The pound traded higher against most of the other major currencies yesterday, boosted by the upside surprise in UK retail sales, as well as by increased optimism over Brexit. The dollar and the yen stayed on the back foot as the broader market sentiment remained supported. As for today, CAD-traders will turn their attention to Canada’s CPIs for August.

UK Retail Sales Beat Estimates, Optimism Around Brexit Increases

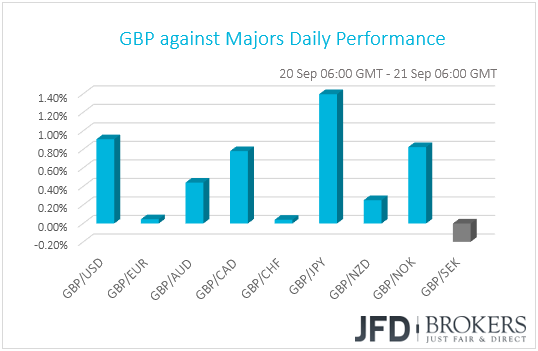

The pound traded higher against most of its G10 peers on Thursday. It gained the most against JPY, USD and NOK, while it lost some ground only against SEK. The British currency traded virtually unchanged against EUR and CHF.

Sterling got a strong boost yesterday after the upside surprise in UK retail sales for August. Headline sales rose 0.3% mom during the month, which still marks a slowdown from the upwardly revised 0.9% mom increase in July, but this was better than the estimated 0.1% slide. Core sales rose 0.3% mom as well, beating expectations of -0.2%. July’s core rate was also revised up, to +1.1% mom from +0.9%. The upbeat report comes just a day after inflation data for the same month showed that both the headline and core CPIs accelerated instead of slowing as the forecasts suggested.

Optimism that a Brexit deal could be eventually struck in the months to come may have also helped the pound. Yesterday, UK Cabinet Office minister David Lidington said that that the UK is 85-95% of the way to agreeing a deal with the EU, while speaking after the EU summit in Salzburg, the head of the EU Council Donald Tusk said he was “a little more optimistic” on the likelihood of a deal and repeated Barnier’s words that the October summit “will be the moment of truth”. “We expect maximum progress and results in Brexit talks”, he said and noted that the November meeting could be used to “finalize and formalize a deal.”

That said, Tusk also noted that “while there are positive elements in the Chequers proposal, the suggested framework for economic cooperation will not work”. UK PM Theresa May was also confident that the two sides will eventually find common ground, but she added that there is still a lot of work to be done. In contrast with Tusk, she insisted that her plan is the “only credible position on the table.”

As for our view, although the willingness of both sides to secure a deal in the months to come may have kept GBP-bulls in the driver’s seat, headlines from the Salzburg summit suggest that there was very little progress made. We still expect the British currency to remain sensitive to Brexit-related headlines until things are finally sorted out. We agree that October could be the “moment of truth”. If the two sides fail to make any material progress at that meeting, this will unwind hopes for a final deal in November and could revive fears for a disorderly Brexit.

