Two more G10 central banks take their turn this week in deciding on monetary policy: the FOMC and the RBNZ. The Fed is widely expected to deliver its 3rd hike for the year, while the RBNZ is anticipated to stand pat once again. The US core PCE for August, the Fed’s favorite inflation measure, and Eurozone’s preliminary CPIs for September are also coming out.

On Monday, during the European morning, we get the German Ifo survey for September. Expectations are for both the current assessment and expectations indices to have declined, to 106.1 and 100.2 from 106.4 and 101.2 respectively. This would drive the business climate index down to 103.2 from 103.8. That said, given that both the current conditions and expectations ZEW indices for the month unexpectedly rose, we view the risks surrounding the Ifo indices as tilted to the upside.

In the UK, the BoE releases its financial stability report, while the CBI industrial trend orders are also coming out. From Canada, we get the wholesale sales for July and expectations are for a 0.4% mom rebound after a 0.8% slide in June.

On Tuesday, during the Asian morning, the BoJ will release the minutes of its July meeting, when policymakers kept policy unchanged, but announced some minor tweaks including more flexibility in bond operations, as well as the introduction of forward guidance for policy rates. Investors may be looking for hints on whether more changes are in the works but given that the September meeting did not provide such hints, we doubt that the July minutes will reveal something like that.

Later in the day, the only release worth mentioning is the US Conference Board consumer confidence index for September. Expectations are for a slide to 132.2 from 133.4.

On Wednesday, the spotlight is likely to fall to the FOMC policy decision. This is one of the “bigger” meetings where besides the rate decision and the statement, we get updated economic projections and a press conference by Fed Chair Jerome Powell.

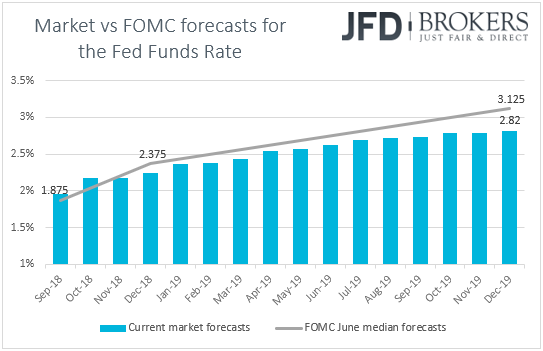

According to the Fed funds futures, market participants are almost certain that the Committee will raise rates by 25bps to the 2.00-2.25% range, with the implied probability for such an action currently standing near 92%. They also assign an 80% chance that another hike will follow in December. Thus, a hike by itself and an unchanged 2018 median dot pointing to another one in December are unlikely to result in any major market reaction. We believe that most of the attention may fall on the 2019 dots as well as the first forecast for 2021. Investors may be eager to find out whether the Fed continues to anticipate 3 more hikes in 2019 and whether the 2021 median will be above or below the Fed’s long run estimate.

Given that the market is almost fully pricing in only two hikes for 2019, an unchanged 2019 median estimate, combined with a 2021 forecast above the Fed’s long run estimate would suggest that officials remain willing to continue raising rates, even above their neutral level for some time, and could prompt the market to adjust its forecasts closer to the Fed’s.

As for Wednesday’s economic indicators, during the Asian morning, New Zealand’s trade balance for August is coming out, as well as the BoJ’s own core CPI for the same month. Later in the day, in the US, besides the Fed decision, we also get new home sales for August. Expectations are for a 0.5% mom rebound after a 1.7% decline in July.

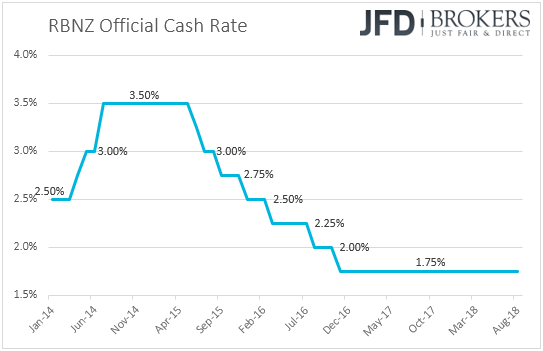

On Thursday, during the early Asian morning, it is the turn of the RBNZ to decide on interest rates, but expectations are for this Bank to keep rates unchanged at +1.75%. The meeting will not be accompanied by updated economic projections, neither a press conference by Governor Adrian Orr, and thus the focus will be only on the statement. When they last met, policymakers stood pat, reiterating that the direction of the next move could be up or down. They also pushed well back the timing of when they expect interest rates to start rising, from September 2019 to September 2020. At the press conference following the decision, Governor Orr said that if growth slows further below its potential rate, then officials would have to cut rates.

Since then, the only top-tier economic data set we got was New Zealand’s GDP for Q2. The release showed that economic growth accelerated to +1.0% qoq from +0.5% qoq in Q1, well above the Bank’s estimate for the quarter, which was also at 0.5% qoq.

In our view, this may have eased concerns with regards to a near-term rate cut, but we don’t expect it to result in any major changes in the statement accompanying the decision. In August, officials noted that “While recent economic growth has moderated, we expect it to pick up pace over the rest of this year and be maintained through 2019.” Thus, the latest GDP figure, although accelerating earlier and more than the Bank’s forecasts suggested, it just confirms that view. We expect officials to acknowledge this, but we also expect them to repeat that the next rate move could be up or down.

