The euro was yesterday’s main loser, feeling the heat of Eurozone’s disappointing PMIs and the dovish shift in the ECB’s language with regards to the Euro-area economic outlook. We also had a Norges Bank meeting, but with this Bank staying on course for a March hike, the Krone did not react much. Once again, the pound was the main gainer, following reports that DUP will support May’s plan B if it includes a definitive end date to the Irish backstop.

Eurozone PMIs Disappoint Again, Draghi Sees Downside Risks

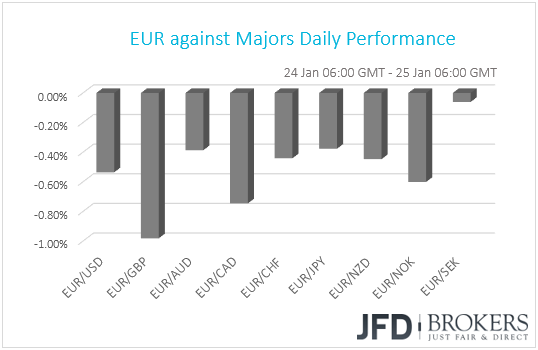

The euro tumbled against all but one of the other G10 currencies on Thursday. It fell the most against GBP, CAD and NOK in that order, while the currency that failed to capitalize against EUR was SEK, with EUR/SEK staying virtually unchanged.

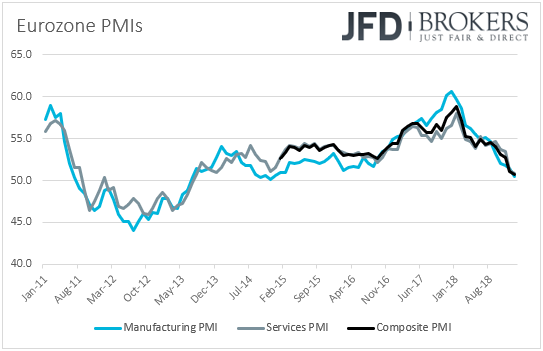

Yesterday was an ECB day, but traders have started selling euros well ahead of the announcement, due to the disappointment of the Euro area PMIs. Both the bloc’s manufacturing and service-sector indices have declined further, missing expectations of marginal increases. This dragged the composite index down to 50.7 from 51.1, the lowest since July 2013, and less than a point above the contractionary zone. At this point, it’s worth mentioning that although Germany’s services index rose and helped the nation’s composite to increase as well, the manufacturing print fell a tick below the boom-or-bust barrier of 50, signaling contraction in Germany's manufacturing activity.

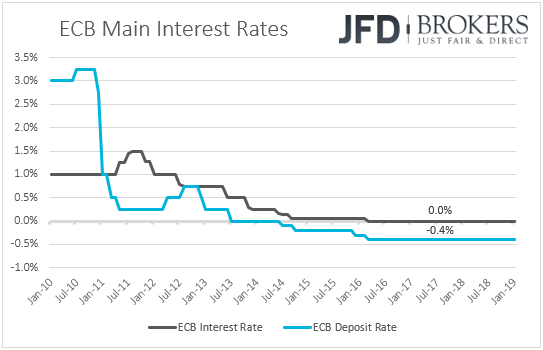

Now, passing the ball to the ECB, the Bank kept all three of its interest rates unchanged as was widely anticipated, and made no changes to the accompanying statement, reiterating that interest rates are likely to “remain at their present levels at least through the summer of 2019, and in any case for as long as necessary to ensure the continued sustained convergence of inflation to levels that are below, but close to, 2% over the medium term.”

The euro, already hit by the PMIs, did not react at the time of the announcement, as investors were probably sitting on the edge of their seats in anticipation of President’s Draghi press conference. At the conference, the ECB chief noted that the incoming information has continued to be weaker than expected, and that the risks surrounding the bloc’s economic outlook have now “moved to the downside on account of the persistence of uncertainties related to geopolitical factors and the threat of protectionism, vulnerabilities in emerging markets and financial market volatility.” Although Draghi noted that they remain confident in the continued sustained convergence of inflation towards their target due to a strong labor market and rising wages, the downside revision to the economic outlook assessment was enough to trigger another leg of selling in the euro.

