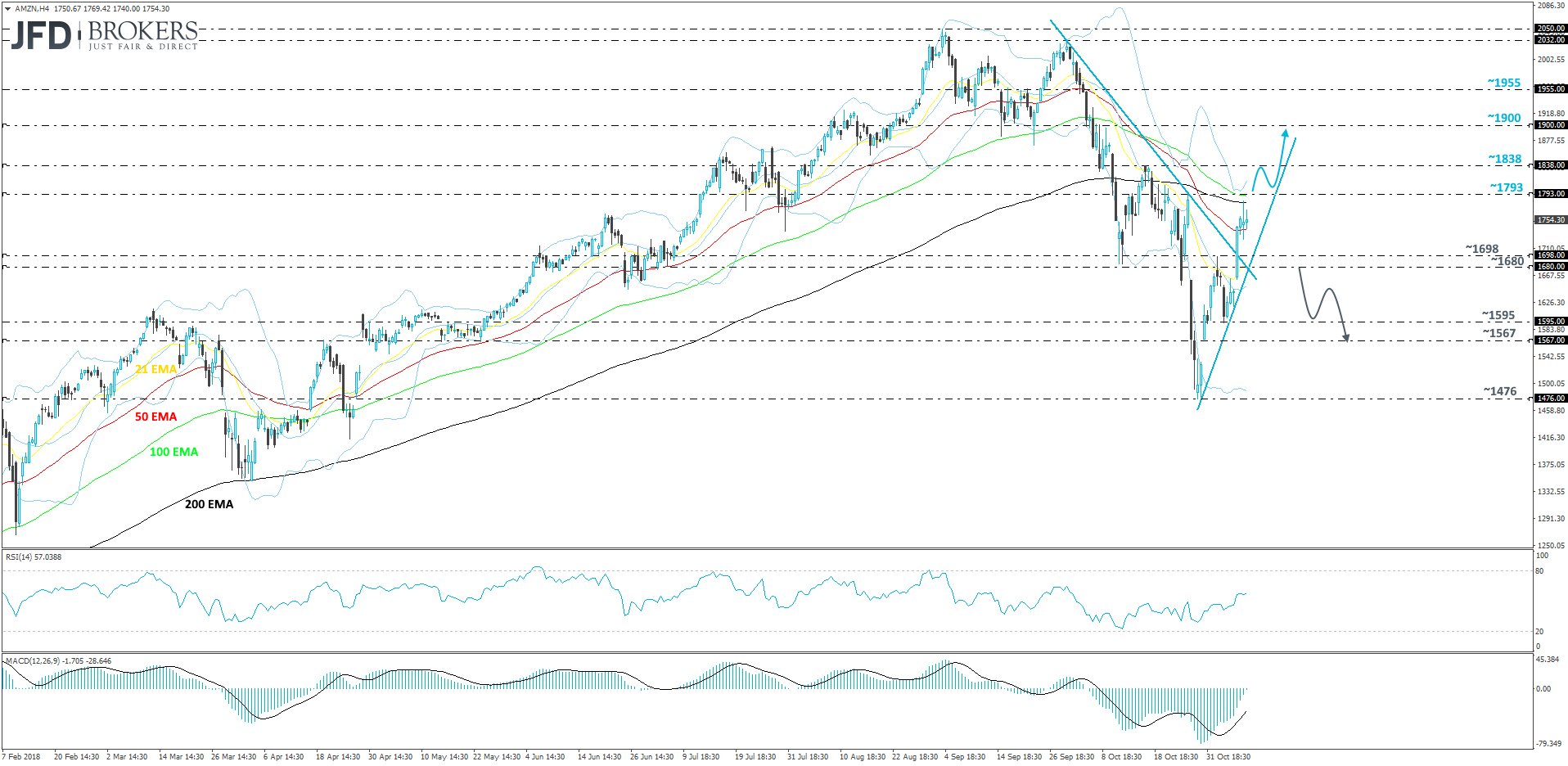

After the October meltdown in the global equity markets, it looked like that the world’s major stock indices were not the place to be in. Big technological companies like Amazon Inc., which were considered more stable, than any others, also got hit hard. For the whole month of October, Amazon’s share price was on a deep slide and it looked like there was no stopping for that. At one point, Amazon Inc managed to lose about 65% of the year’s gains. However, the stock bottomed on the 30th of October and rebounded again. From the technical side, the stock has now broken the short-term downside resistance line drawn from the peak of the 1st of October. At the same time Amazon Inc. has established a new trendline for itself, which starts from the low of the 30th of October and runs in the upwards direction. For now, we will remain cautiously bullish and target higher levels.

If the share price of Amazon rises above the 1793-dollar price tag, we could expect more buyers to join in, as this would mean that the stock has cleared an important obstacle on its way higher, which was marked by the high of the 25th of October. A further acceleration of the price could lead towards a test of the 1838 zone that was the high of the 17th of October. If that zone is not able to withhold the bull-pressure, a further price-rise to the psychological 1900 level could be possible.

Our oscillators, the RSI and the MACD, are also in support of the above-discussed scenario. The RSI is above 50 and points to the upside. The MACD is just fractionally below zero, but the slope to the upside is very steep and the indicator is running above the trigger line. All this is helping traders to assume that the stock has got some room for the upside.

Alternatively, if the aforementioned short-term upside support line breaks and the share price drops below 1680, this could be a warning sign for the bulls, as more bears could see this as a good opportunity to step in and lead the way. This may move Amazon Inc. towards the next potential area of support, seen around the 1595 hurdle, marked by the low of the 5th of November. A break below that level could push the stock a bit lower to test the 1567 barrier, which was the low of the 31st of October.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Brokers, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Brokers analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyzes and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyzes and must therefore be viewed by the reader as marketing information. JFD Brokers prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2018 JFD Brokers Ltd.