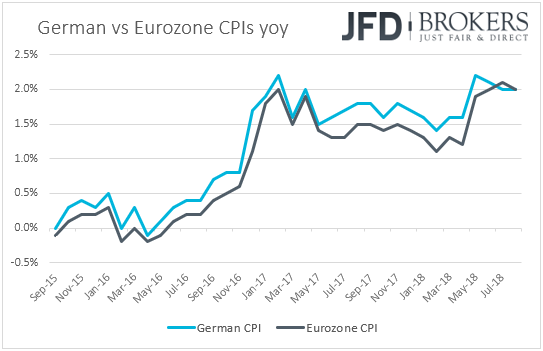

As for Thursday’s indicators, during the European morning, Germany’s preliminary CPI data for September are scheduled to be released. Expectations are for inflation in Eurozone’s economic power house to have held steady at 2.0% yoy, which could raise some speculation that the bloc’s headline CPI rate, due out the following day, may have remained unchanged as well.

Later in the day, we get the final US GDP data for Q2. Expectations are for the final print to confirm the 2nd estimate and show that the US economy expanded 4.2% qoq SAAR, which is the strongest rate in nearly four years. That said, barring any major deviations from the forecast, we doubt that this release will have a major market impact. We are nearing the end of Q3 and we already have models suggesting how the economy may have performed during this quarter. According to the Atlanta Fed GDPNow model, the economy expanded accelerated to +4.4% qoq in Q3, but the New York Fed Nowcast points to a slowdown to +2.3%.

Durable goods orders for August are also due to be released. Expectations are for headline orders to have rebounded 1.9% mom after falling 1.7% in July, while core orders are anticipated to have accelerated to 0.5% mom from 0.1%. Pending home sales for the same month are coming out as well.

On the political front, Italy will publish its 2019 deficit and debt targets and investors will be sitting on the edge of their seats to see whether the populist government has kept the budget deficit less than 3% of annual GDP, in line with the EU rules.

Finally, on Friday, during the Asian morning, we get the usual end of month data dump from Japan. The nation’s unemployment rate for August is expected to have remained unchanged at 2.5%, while preliminary figures on industrial production for the same month are anticipated to reveal a rebound of +1.5% mom following a 0.2% decline in July. Retail sales for the month are forecast to have accelerated to +2.2% yoy from +1.5%. The Tokyo CPIs for September are also coming out and expectations are for the headline rate to have ticked down to +1.1% yoy from +1.2%, while the core rate is expected to have remained unchanged at +0.9% yoy. The BoJ’s summary of opinions from its latest policy gathering is due to be released as well. From China, we have the Caixin manufacturing PMI for September and expectations are for the index to have ticked down to 50.5 from 50.6.

During the European day, we get the final UK GDP for Q2. Expectations are for the final print to confirm its second estimate and show that the UK economy expanded 0.4% qoq. Similarly, to the US growth data for the quarter, we will treat this data set as outdated as well. We already have numbers showing how the economy performed after that quarter. The official monthly GDP data showed that the economy accelerated to +0.3% mom in July from +0.1% in June, which led to a +0.6% expansion for the three months to July, the fastest pace in almost a year.

From the Eurozone, we have the preliminary inflation data for September. Expectations are for both the headline and core CPI rates to have ticked up to +2.1% yoy and +1.1% yoy, from 2.0% and 1.0% respectively. However, Germany’s CPI rate for the month is forecast to have held steady on Thursday, which suggests that the bloc’s headline rate may have remained unchanged as well. In any case, even if Eurozone’s inflation accelerates somewhat, we believe that there is not much room for ECB hike expectations to come forth. At its latest policy gathering, the Bank reiterated that interest rates will stay unchanged at “least through the summer of 2019”, which, in our view, means that rates could start rising in September 2019 the earliest.

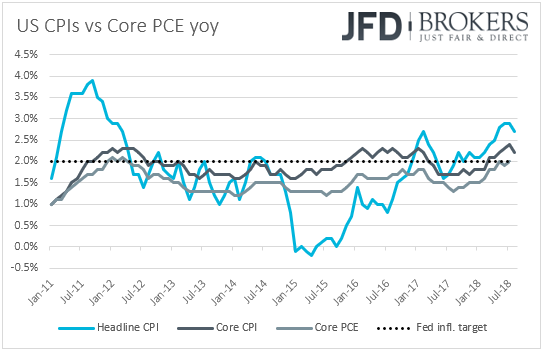

From the US, we get the personal income and spending data for August, as well as the core PCE index for the month. Income is expected to have accelerated to +0.4% mom from +0.3%. Spending is anticipated to have risen 0.4% mom as well, the same pace as in July. The income forecast is supported by a similar acceleration in the monthly earnings rate for the month, while the slowdown in retail sales suggests that the risks surrounding the spending forecast may be tilted to the downside.

As for the yearly core PCE rate, the Fed’s favorite inflation metric, it is expected to have remained unchanged at 2.0%. Bearing in mind that the core CPI rate for the month declined, we see the risks surrounding the PCE rate as skewed somewhat to the downside. Having said that though, if the Fed hikes rates on Wednesday and the new dots continue to point to another rate increase in December, we don’t expect a modest slowdown in the core PCE rate to alter much expectations around that front.

In Canada, the monthly GDP for July is coming out. No forecast is currently available, but anything suggesting that the economy expanded during the month is likely to be welcomed news as the prior monthly print, for June, was 0.0%. Last Friday, Canada’s CPI data showed that the headline rate slowed to +2.8% yoy from 3.0%, matching expectations, while the core rate ticked up to +1.7% yoy from +1.6%. Headline retail sales rebounded less than anticipated, but core sales accelerated by more than the forecast suggested. In our view, these numbers keep the door wide open for an October rate increase by the BoC, and a decent GDP print could further increase that likelihood.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Brokers, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Brokers analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyzes and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyzes and must therefore be viewed by the reader as marketing information. JFD Brokers prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.