What’s more, when asked about the timing of when the markets expect a hike, he replied that the markets place the first hike in 2020 and this shows that they understood the Bank's reaction function. In our view, this means that even though the ECB has kept its interest rate guidance unchanged, interest rates may not rise this year if data does not suggest so. After all, the guidance says that rates will stay at current levels “at least through the summer of 2019”, which means that they could rise in September, but also well thereafter. With regards to whether they have started looking into a new round of TLTROs (Targeted Long-Term Refinancing Operations), which are cheap loans to banks, Draghi said that several policymakers raised the issue, but no decision was taken because there was no policy discussion this time. “We only focused on the assessment,” he added.

As for our view, we expect the euro to continue being data driven. Further weakness in the data may increase speculation that Draghi and co. will push back their guidance on interest rates at some point in the foreseeable future, and could enhance the case for a new round of TLTROs, perhaps as early as at the March gathering. Such expectations may keep the euro under selling interest, at least until the data start to suggest otherwise.

We also had a Norges Bank meeting, but as we expected, it proved to be a non-event with the Norwegian Krone reacting little at the time of the announcement, although, overall, it was among the main gainers against the euro yesterday. Just for the record, the Bank kept interest rates unchanged at +0.75%, reiterating that “the policy rate would most likely be raised in March 2019”. Officials also noted that outlook for the future rate path is little changed since the December gathering.

EUR/CHF – Technical Outlook

After yesterday’s volatile euro-trading, EUR/CHF broke through its short-term upside support line taken from the low of the 2nd of January. This move increases the chances of seeing further declines at least for a while more. At the time of this analysis, the pair is retracing back up, but if it fails to get back above either the 1.1275 hurdle, or even the above-mentioned upside line, then this might be an opportunity for the bears to step in again and drive EUR/CHF lower.

If the bears remain strong and push the rate back down, this may lead towards the next potential area of support at 1.1245, marked by the low of the 14th of January. Of course, near that area there may be some room for another small rebound, but If the sellers continue dictate the rules, the potential recovery could be short-lived and EUR/CHF could once again travel lower. If the 1.1245 hurdle fails to withhold this time, this is when we will start examining the possibility of seeing a test of the level at 1.1220, which is the low of the 8th of January.

Alternatively, a strong move back above the aforementioned upside support line could ring alarm bells in the bear-bloc. This is when it may become more interesting for the bulls, as a push above the 1.1300 barrier could clear the path towards higher levels. We will then target the 1.1317 obstacle, a break of which might lift the rate towards the next potential resistance zone, between 1.1340 and 1.1345 levels.

Pound Rallies on Reports DUP Will Support May

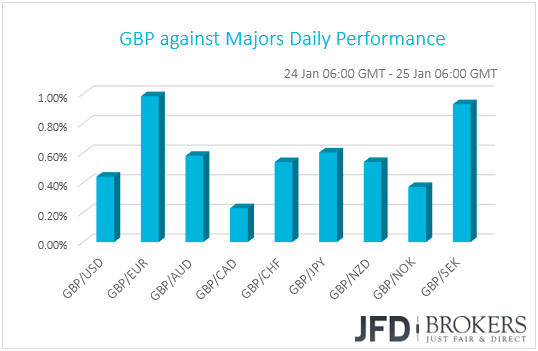

The pound stood tall once again, outperforming all the other major currencies, with Cable reaching levels last seen back in early November. Although it traded in a somewhat consolidative manner during the European trading, it started gaining ground again as the US session got underway, with the advance accelerating overnight. The catalyst behind the overnight rally may have been reports that Northern Ireland’s DUP (Democratic Unionist Party) has privately decided to support May’s alternative Brexit plan next week if it includes a definitive end date to the Irish backstop.

As we noted yesterday, the pound has been in a recovery mode since the begging of the year on expectations that a disorderly Brexit can be eventually avoided. Wednesday’s reports that the Labour party will back an amendment suggesting an extension to the Article 50 may have fueled further those expectations, while the overnight headline of DUP supporting May might have sparked some hopes that an extension may not even be necessary, as a breakthrough could be found before the end of March.

