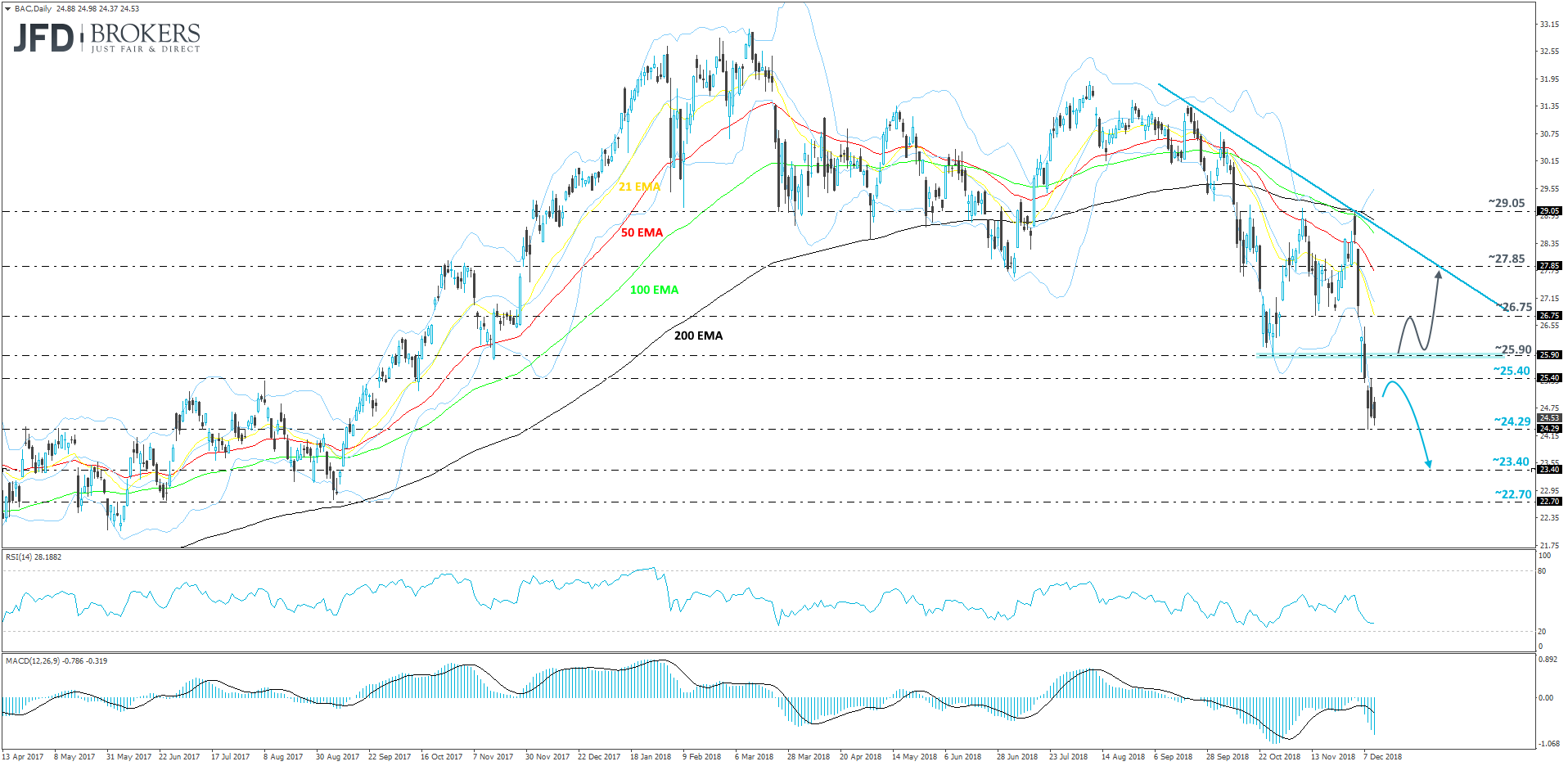

2018 has not been the best year for the Bank of America Corp. stock (NYSE: BAC) performance-wise. The share price keeps flushing down the drain and it is unclear where it will close by the end of the year. On the 3rd of December, the bulls still had some hope, but the bears quickly shattered those bull-dreams into pieces and took control of the steering wheel and drove BAC lower. The stock marked a new low for the year, hitting the 24.29 level. From the technical side, it is now trading well below a short-term downside line drawn from the high of the 21st of September. Even if the stock manages to recover some of its losses, as long as that downside line remains intact, we will keep looking south.

From the short-term perspective, a bit of retracement could be seen over the upcoming days, as BAC is currently slightly oversold. But, if the stock struggles to move above Tuesday’s high at 25.40, this could be another warning sign for the bulls that not all is good with the upside idea. This is where the sellers may take advantage of the higher price and push the share price down, this way creating another round of selling. This is when we will target the 24.29 hurdle again, a break of which might pull Bank of America Corp. towards the next potential area of support at 23.40, marked by the high of the 11th of September 2017.

Looking at our momentum indicators, the RSI and the MACD, both are near their lows. The RSI is currently at around 28, which means that even though the stock seems to be slightly oversold, it doesn’t mean that it will reverse back up straight away. The indicator could hang around it that area for quite a while. The MACD is in the negative territory and remains below its trigger line, which is not a positive indication either.

In the short-term upside scenario, in order to aim for slightly higher levels, we would need to see a push back above the 25.90 barrier, marked by the October’s low. Only then we could consider BAC moving a bit higher towards the next potential area of resistance at 26.75, a break of which might lead to a re-test of the 27.85 level. This level is marked by the inside swing low of the 30th of November. This is where the upside could get limited, as the price would arrive to the aforementioned short-term downside line, which could hold the share price down.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Brokers, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Brokers analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyzes and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyzes and must therefore be viewed by the reader as marketing information. JFD Brokers prohibits the duplication or publication without explicit approval.

FX and CFDs are leveraged products. They are not suitable for every investor, as they carry high risk of losing your capital. You should be aware of all the risks associated with trading on margin. Please read the full Risk Disclosure.

Copyright 2018 JFD Brokers Ltd.