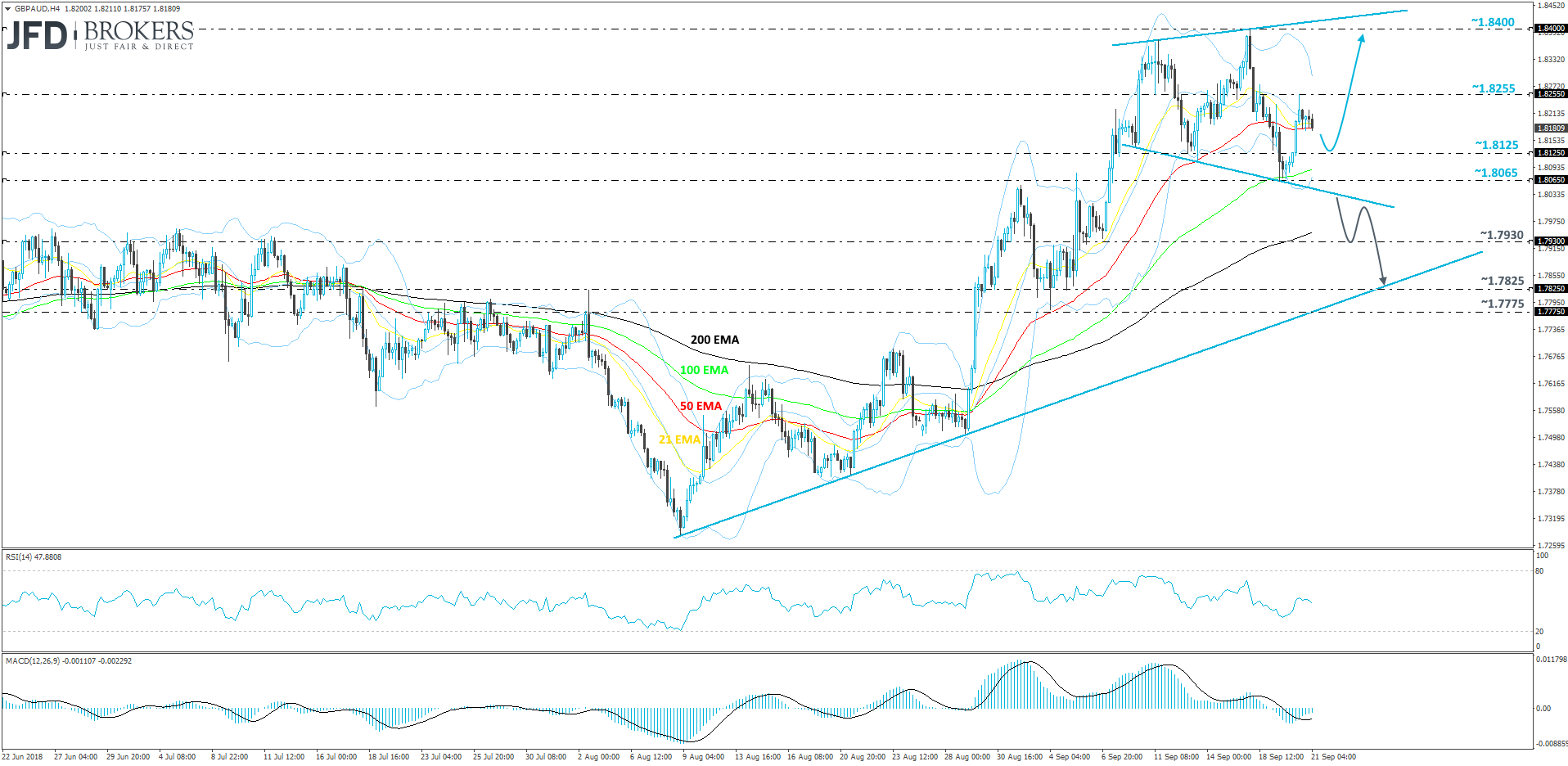

GBP/AUD – Technical Outlook

The British pound continues to surge against the US dollar and some other G10 currencies. Since the beginning of August, GBP/AUD remains on an uptrend, marked by the trendline taken from the low of the 9th of August, but from around the middle of last week, the Australian dollar started picking up the pace and we saw the pair correcting to the downside. That said, GBP/AUD started forming a broadening triangle, which could limit the pair’s movement in the short-run. For now, we will remain somewhat bullish, at least for the short-term, until we reach the upper side of the abovementioned formation.

Yesterday, GBP/AUD found good resistance near the 1.8255 level, which held the rate down. But this could be a temporary appearance, as the pound buyers could come in again and lift the pair back up. A break above the 1.8255 hurdle, could set the stage for a possible move towards the 1.8400 barrier, marked by the peak of the 18th of September. Slightly above lies the upper side of the aforementioned broadening triangle that could stall the rate initially, until the bulls and the bears decide on who will take control from there.

The RSI is currently running flat and sits just slightly below 50. The MACD, on the other hand, even though still in the negative zone, has now moved above its trigger line and is close to the zero mark. These contradictive signs keep us somewhat flat for now and support our view to wait for a break above 1.8255 before trusting more bullish extensions.

On the downside, we would need to see a break and a close below the lower side of the aforementioned formation in order to start examining the case of a deep downside correction. We could then aim for the 1.7930 obstacle, marked near the low of the 6th of September. If that area is not enough to withstand the pressure from the bears, we could see the pair sliding towards the 1.7825 zone, which acted as good support between the 3rd and the 5th of September. This is where GBP/AUD could also meet the aforementioned uptrend line, which could hold the rate from dropping lower, at lest for a short period of time.

Risk Appetite Remains Supported, Canada’s CPIs in the Limelight

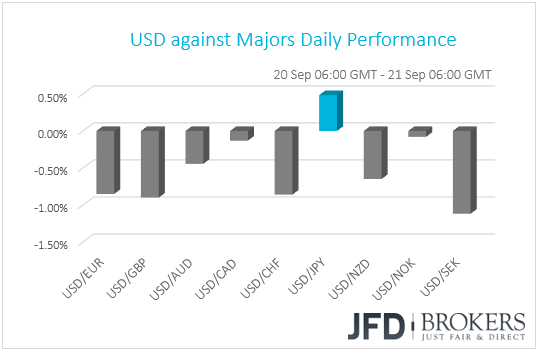

The dollar continued to underperform against most of the other G10 currencies yesterday. It gained only against the safe-haven JPY, while it lost the most versus SEK, GBP, and CHF in that order. The greenback traded virtually unchanged against CAD and NOK.

