We don’t have any central bank meetings on this week’s agenda, but we get the minutes of the latest FOMC, ECB and RBA gatherings. Eurozone’s PMIs are also likely to attract special attention as investors try to assess whether the ECB will indeed hike later this year (or not). With regards to the US-China trade sequel, following another round of talks accompanied by positive remarks last week, but no final deal, trade negotiations are set to continue in Washington.

On Monday, the calendar is almost empty. No major economic releases or events are scheduled, with Canada and US markets closed in celebration of Family Day and Washington’s Birthday respectively.

On Tuesday, Asian time, the RBA releases the minutes of its latest policy meeting. At that meeting, the Bank kept interest rates unchanged, and while the statement had a somewhat dovish flavor compared to the previous one, it included no hints with regards to a potential rate cut in the months to come. That said, just the following day, Governor Lowe put that prospect well on the table, noting that interest rates could move in either direction, with the probabilities of an up and a down move evenly balanced. What’s more, in its quarterly Statement on Monetary Policy, the Bank slashed its GDP and inflation forecasts, also noting that financial market prices suggest that interest rates are likely to stay unchanged over the months ahead, with some expectation of a decrease by the end of this year. So, having in mind that market participants may have already got all the information they need with regards to this Bank, we see little room for surprises from the minutes.

During the European morning, Sweden’s CPIs for January are due to be released. Both the CPI and CPIF rates are expected to have risen to +2.2% yoy and +2.3% yoy, from +2.0% and +2.2% respectively. However, we will once again pay more attention to the core CPIF metric, which excludes energy. At last week’s policy meeting, the Riksbank decided keep interest rates unchanged at -0.25%, while in the accompanying statement, officials repeated that the next increase is likely to come during the second half of 2019, also keeping their rate-path projections unchanged. In December, the core CPIF rate ticked back up to +1.5% yoy from +1.4% and thus, another increase may encourage some participants to raise bets that the next hike could come during the summer months. However, the Bank’s upcoming gathering is scheduled for the 25th of April, and up until then, we have the February and March inflation data. Thus, we prefer to wait for upcoming inflation numbers before we start examining whether (or not) the world’s oldest central bank will signal that rates could rise early in the second half of the year.

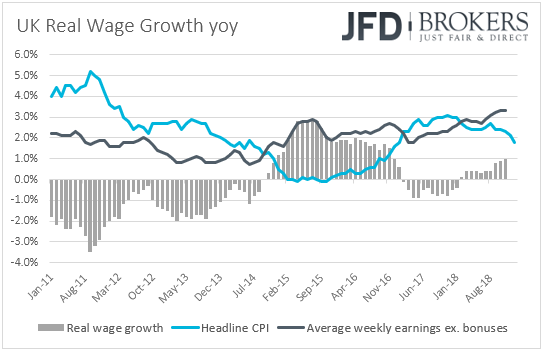

From the UK, we get the employment report for December. Expectations are for the unemployment rate to have held steady at 4.0%, while average weekly earnings, both including and excluding bonuses, are expected to have accelerated. The including bonuses rate is anticipated to have ticked up to +3.5% yoy from +3.4%, while the excluding bonuses one is forecast to have risen to +3.4% yoy from +3.3%. According to the IHS Markit/KPMG & REC Report on Jobs for the month, given that demand for workers outstripped supply, starting salaries continued to increase, with wage inflation among the quickest seen for over three years. In our view, this supports the case for accelerating weekly earnings.

All that said though, we expect market participants to continue paying more attention to UK politics than UK economic data. Last week, UK PM Theresa May suffered another defeat in Parliament, with MPs voting against her request for support in seeking changes to the Brexit bill. Although the vote does not prevent May from returning to Brussels and try to renegotiate, the defeat suggests that with no parliamentary backing, the EU may be less willing to listen to May’s proposals.

In Germany, the ZEW survey for February is due to be released. Expectations are for the current conditions index to have declined for the 5th consecutive month, to 20.0 from 27.6, while the economic sentiment index is forecast to have risen somewhat, but to stay within the negative territory (-14.0 from -15.0). Although this survey is usually not a major market mover, it comes in the midst of disappointing data out of the Eurozone as a whole. Thus, another deterioration in analysts’ morale with regards to Eurozone’s growth engine could slightly increase speculation that the ECB may not raise interest rates this year.

