Technical Outlook

Yesterday, GBP/USD had a strong reversal back to the upside, where it broke the short-term downside resistance line taken from the high of the 16th of October. From the short-term perspective, the pair could easily continue with its new direction, and higher resistance levels could be met.

A break above the key resistance zone at 1.2855, where GBP/USD is held at the time of this analysis, could open the path towards the next potential area, at the 1.2920 hurdle. This hurdle held the rate down on the 25th of October, but if this time the bulls will be stronger, we might get a break of that area, which could lead to a test of the 1.3005 obstacle. This resistance line is marked near the high of the 23rd of October and also is just slightly above the psychological 1.3000 level.

The RSI has bounced from its oversold territory at around the 20 zone and moved above 50, which is a positive sign. The MACD, even though still in the negative area, has bottomed, pushed itself above the trigger line and holds the direction north. Both indicators are supporting the scenario discussed above.

Alternatively, if GBP/USD decides not to follow the bullish scenario and reverses to the downside, breaks back below the aforementioned downside resistance and also drops below the 1.2775 line, this could be a sign that bulls are not quite ready to push the pair higher, for now. A further slide could lead towards the yesterday’s lows near the 1.2700 barrier, a break of which, could invite more bears into the action. This could bring the rate lower, to the next possible area of support at 1.2660, marked by the lowest point of August.

As for the Rest of Today’s Events

In the UK, besides the BoE decision and the quarterly Inflation Report, we have the manufacturing PMI for October which is expected to have slid 53.1 from 53.8. That said, we expect the release to be overshadowed by the BoE policy decision.

From the US, we get the final Markit manufacturing PMI for October, as well as the ISM manufacturing index for the month. The final Markit print is expected to confirm its preliminary estimate of 55.9, while the ISM index is anticipated to have declined to 59.0 from 59.8. Initial jobless claims for the week ended on the 26th of October and the Unit Labor Costs index for Q3 are also due to be released.

As for tonight, during the Asian morning Friday, New Zealand’s ANZ business confidence index for October and the nation’s PPIs for Q3 are coming out. In Australia, we have retail sales for both September and Q3. On a monthly basis, retail sales are forecast to have risen 0.3% mom in September, the same pace as in in August, but this is likely to drive the qoq rate down to +0.4% from +1.2% in Q2.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Brokers, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Brokers analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyzes and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyzes and must therefore be viewed by the reader as marketing information. JFD Brokers prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.