The yen and the greenback were once again the main losers among the G10s, as safe-haven demand continued to shrink in favor of riskier assets. Indeed, most major EU and US equity indices ended their session in the green, while during the Asian morning Friday, Japan’s Nikkei 225 and China’s Shanghai Composite indices closed 0.86% and 2.50% up respectively.

It seems that investors continued to shrug off the latest trade salvo between the US and China. As for our view, it remains the same as on Tuesday. Although further escalation in tensions between the two nations could hurt again market sentiment, any new announcements may continue to have diminishing effects. Investors have been digesting the idea of a full-blown trade war for months now, and on top of that, they are already aware of what could be the next steps of both the US and China.

The Norwegian Krone ended the day virtually unchanged against its US counterpart, but the ride was not as quiet as it seems. NOK tumbled during the European morning after the Norges Bank decided to increase rates as was widely anticipated, but lowered its projected rate path, disappointing those expecting more hawkish approach. The Bank also noted that the next rate increase will most likely come in Q1 2019. In any case, NOK managed to recover all the meeting-related loses within the next few hours.

The SNB also decided on interest rates yesterday. This Bank kept its benchmark rate unchanged at -0.75%, reiterating that it will remain active in the FX market as necessary and repeating that the Swiss franc is highly valued. However, it revised down its inflation forecasts. It now expects inflation to hit its 2% target in Q2 2021. Previously, the Bank suggested that the CPI will hit 2.2% in Q1 2021. The franc weakened slightly at the time of the release but was quick to rebound and end the day among the main gainers against its US counterpart.

Apart from the Krone, the Loonie also ended the day almost unchanged against its neighboring dollar. CAD traders are still on the edge of their seats in anticipation for a deal between the US and Canada by the end of the month in order to revamp NAFTA, but today, they will also pay attention to the economic calendar, and especially Canada’s CPIs for August.

Expectations are for the headline rate to have declined to +2.8% after surging to +3.0% in July, while no forecast is available for the core rate. In our view, even if inflation slows somewhat, we don’t expect it to alter expectations with regards to an October rate increase by the BoC. After all, a tick down following the surge to +3.0% yoy in July from +2.5% appears more than normal to us. What’s more, at its latest meeting, the BoC remained willing to keep raising rates, while the following day, BoC Deputy Governor Carolyn Wilkins said that the Bank discussed dropping the “gradual approach” language on interest rates, and that they may raise rates even if NAFTA talks fall apart.