Apart from the economic data, investors are also likely to keep their gaze locked on the US-China trade saga. Following another round of talks accompanied by positive remarks, but no final deal, trade negotiations are set to continue in Washington this week. This, combined with US President Trump’s fresh comments on Friday that he could eventually extend the March 1st deadline if there is further progress, confirms the willingness of both sides to find common ground and is a positive element with regards to the broader market sentiment. Further progress this week may allow risk assets, like equities, to add to their latest gains, but we stick to our guns that a final deal may not be reached.

Speaking at a news conference on Friday, President Trump said that the two nations are closer than ever before to “having a real trade deal” and that he would be “honored” to remove tariffs if this is achieved. However, he also added that the talks are “very complicated”, which suggests that signing a deal this week remains a low-probability scenario. This week’s talks will be led by China’s Vice Premier Liu He and US Trade Representative Robert Lighthizer, which is another reason why we don’t expect a final consensus. As we noted in the past, we expect something like that to happen at a meeting between US President Trump and his Chinese counterpart Xi Jinping.

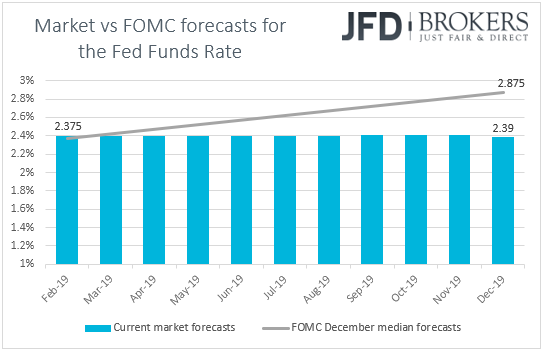

On Wednesday, the minutes from the latest FOMC gathering are scheduled to be released. At that meeting, the Committee kept interest rates unchanged as was broadly anticipated, but in the statement accompanying the decision, officials decided to remove the part suggesting that “some further gradual increases” are warranted and instead noted that they will be “patient” in determining what future adjustments to interest rates may be appropriate.

According to the Fed fund futures, the market is around 80% confident that the Committee will not proceed with any further rate increases this year. Investors assign only a nearly 10% chance for such a move by December, while they see an equal probability for a rate cut. We believe that investors will dig into the minutes for clues with regards to how long the Committee is planning to stay patient. Anything suggesting that they could raise interest rates even once by the end of the year could lift the hike probability and thereby support the dollar. On the other hand, hints that the Committee is not planning to move this year, or any discussion with regards to a rate cut, may prompt participants to abandon the US currency.

With regards to Wednesday’s data, during the Asian day, we get Japan’s trade balance for January, which is expected to show that the nation’s deficit has widened. Exports are expected to have fallen at a faster pace than in December, while the imports rate is expected to have dipped into the negative zone for the first time since March 2018. Australia’s wage price index for Q4 is also coming out and the forecast suggests that the yoy rate remained unchanged at +2.3%, its highest since Q3 2015. Although this is positive, we doubt that it can alter market expectations with regards to the RBA’s future plans. After all, Governor Lowe has put the likelihood of a rate cut on the table, with the Bank’s meeting statement acknowledging the pick-up in wage growth.

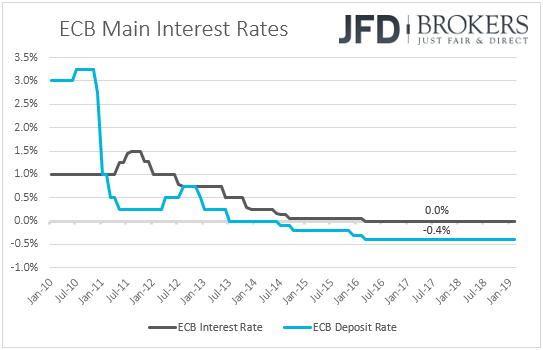

On Thursday, it’s the turn of the ECB to release its meeting minutes. When they last met, policymakers kept all three interest rates unchanged, and made no changes to the accompanying statement, reiterating that interest rates are likely to remain unchanged “at least through the summer of 2019”. That said, at the conference following the decision, ECB President Mario Draghi noted that the risks surrounding the bloc’s economic outlook have now “moved to the downside”.

What’s more, when asked about the timing of when the markets expect a hike, he replied that the markets place the first hike in 2020 and this shows that they understood the Bank's reaction function. So, having that in mind, we believe that investors will scan the minutes for clues on whether the Bank plans to change its interest-rate guidance at one of their upcoming meetings.

