Yesterday, the pound continued to drift lower on increasing concerns that the UK could end up leaving the EU with no deal. Overnight, the Aussie barely moved on the RBA decision. The Bank stood pat once and although it made some changes in the statement, those were probably not significant enough to change investors’ view around its future plans.

Pound Continues to Drift South on Brexit Concerns

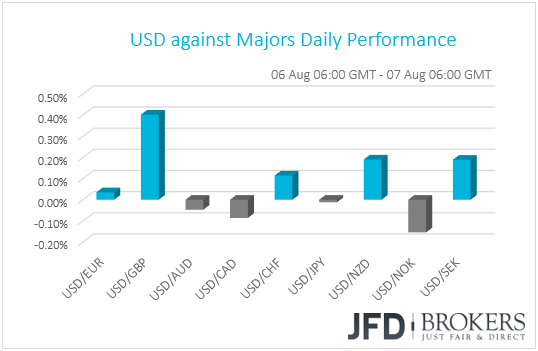

The US dollar traded higher or unchanged against all but two of the other G10 currencies on Monday. It gained against GBP, NZD, SEK and CHF, while it traded virtually unchanged against EUR, AUD and JPY. The greenback underperformed only against NOK and CAD.

The yen strengthened against its US counterpart on Friday and remained fairly stable on Monday as the “trade war” theme took center stage again. On Friday, China said that it will proceed with tariffs of 5-25% on USD 60bn worth of US imports, but only if the US proceeds with further actions. Later in the day, the White House economic advisor Larry Kudlow said that China should not underestimate Trump’s determination.

Approximately an hour ahead of China’s announcement, the PBOC decided to lift the reserve requirement ratio for FX forwards to 20% from 0%, a move that will make it costlier to short the yuan. The yuan came under strong buying interest against its US counterpart on this decision but reversed some of those gains on Monday, perhaps due to the escalating trade tensions between the world’s two largest economies. As for our view, with the US-China trade conflict showing no signs of easing, it’s hard for us to imagine that the yuan will not continue sliding, something that could prompt the PBOC to proceed with more measures.

The pound was the loser of the day. It continued to drift lower after the UK trade secretary Liam Fox said in an interview with Sunday Times that the odds of the UK leaving the EU without any deal are 60-40. His comments follow similar remarks by BoE Governor Carney on Friday, who noted that the possibility of a no-deal Brexit is “uncomfortably high”.

On Thursday, the BoE decided to increase its benchmark interest rate to +0.75%, but Carney’s comments at the press conference, as well as in an interview after the conference, suggested that the BoE is probably done hiking for this year. Therefore, having that in mind, sterling traders may have turned all their attention to politics and developments surrounding the UK’s departure from the EU. With the clock ticking towards the 29th of March 2019, the official date of the EU-UK divorce, further delays between the two sides to find common ground could increase investors’ anxiety and could keep the pound under selling pressure.