Having said all that though, we stick to our guns and we see the case of a new deal being broadly accepted as a hard task. Even if May manages to find common ground with Parliament, she may not find the EU on the same page. As we noted yesterday, EU officials have been adamant that the accord already agreed with May, the one defeated by a large margin in the UK Parliament last week, is the only possible deal. EU Chief Negotiator Michel Barnier reiterated that position on Wednesday. Thus, given that everyone wants to avoid a no-deal Brexit, we still see extending Article 50 as the most likely outcome for now.

As for the pound, heading into Tuesday’s debate on May’s plan B and amendments proposed by lawmakers, it could continue drifting north as investors who have previously sold sterling on fears of a chaotic EU-UK divorce keep liquidating more and more of their positions.

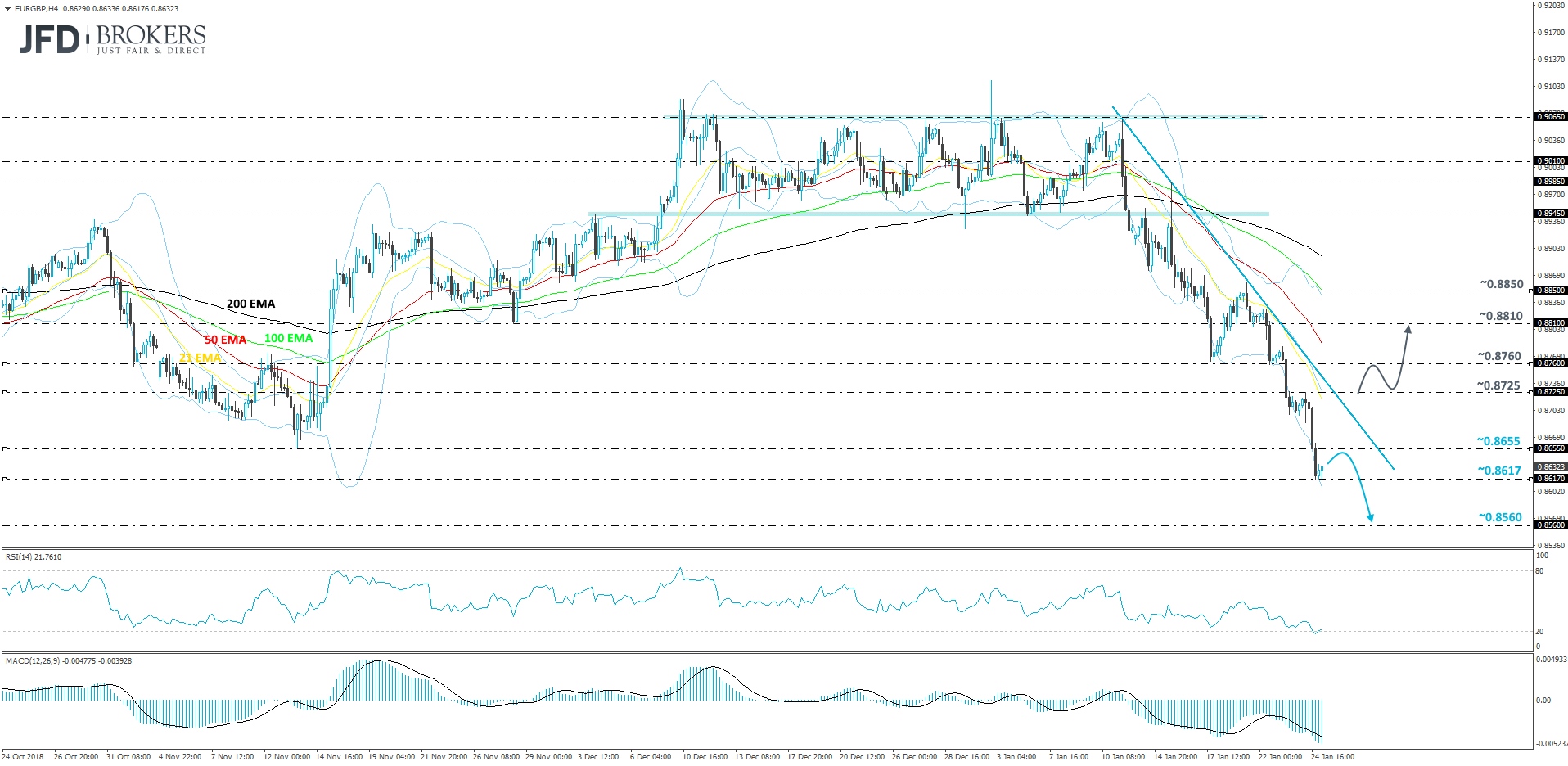

EUR/GBP – Technical Outlook

EUR/GBP continues to slide down the hill, trading below a short-term downside resistance line taken from the high of the 11th of January. Yesterday, the pair found good support near the 0.8617 hurdle, from which the rate rebounded back up a bit. However, as long as EUR/GBP stays below the 0.8655 barrier and the above-mentioned downside resistance line, we will continue aiming lower, at least in the short-run.

As mentioned above, we could see a small rebound for now, which could result in a test of the 0.8655 area. If that zone continues to hold, this may be a good opportunity for the sellers to jump in again and drive EUR/GBP back down towards the 0.8617 obstacle. If this time that obstacle fails to withhold the rate from moving lower, a push through it could drag the pair all the way to the 0.8560 hurdle, which is the low of the 17th of May 2017. Even if the rate gets above the previously-mentioned 0.8655 barrier and travels higher, as long as the pair remains below that downside resistance line, we will continue aiming south.

