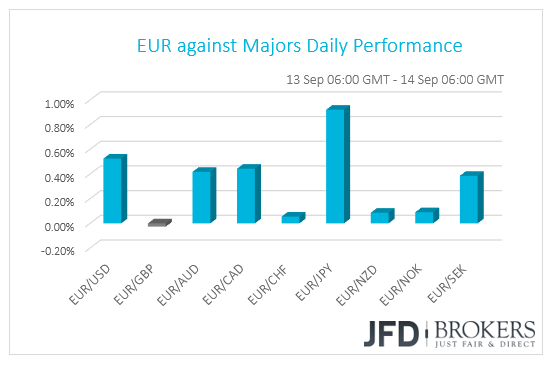

Yesterday was a big day in Europe, as the BoE and the ECB delivered their announcement on interest, which were kept unchanged as expected. But the spotlight also fell on one neighbouring country’s central bank, which raised their rates by 625 basis points, in order to try and control inflation.

As expected, rates remain the same.

Yesterday, was the central bank day in Europe, where we had the BoE, the ECB and the Turkish central bank announcing their interest rate decisions. The only one who raised the rates was Turkey, due to certain economic circumstances. The BoE and the ECB, as expected, kept their rates the same at +0.75% and 0.00% respectively.

In regards to the ECB, yesterday they lowered their growth forecasts of the European economy for the remaining of this year. In addition to that, Mario Draghi said they are planning to slowly phase out easy money. The ECB have plans to cut their €2.5 trillion quantitative easing program by the end of the year.

The euro was trading unchanged during the interest rate announcement. It was expected that the rate will stay the same, at least till the summer of 2019, so the euro stood still in anticipation of Mario Draghi’s press conference. This is when the euro moved higher, once the president started giving his summary of the economic outlook, where the tone of his voice sounded confident and reassuring.

