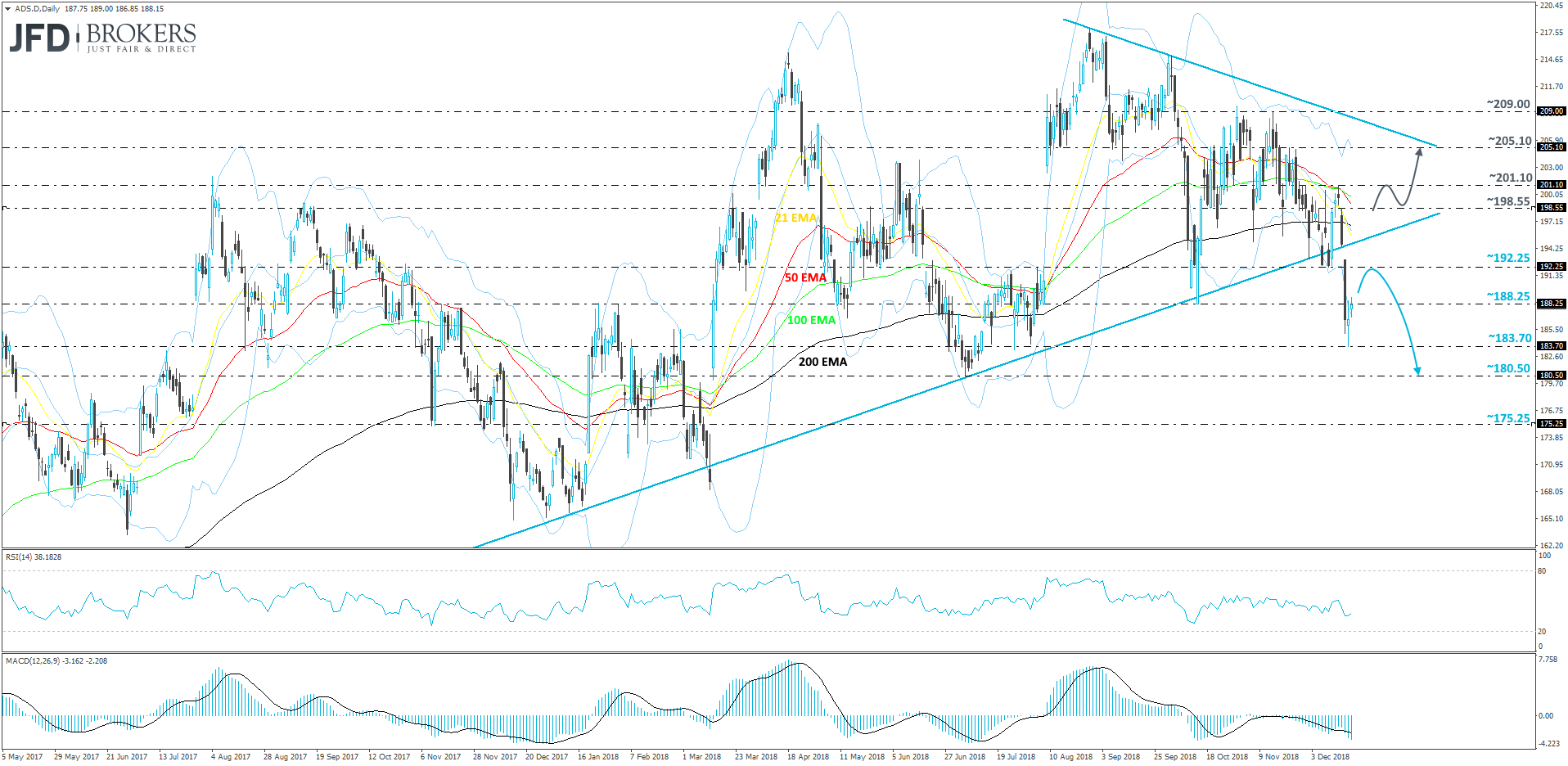

Looking at the overall picture from the technical side, Adidas AG (ETR: ADS) had been trading above its long-term upwards-moving trendline, drawn from the low of the 10th of November 2016. But on Monday, the stock opened with a runaway gap, but this time below that trendline. This resulted in heavy selling on Monday, as the bears dominated the field. Currently, the stock is trying to recover some of its losses and it has got some potential to move a bit higher. But now, such a move could only be classed as a corrective one, which may lead to more selling, which could pull the share price back down again. Hence why, for now, we will remain negative for now, over the near-term outlook.

If ADS makes another run towards the 192.25 barrier, but fails to overcome it, the stock might travel down towards the 188.25 obstacle, marked by the low of the 15th of October. If that obstacle is not able to withstand the bear-pressure, a further depreciation of the price may lead to a re-test of Tuesday’s low at 183.70, a break of which could drag the stock towards the 180.50-euro price tag. Last time this area was tested on the 5th of July.

Looking at our oscillators, the RSI and the MACD, both are somewhat in support of the above-discussed scenario. Even though the RSI has slightly curved up, still, it remains below 50, which is a bearish indication. The MACD continues to move lower, comfortably sitting below zero and its trigger line.

Alternatively, in order to examine the upside again, we would need to see ADS pushing above, not only the aforementioned upwards-moving trendline, but also getting back above the 198.55 level, marked by Friday’s high. This way we could once again aim for higher areas like the 201.10 hurdle, a break of which may take the price higher towards a re-test of the 205.10 barrier, which was the high of the 22nd of November. Slightly above that we have the short-term downside resistance line taken from the highest point of this year, at 217.90, reached on the 28th of August.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyzes and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyzes and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

FX and CFDs are leveraged products. They are not suitable for every investor, as they carry high risk of losing your capital. You should be aware of all the risks associated with trading on margin. Please read the full Risk Disclosure.