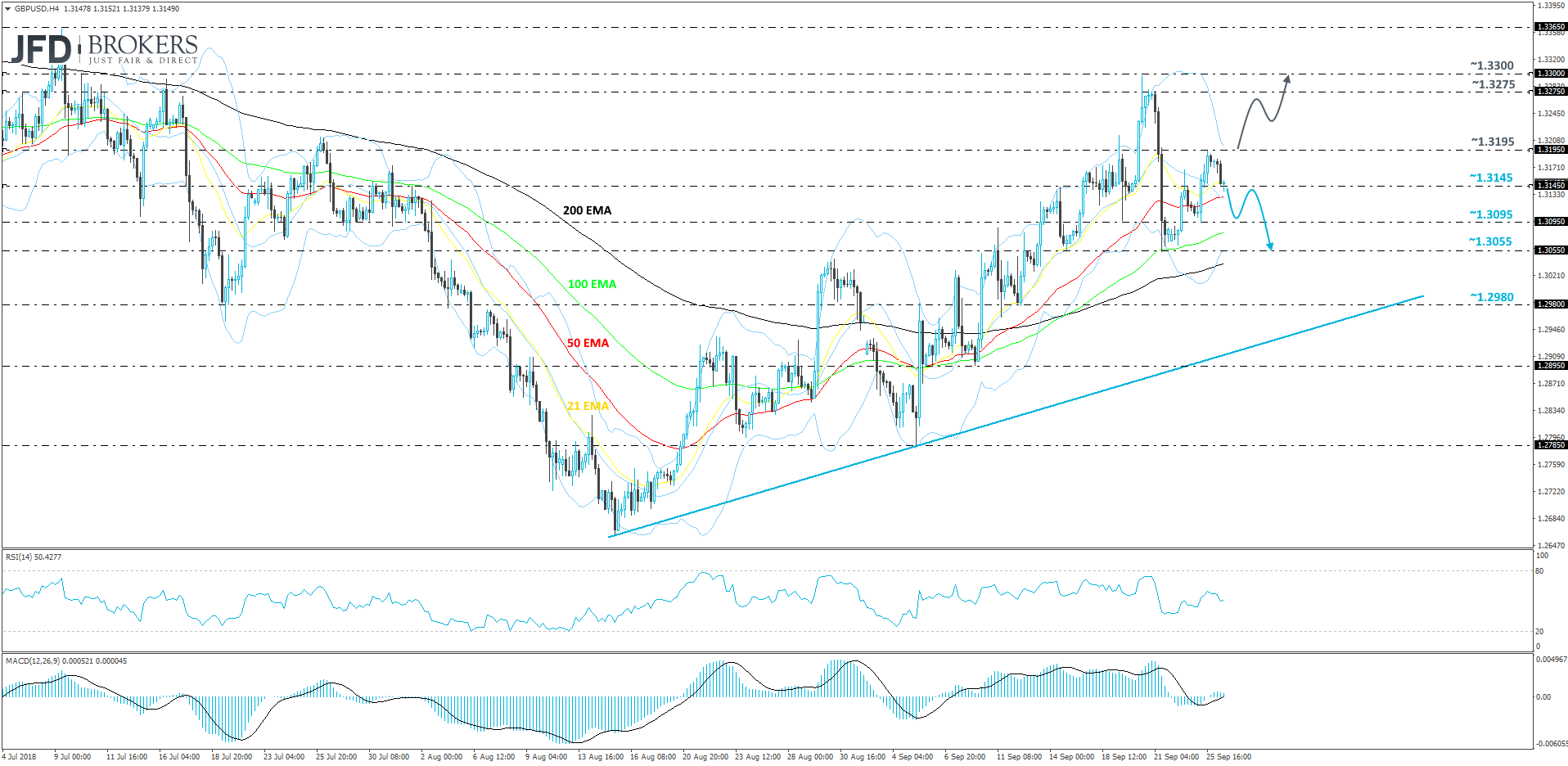

The previous week, we saw GBP/USD making highs that were last time seen in mid-July. But Friday was marked by heavy selling that put the prospect of further upside into jeopardy. Even though the pair had a good start this week, still, it seems that the bulls are not feeling that confident right now. This week’s move higher could just be seen as a breather before the second stage of selling could kick in. That’s why, from the very short-term perspective, we will stick to the downside and aim for lower levels.

A close below 1.3145 could just be enough to confirm the potential for the upcoming weakness. The level recently acted as good resistance on the 24th of September, which temporarily held GBP/USD from moving higher. If the selling doesn’t stop there, then a drop below that level could lead to a test of the 1.3095 obstacle, which acted as strong support yesterday. If the buyers continue to be overshadowed by the sellers, a break below that obstacle could set the stage for a move towards the next good area of support at 1.3055, marked by the low of the 21st and the 14th of September. This is where the bears could meet resistance from the bulls and the rate could stall for a while.

If, suddenly, the bulls make a huge comeback and GBP/USD reverses to the upside, all eyes could be on the 1.3195 barrier, marked by yesterday’s high, a break of which could open the door towards some higher levels like 1.3275. This was near the Friday’s high, which was hit just before the pair rolled over and dropped around 200 pips. At the same time, if the buyers continue feeling confident, they could lift GBP/USD pair slightly higher, in order to test the highest point seen last week, near the 1.3300 hurdle.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Brokers, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Brokers analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyzes and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyzes and must therefore be viewed by the reader as marketing information. JFD Brokers prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2018 JFD Brokers Ltd.