In order to get comfortable with the upside scenario, at least in the short-run, we would like to see EUR/GBP breaking above the aforementioned downside line and also place itself above the 0.8725 level, marked by yesterday’s high. This way we could start examining the possibility of seeing the pair reaching the 0.8760 obstacle, which if broken could push the rate further up towards the 0.8810 resistance zone, marked by the inside swing low of the 21st of January.

As for Today’s Events

During the Asian morning, Japan’s Tokyo CPIs for January were released. The headline rate ticked up to +0.4% yoy from +0.3%, while the core one rose to +1.1% yoy from +0.9%. This suggests that the National CPIs for the month are likely to rebound somewhat as well, but bearing that all metrics are still well below the BoJ’s 2% price objective, we don’t expect any policy response by the BoJ soon.

During the European day, we have the German Ifo survey for January. Both the current assessment and business expectations indices are expected to have slid to 97.0 and 104.2 from 97.3 and 104.7 respectively, which could drive the business climate index down to 100.7 from 101.0. A potential slide in the current assessment index is supported by the tumble in the ZEW current conditions index for the month, but the rise the ZEW economic sentiment index suggests that the risks surrounding the Ifo expectations print may be tilted somewhat to the upside.

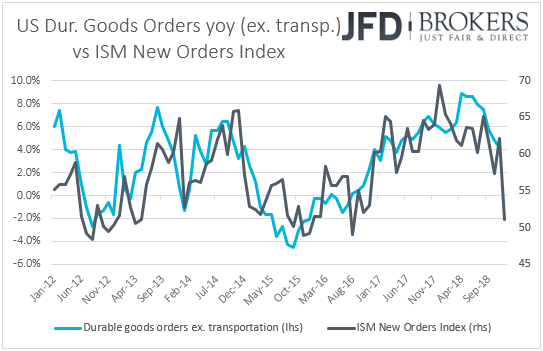

Later, from the US, we get durable goods orders for December. Expectations are for headline orders to have accelerated to +1.8% mom from +0.8% in November, while core orders are anticipated to have rebounded 0.2% mom after falling 0.3%. That said, bearing in mind that the monthly prints of December 2017 that will drop out of the yearly calculation were 2.6% and 0.7%, we would expect the yoy rates continue drifting lower. The case for sliding yoy rates in durable goods orders is also supported by the New Orders Sub-index of the ISM manufacturing PMI, which plunged 11 points in December, to 51.1 from 62.1.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

68% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.