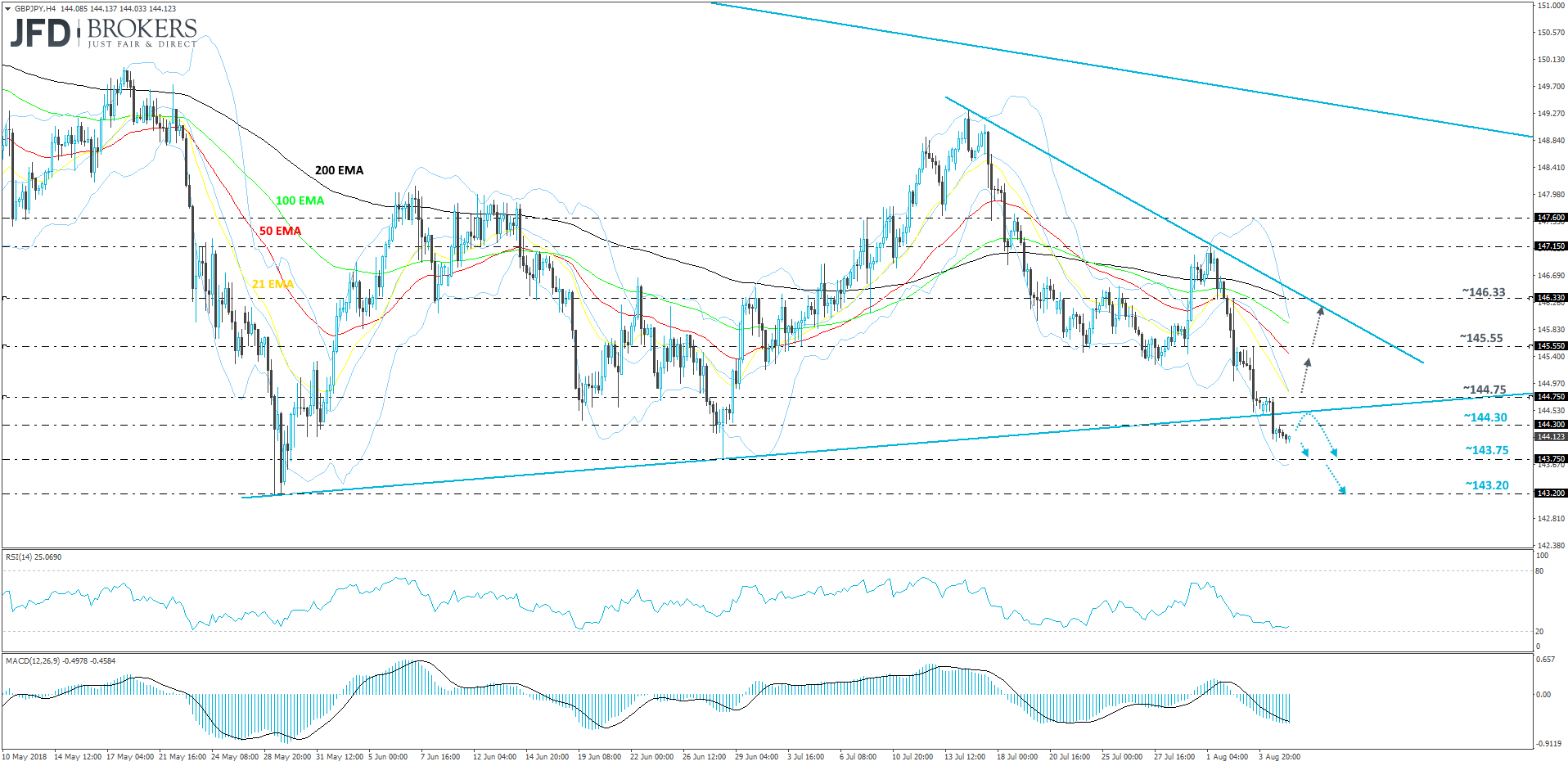

GBPJPY – Technical Outlook

GBP/JPY continues to drift lower and this has led to a break of the near-term upside support line, drawn from the low of the 29th of May. This tells us that there could be some more weakness to come later on. That said, before the pair could move lower, it could also correct itself higher, where the bears could take advantage of the situation.

For now, we will stick to the downside and aim for lower support levels. We would expect the latest slide to continue towards the 143.75 level, the break of which could invite more bears to join in and drive GBP/JPY towards the 143.20 zone, marked by the low of the 29th of May. Certainly, let’s not exclude the possibility of a scenario, where the pair could retrace back up a bit and then sell-off. A good potential area of resistance could be the aforementioned short-term upside line, which could hold down the rate.

On the other hand, if the abovementioned upside support line gets broken and GBP/JPY closes the day above it, then this could raise some interest on the bull-side. But for us to become comfortable with the upside scenario, we would need to see a break and a close above the 144.75 hurdle, which was yesterday’s high of the day. Further rate increase could lead to a test of the 145.55 barrier, marked by last Friday’s high, or even the short-term downside resistance line, taken from the peak of the 16th of July.

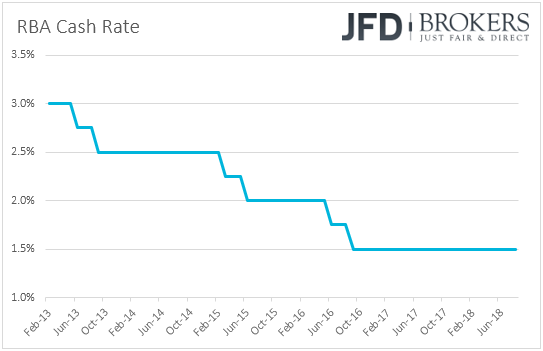

Another RBA Decision with no Fireworks

Overnight, another RBA meeting ended with no fireworks and thus, the Aussie was once again little moved. The Bank decided to keep interest rates unchanged at +1.50%, and although it made some changes in the accompanying statement, those were probably not significant enough to change investors’ view around its future plans.