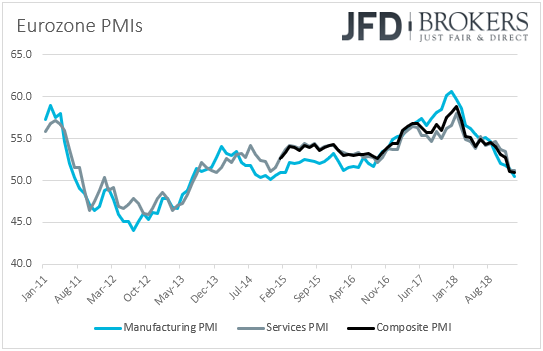

That said, we believe that investors will prefer to focus more on up-to-date clues on that front. In this respect, they could pay more attention to the preliminary Eurozone PMIs for February, which come out ahead of the ECB minutes. The manufacturing index is forecast to have declined to 50.3 from 50.5, while the services index is anticipated to have increased to 51.5 from 51.2. The composite PMI is forecast to have slid to 50.8 from 51.0. Combined with a soft German ZEW survey on Tuesday, another weak set of PMIs may allow investors to keep on the table their bets with regards to no action by the ECB this year.

As for the rest of Thursday’s releases, Australia’s employment data for January is due to be released. The unemployment rate is anticipated to have stayed at 5.0%, while the net change in employment is expected to show that the economy gained 15.2k jobs, less than December’s 21.6k. Even if we get a minor positive surprise, which may support the Aussie at the time, we stick to our guns that labor-related releases are unlikely to prove game changers. Governor Low discussed the case of a rate cut, even after the RBA acknowledged the strength of the labor market.

During the European day, apart from the Euro-area PMIs, we also get the final German CPIs for January, but, as it is usually the case, expectations are for the final number to confirm the preliminary estate, namely that inflation in Eurozone’s growth engine slowed to +1.4% yoy from +1.7%.

Later in the day, we get PMIs from the US as well. Specifically, we get the preliminary Markit indices for February, with the forecasts suggesting that the manufacturing index remained unchanged at 54.9, and the services one rose fractionally, to 54.4 from 54.2. This is likely to drive the composite index higher, but as we noted several times in the past, the market tends to pay more attention to the ISM indices, due out on March 1st and 5th. Durable goods orders for December and existing home sales for January are also coming out.

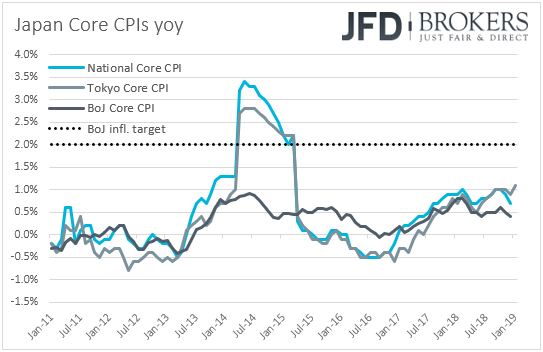

Finally, on Friday, we have Japan’s National CPIs for January. The headline rate is expected to have declined further, to +0.2% yoy from +0.3%, while the core rate is anticipated to have ticked up to +0.8% from +0.7%. That said, bearing in mind that both the headline and core Tokyo rates rose somewhat, we see the risks surrounding the headline rate as tilted to the upside. However, even if both the national rates rise somewhat, they would still be well below the BoJ’s objective of 2%. Thus, with all the Japanese inflation metrics, especially the Bank’s own core CPI, still far from that target, we stick to our guns that BoJ policymakers have a long way to go before they start to consider altering their ultra-loose monetary policy.

Later, we get the final CPIs for January from the Eurozone. As usual, the final rates are expected to confirm the initial estimates, namely that the headline CPI slowed to +1.4% yoy from +1.6%, and that the core rate ticked up to +1.1% yoy.

From Canada, we have retail sales for December. Headline sales are anticipated to have stagnated after falling 0.9% mom in November, while core sales are forecast to have fallen again, but at a somewhat slower pace (-0.5% mom from -0.6%). When they last met, BoC policymakers kept the door open for further rate increased and noted that growth has been running close to its potential rate. However, latest GDP data showed that economic activity contracted in November, dragging the yoy rate down to +1.7% from +2.2%. What’s more, although inflation for December came in higher than anticipated, and January’s employment data were decent overall, manufacturing sales slumped for the second consecutive month. Thus, another weak retail sales report may raise doubts as to whether the BoC could indeed maintain its upbeat view with regards to future rate increases. Having said all this though, investors may get hints on the Bank’s future plans by Governor Stephen Poloz, who speaks the day before. Thus, bearing in mind that they may already get the clues they need with regards to whether the Bank remains willing to hike more (or not), they may prefer to pay less attention to retail sales this time around.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

76% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2019 JFD Group Ltd.