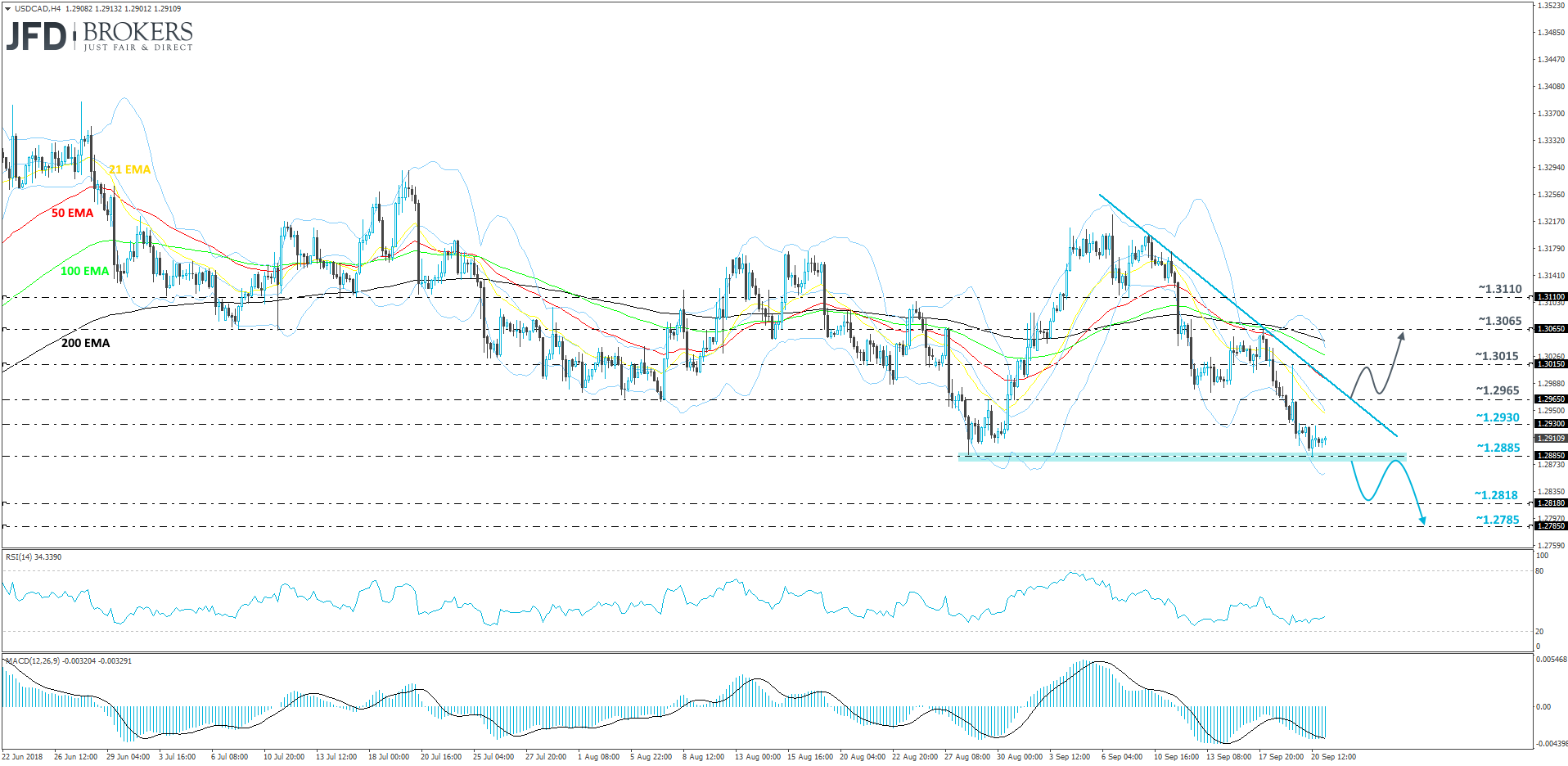

USD/CAD – Technical Outlook

Lately, the Canadian dollar has been strengthening against its US counterpart, which is clearly reflected in USD/CAD. The pair continues to trade below its short-term downside resistance line, taken from high of the 10th of September. That said, yesterday, it found strong support near the 1.2885 zone and now it has stalled a bit, probably in anticipation of the next market-driving news. Bearing all this in mind, for now, we remain somewhat bearish over the near-term outlook.

As mentioned above, USD/CAD found good support yesterday at the 1.2885 barrier, marked by the low of the 28th of August. If the line breaks and the pair closes below it, this could be a nice invitation for more bears to step in and drive USD/CAD down towards the next potential area of support at the 1.2818 hurdle, which was last time tested on the 31st of May. If the bears remain in the driver’s seat, then further declines could lead towards the 1.2785 zone, which acted as strong support throughout the whole month of May. Certainly, let’s not exclude a possibility for USD/CAD retracing a bit to the upside to hit the previously mentioned downside resistance line, where the bears could quickly pick up on that and take advantage of the higher rate.

Alternatively, a break and a close above that downside resistance line, could spook the bears in favour of the bulls, who could see this as a good opportunity to step in and push USD/CAD higher. With the break of that downside line, we may also get a close above the 1.2965 level, which acted as resistance on the 19th of September and also as an inside swing high of the 28th of August. Further acceleration of the rate could lead to a test of the 1.3015 obstacle, a break of which could open the path to the 1.3065 barrier, marked by the high of the 18th of September.

As for the Rest of Today’s Events

During the European morning, we get the preliminary manufacturing and service-sector PMIs for September from several European nations and the Eurozone as a whole. Expectations are for the bloc’s manufacturing index to have declined to 54.4 from 54.6, while the services figure is anticipated to have remained unchanged at 54.4. This could drive the composite PMI down to 54.4 from 54.5.

We get preliminary PMI data for September from the US as well. Both the manufacturing and services PMIs are expected to have risen to 55.0, from 54.7 and 54.8 respectively.

From Canada, besides the CPIs, we also get the nation’s retail sales for July. The forecasts suggest that both headline and core sales rebounded to +0.4% mom and +0.6% mom, after sliding 0.2% and 0.1% respectively.

Finally, OPEC and major non-OPEC oil producers meet in Algeria over the weekend in order to discuss how to allocate the 1mn bpd increase agreed in June, and whether the market needs more oil in order to compensate for Iran’s supply shortfalls due to the US sanctions, as well as due to the decline in Venezuela’s production.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Brokers, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Brokers analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyzes and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyzes and must therefore be viewed by the reader as marketing information. JFD Brokers prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.