The Bank noted that the central forecast is for inflation to be higher in 2019 and 2020 than it currently is, but also pointed out that once-off declines in some administered prices in the September quarter are expected to result in headline inflation in 2018 being a little lower than earlier expected, at 1.75%. With regards to the labor market, officials said that a further decline in the unemployment rate is expected over the next couple of years to around 5%. That said, they reiterated that wage growth remains low and that this is likely to continue for a while yet. As for the growth outlook, they noted that their central forecast remains unchanged. Another point to be made is that officials remained concerned over household consumption as well as over the direction of international trade policy in the US, while they acknowledged the slowdown in China’s economic growth.

In our view, all these suggest that, in the quarterly Statement on Monetary Policy, due out on Friday, the Bank is likely to lower its inflation forecast for the end of the year but it could revise up its projections for 2019 and 2020. We could also see downside revisions in the unemployment rate.

As for the Aussie, bearing in mind that the RBA has a long way to go before considering pushing the hiking button, we expect it to remain under selling interest against currencies like the US and Canadian dollars, the central banks of which are in a normalization process. What’s more, as noted in the past, trade tensions between China and the US are likely to keep extra pressure on the Australian currency as the Australian economy is heavily dependent on exports to China. The New Zealand dollar may also stay under pressure due to trade developments as well as monetary policy, but between the two, Aussie looks to be a bit stronger. This could be due to the fact that the RBNZ has been keeping the door open for a rate cut. New Zealand’s central bank meets on Thursday, early Asian morning, and a repetition that interest rates could equally go up or down, accompanied with downside revisions in the growth projections, could keep AUD/NZD supported for a while more.

AUDNZD – Technical Outlook

AUD/NZD continues to climb higher, well above its upside support line taken from the low of the 19th of June. Another important thing to mention is that last Friday, the pair broke its short-term downwards moving resistance line, drawn from the peak of the 3rd of July. All this has just been a good reason for the bulls to continue driving the pair higher.

For now, we remain bullish on the near-term outlook of AUD/NZD, but we do not exclude a possibility for the pair to retrace back down towards one of the abovementioned lines, which could act as good bouncing grounds. A good rebound from one of those lines could push AUD/NZD back up towards the 1.0990 level, which could again act as good level of resistance.

If the pair decides not to retrace back down yet and breaks and closes above the 1.0990 barrier, then this could straight away open the path towards the next potential area of resistance at 1.1040, a break of which could set the stage for a move to the 1.1073 hurdle, marked by the highest point in January.

For us to take the side of the bears, we would need to see a good move below the aforementioned short-term upside support line. This way we could start examining a possible test of the 1.0840 level, marked by the low of the 30th of July. A break below that level could open the door for another drop, which could lead to a test of the other strong area of support at around 1.0780. That area held the rate from falling on the 27th of June.

As for Today’s Events

In the US, we get the JOLTs Job Openings for June and expectations are for a slight increase to 6.74mn from 6.64mn in May. In Canada, the Ivey PMI is anticipated to have risen to 64.2 from 63.1. New Zealand’s Global Dairy Trade Price Index is coming out, but no forecast is available.

Tonight, during the Asian morning Wednesday, Australia’s home loans are expected to have slowed to +0.1% mom in June from +1.1% in May. China’s trade balance for July is also coming out. The forecast is for the nation’s surplus to have decreased somewhat, to 39.3bn from 41.5bn in June. Imports are expected to have accelerated to +16.2% yoy from +14.1%, while exports are anticipated to have slowed to +10.0% yoy from +11.3%.

As for the speakers, we have one on the agenda. RBA Governor Lowe speaks during the Asia morning Wednesday.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Brokers, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Brokers analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyzes and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyzes and must therefore be viewed by the reader as marketing information. JFD Brokers prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.