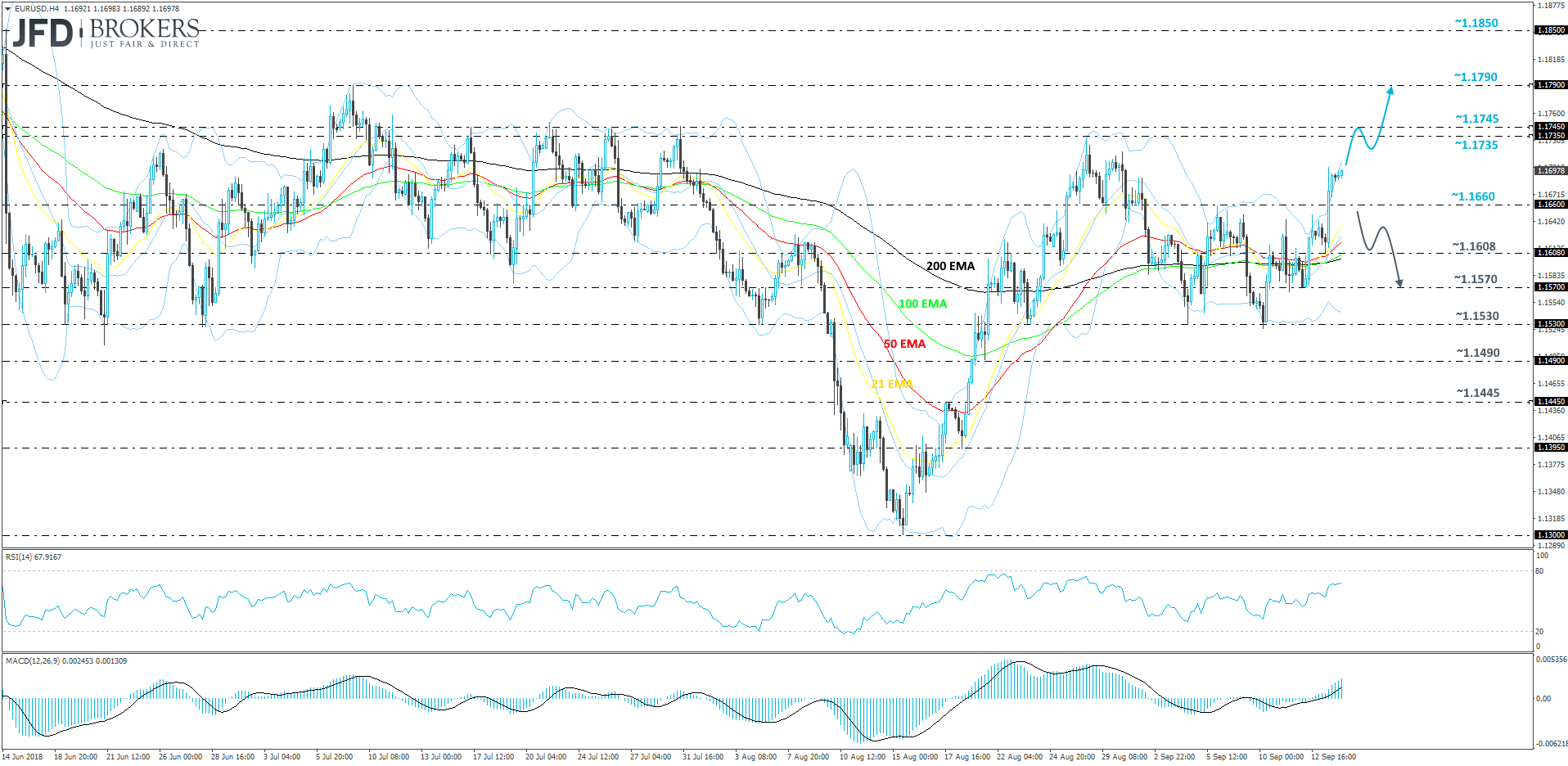

EUR/USD – Technical Outlook

The EUR/USD blasted to the upside, yesterday, during the ECB president’s speech. The pair broke through its important resistance of 1.1660 and closed above it, this way signalling a potential continuation in the rate acceleration. That said, there is a chance to see a bit of a correction to the downside before EUR/USD could push back up again in the near-term. For now, we remain bullish, at least the short-run.

After breaking and closing above the 1.1660 level, the move has sparked confidence among the EUR/USD bulls. The pair is now set to potentially make its way higher, towards the next good area of support between 1.1735, marked near the high of the 28th of August, and 1.1745, which was the high of the 31st of July. If that area is not able to withhold the rate from accelerating further, this could be seen as good opportunity for more bulls to start joining in and lifting EUR/USD towards the 1.1790 hurdle, marked by the peak of the 9th of July.

Alternatively, if EUR/USD moves back down below the 1.1660 level, this could interest the bears in potentially stepping in and leading the pair back down to lower levels like the 1.1608, which acted as good support for EUR/USD’s bounce yesterday. If the bears remain in the driver’s seat, this could open the path towards the 1.1570 barrier, marked by the low of the 12th of September.

Turkish central bank hikes rates

Yesterday, the Turkish central bank finally raised their interest rates by 625 basis points following the weeks of pressure from foreign investors, who demanded such action, in order to try and maintain the level of inflation inside the country. In a way, the bank showed its independence from the ruling government led by Recep Tayyip Erdogan, which from the beginning of the Turkish turmoil, was opposing the rate hike. Now, the president will have to find a way of how to smooth out the tensions that are arising inside the country and how to bring back the trust of his electorate.

Turkey is already not far from adding their name to the list of those, who would require help from the International Monetary Fund (IMF) in the future. Argentina is one of those emerging markets countries that already agreed a loan earlier this summer with the IMF. The next potential “clients” of the fund could be South Africa, Mexico, Indonesia and Turkey, unless they will be able to sort out everything themselves.

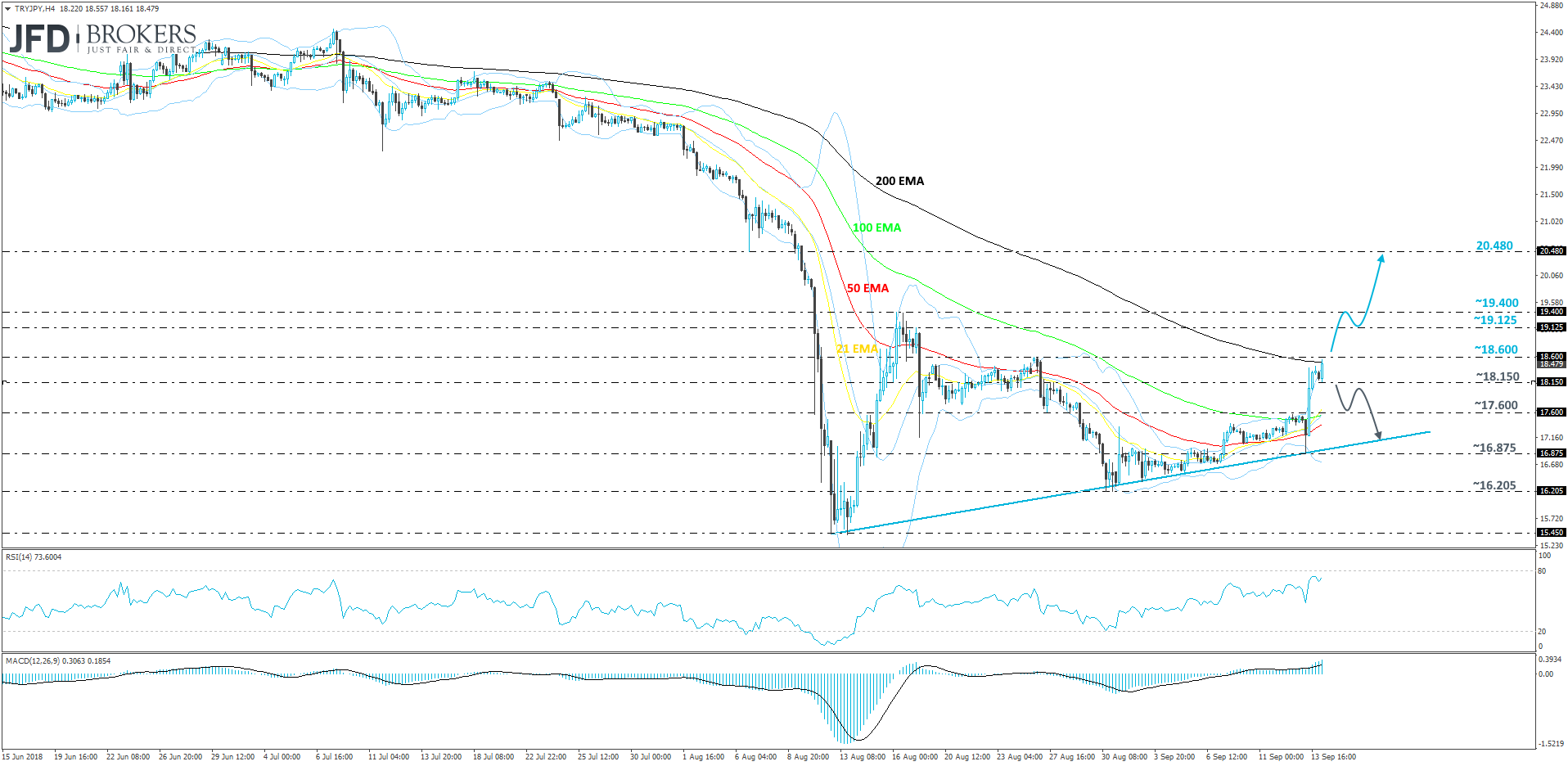

TRY/JPY – Technical Outlook

Finally, the Turkish lira got a breath of fresh air yesterday, after the country’s central bank announced an increase in the interest rate. This action has pleased the international community and investors, as the move by the bank led to lira’s strengthening. How long will the fragile Turkish currency move higher, it is unknown, but for now, we will stay positive on the short-term outlook.

Looking at the TRY/JPY on the 4-hour chart, we can see that the pair spiked higher on the rate announcement and now is trading near its 200 EMA (black line). But the main focus right now will be around the 18.600 zone, marked by the high of the 27th of August. If that zone is not able to withhold the rate from moving higher, the next potential resistance area on our radar is between 19.125 and 19.400, where the last was the peak of the 16th of August. If the bulls remain in control, we could potentially see a test of the 20.480 barrier, which acted as good support on the 6th of August.

On the other hand, if suddenly TRY/JPY moves and closes below the 18.150 hurdle, this could be quickly picked by the bears, who in their case, could drive the pair down towards the 17.600 area, which acted as good resistance on the 12th of September and now could act as strong support. Below that area runs the short-term upside support line, taken from the low of the 12th of August, which could initially stop the pair’s slide. The bulls and the bears could start battling it out around that line, over who will take control from there onwards.

As For the Rest Of Today’s News

Looking at the economic calendar, the Bank of England governor Mark Carney is set to the deliver a speech. An hour after that, the BoE’s quarterly bulletin is expected to come out, but it could be a non-market driven event.

The US will deliver their retail sales figures for the month of August. The core number is expected to have slightly dropped by a tenth of a percent, going from the previous +0.6% to +0.5% forecasted. The headline figure is also believed to come out lower at +0.4%, comparing to the previous +0.5% the month before.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Brokers, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Brokers analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyzes and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyzes and must therefore be viewed by the reader as marketing information. JFD Brokers prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

Copyright 2018 JFD Brokers Ltd.